Answered step by step

Verified Expert Solution

Question

1 Approved Answer

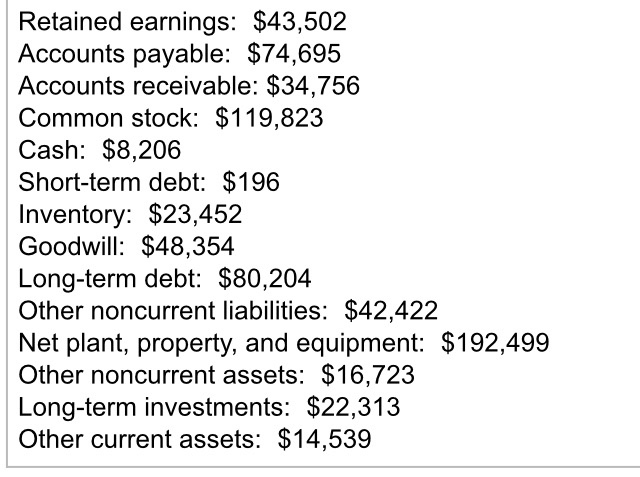

Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information: In picture Complete the balance sheet below:(Round to the

Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information: In picture

Complete the balance sheet below:(Round to the nearest thousand dollars.)

Barron Pizza, Inc.

Balance Sheet as of December 31, 2015

($ in thousands)

ASSETS

LIABILITIES

Current Assets

Current liabilities

$

$

$

$

$

Total current liabilities

$

$

$

Total current assets

$

$

Total liabilities

$

$

OWNERS EQUITY

$

$

$

$

$

Total owners equity

$

TOTAL LIABILITIES

TOTAL ASSETS

$

AND OWNERS EQUITY

$

Complete the table below for the assets part of the balance sheet:(Round to the nearest thousand dollars.)

Barron Pizza, Inc.

Balance Sheet as of December 31, 2012, 2013, and 2014

($ in thousands)

ASSETS

2014

2013

2012

Current Assets

Cash

$

6,907

$

9,352

$

17,622

Accounts receivable

$

26,621

$

$

25,719

Inventory

$

$

16,293

$

12,555

Other current assets

$

11,595

$

10,886

$

Total current assets

$

62,398

$

57,467

$

65,079

Long-term investments

$

19,038

$

$

20,875

Net plant, property,

and equipment

$

203,878

$

223,515

$

Goodwill

$

$

48,747

$

48,140

Other assets

$

13,297

$

13,828

$

14,045

TOTAL ASSETS

$

347,159

$

365,409

$

387,322

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started