Answered step by step

Verified Expert Solution

Question

1 Approved Answer

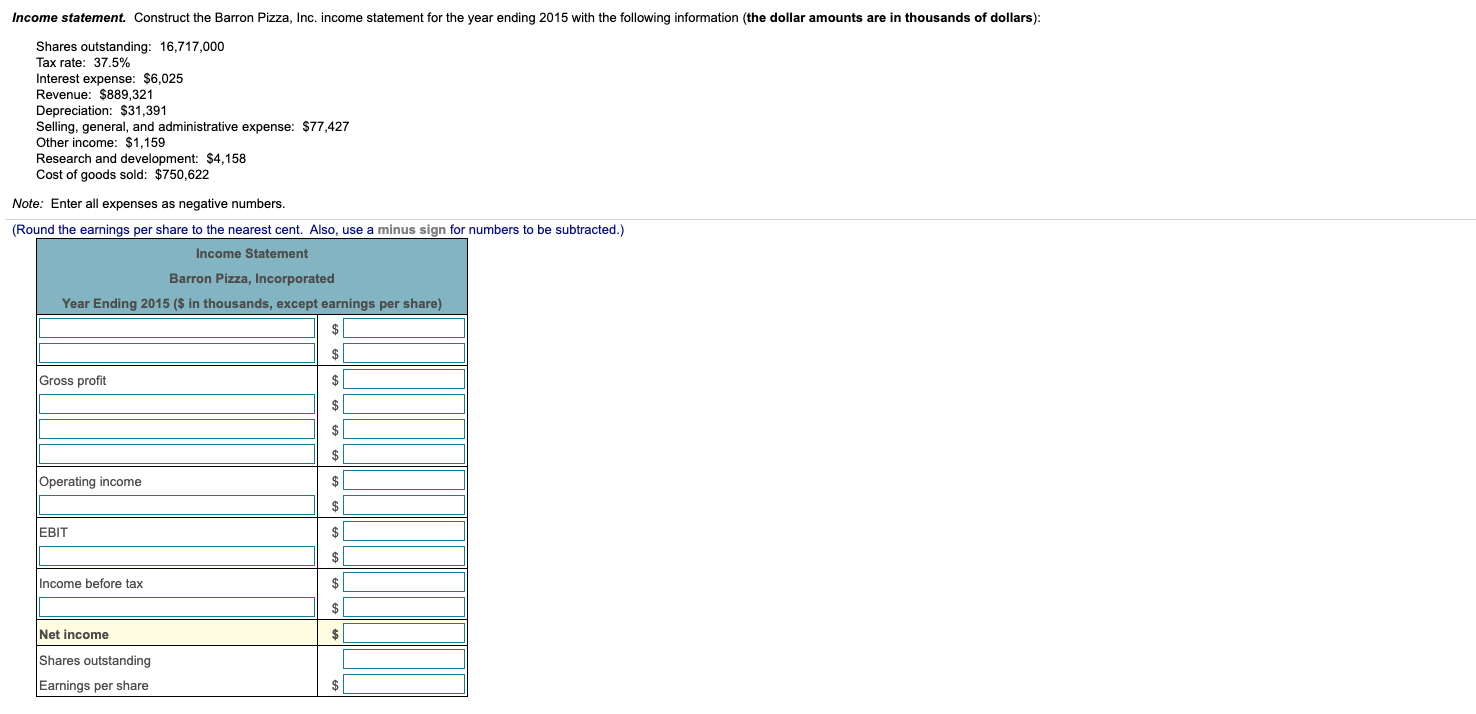

Construct the Barron Pizza, Inc. income statement for the year ending 2015 with the following information (the dollar amounts are in thousands of dollars): Construct

Construct the Barron Pizza, Inc. income statement for the year ending 2015 with the following information (the dollar amounts are in thousands of dollars):

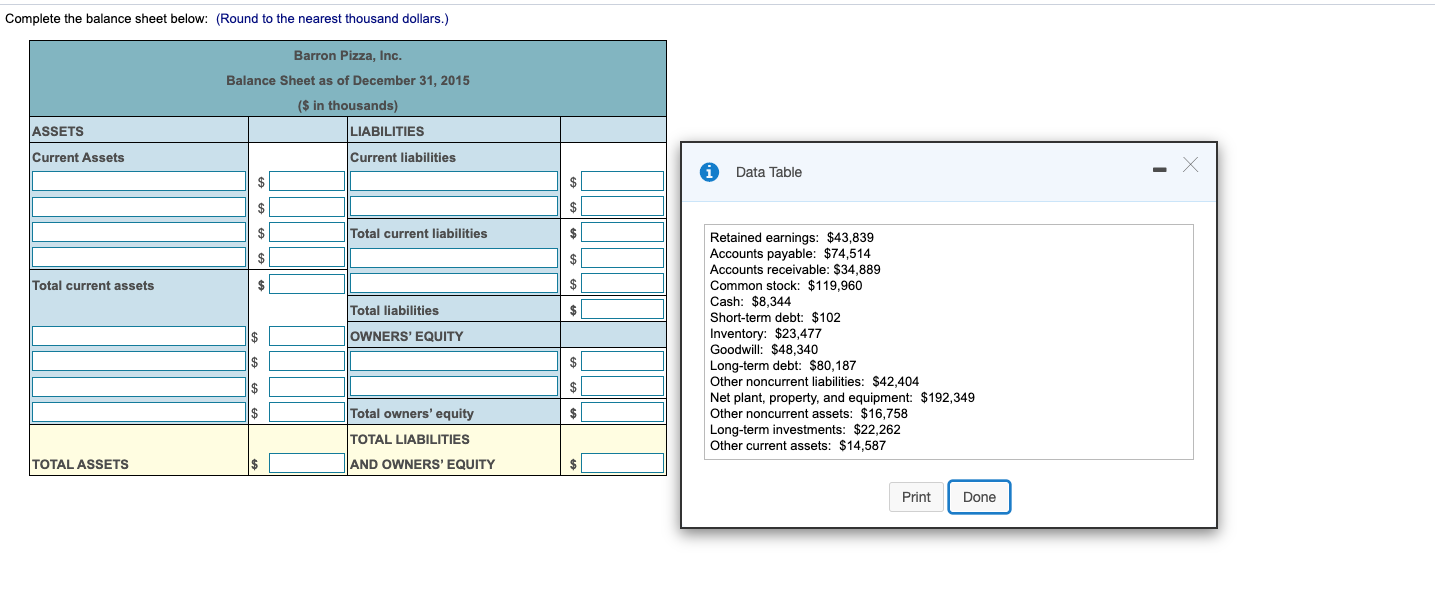

Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information:

Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information:

Income statement. Construct the Barron Pizza, Inc. income statement for the year ending 2015 with the following information (the dollar amounts are in thousands of dollars): Shares outstanding: 16,717,000 Tax rate: 37.5% Interest expense: $6,025 Revenue: $889,321 Depreciation: $31,391 Selling, general, and administrative expense: $77,427 Other income: $1,159 Research and development: $4,158 Cost of goods sold: $750,622 Note: Enter all expenses as negative numbers. (Round the earnings per share to the nearest cent. Also, use a minus sign for numbers to be subtracted.) Income Statement Barron Pizza, Incorporated Year Ending 2015 ($ in thousands, except earnings per share) $ Gross profit $ $ $ $ Operating income $ $ EBIT $ $ Income before tax $ $ Net income $ Shares outstanding Earnings per share $ Complete the balance sheet below: (Round to the nearest thousand dollars.) Barron Pizza, Inc. Balance Sheet as of December 31, 2015 ($ in thousands) ASSETS LIABILITIES Current Assets Current liabilities Data Table - $ $ $ $ $ $ Total current liabilities $ $ Total current assets $ $ Total liabilities $ Il $ OWNERS' EQUITY Retained earnings: $43,839 Accounts payable: $74,514 Accounts receivable: $34,889 Common stock: $119,960 Cash: $8,344 Short-term debt: $102 Inventory: $23,477 Goodwill: $48,340 Long-term debt: $80,187 Other noncurrent liabilities: $42,404 Net plant, property, and equipment: $192,349 Other noncurrent assets: $16,758 Long-term investments: $22,262 Other current assets: $14,587 $ $ $ $ $ Total owners' equity TOTAL LIABILITIES TOTAL ASSETS AND OWNERS' EQUITY $ Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started