Answered step by step

Verified Expert Solution

Question

1 Approved Answer

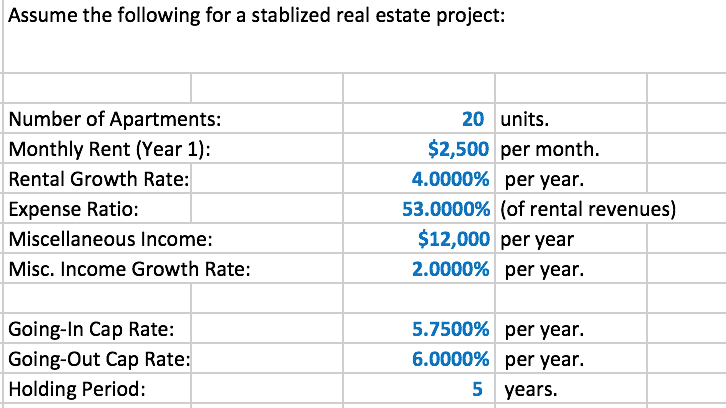

Construct an income statement and calculate the following: Unleveraged Yield Cash on Cash (Leveraged) Yield. Annual DSCR Unleveraged Holding Period Return Unleveraged Holding Period Profit

Construct an income statement and calculate the following:

Unleveraged Yield

Cash on Cash (Leveraged) Yield.

Annual DSCR

Unleveraged Holding Period Return

Unleveraged Holding Period Profit

Unleveraged Holding Period Investment Mulitple

Leveraged Holding Period Return

Leveraged Holding Period Profit

Leveraged Holding Period Investment Mulitple

Assume the following for a stablized real estate project: Number of Apartments: Monthly Rent (Year 1): Rental Growth Rate: Expense Ratio: Miscellaneous Income: Misc. Income Growth Rate: 20 units. $2,500 per month. 4.0000% per year. 53.0000% (of rental revenues) $12,000 per year 2.0000% per year. Going-In Cap Rate: Going Out Cap Rate: Holding Period: 5.7500% per year. 6.0000% per year. 5 years. Assume the following for a stablized real estate project: Number of Apartments: Monthly Rent (Year 1): Rental Growth Rate: Expense Ratio: Miscellaneous Income: Misc. Income Growth Rate: 20 units. $2,500 per month. 4.0000% per year. 53.0000% (of rental revenues) $12,000 per year 2.0000% per year. Going-In Cap Rate: Going Out Cap Rate: Holding Period: 5.7500% per year. 6.0000% per year. 5 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started