Question

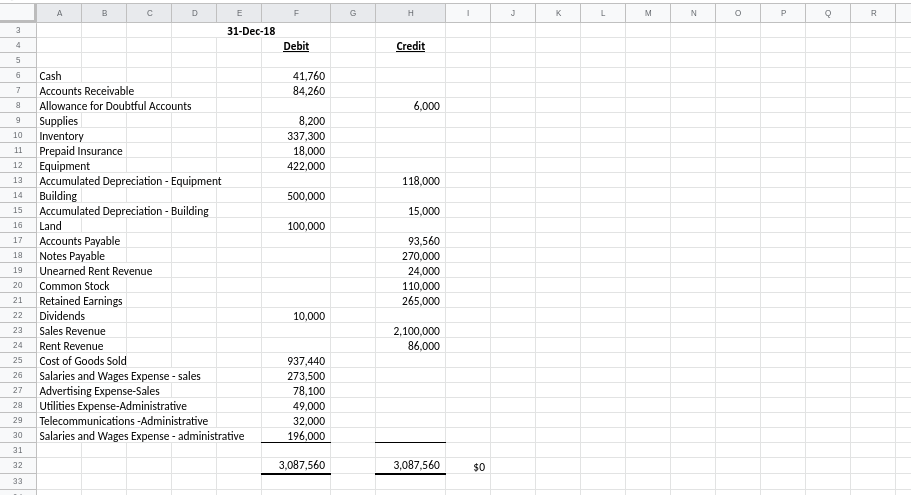

Construct General Ledger T-accounts and enter the balances shown. The following adjusting entries have been identified: 1. Bad debt expense is estimated to be $6,000.

Construct General Ledger T-accounts and enter the balances shown.

The following adjusting entries have been identified:

1. Bad debt expense is estimated to be $6,000. (sales expense)

2. Annual depreciation expense on the Equipment is $13,000 and annual depreciation expense for building is $8,000. (administrative expense)

3. Prepaid Insurance is for 2 years of insurance paid on 1/1/18. Record the amount for 2018. (administrative expense)

4. The note payable ($270,000) has interest of 7% per year (simple interest) and the interest is payable on 1/1/19. Record the interest for 2018.

5. Salaries and wages earned but unpaid as of year-end are $9,500 (sales) and $4,500 (administrative).

6. At year-end, $1,100 of Supplies remain on hand. (administrative expenses)

7. $10,000 of the unearned rent revenue was earned as of 12/31/18.

8. Utilities expense incurred for December, but unpaid and unrecorded was $3,000. (administrative expense)

9. Income Tax Expense is $134,000.

Weighted Average Common Shares Outstanding 12/31/18 is 5,000.

Prepare the adjusting journal entries (include explanations) and post the entries to the appropriate general ledger T-accounts (construct additional T-accounts as necessary).

1. Prepare an adjusted trial balance.

2. Prepare a classified balance sheet, a statement of retained earnings and a multi-step income statement in good form.

3. Prepare closing journal entries and post to the T-accounts.

4. Prepare a post-closing trial balance.

0 31-Dec-18 re 6 Cash 7 Accounts Receivable 8 Allowance for Doubtful Accounts 9 Supplies 10 Inventory 11 Prepaid Insurance 41,760 84,260 6,000 8,200 337,300 18,000 422,000 Equipment Accumulated Depreciation - Equipment 118,000 14 Building 15 Accumulated Depreciation - Building 16 17 Accounts Payable 18 Notes Payable 19 Unearned Rent Revenue 20 Common Stock 21 Retained Earnings 22 Dividends 23 Sales Revenue 24 Rent Revenue 25 Cost of Goods Sold 500,000 15,000 100,000 93,560 270,000 24.000 110,000 265,000 10,000 2,100,000 86.000 937,440 273,500 78,100 49,000 32,000 196,000 Salaries and Wages Expense-sales 27 Advertising Expense-Sales 28 Utilities Expense-Administrative 29 Telecommunications -Administrative a0 Salaries and Wages Expense-adminstrative 31 32 3,087,560 3,087,560

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started