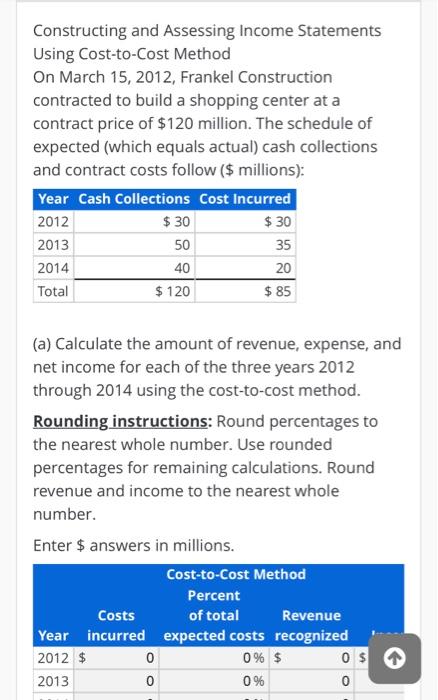

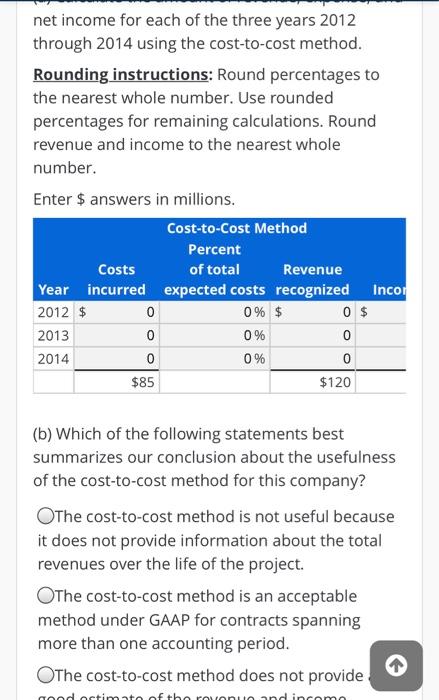

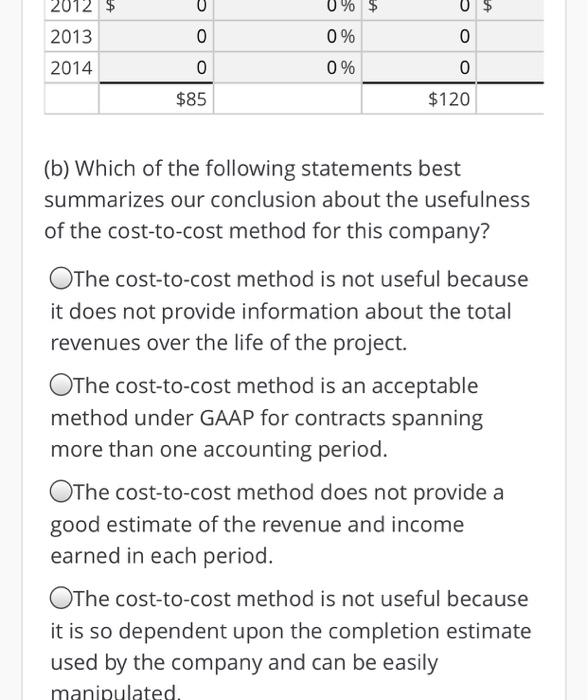

Constructing and Assessing Income Statements Using Cost-to-Cost Method On March 15, 2012, Frankel Construction contracted to build a shopping center at a contract price of $120 million. The schedule of expected (which equals actual) cash collections and contract costs follow ($ millions): Year Cash Collections Cost Incurred 2012 $ 30 2013 50 35 2014 40 20 Total $ 120 $85 $30 (a) Calculate the amount of revenue, expense, and net income for each of the three years 2012 through 2014 using the cost-to-cost method. Rounding instructions: Round percentages to the nearest whole number. Use rounded percentages for remaining calculations. Round revenue and income to the nearest whole number. Enter $ answers in millions. Cost-to-Cost Method Percent Costs of total Revenue Year incurred expected costs recognized 2012 $ 0 0% $ 2013 0% 0 0 net income for each of the three years 2012 through 2014 using the cost-to-cost method. Rounding instructions: Round percentages to the nearest whole number. Use rounded percentages for remaining calculations. Round revenue and income to the nearest whole number. Enter $ answers in millions. Cost-to-Cost Method Percent Costs of total Revenue Year incurred expected costs recognized Incon 2012 $ 0 0% $ 0 $ 2013 0 0% 0 2014 0 0% 0 $85 $120 (b) Which of the following statements best summarizes our conclusion about the usefulness of the cost-to-cost method for this company? OThe cost-to-cost method is not useful because it does not provide information about the total revenues over the life of the project. OThe cost-to-cost method is an acceptable method under GAAP for contracts spanning more than one accounting period. OThe cost-to-cost method does not provide and ortimate of the mounun and incomo 2012 $ 0 % $ 2013 0 0 % 0 2014 0 0 % 0 $85 $120 (b) Which of the following statements best summarizes our conclusion about the usefulness of the cost-to-cost method for this company? OThe cost-to-cost method is not useful because it does not provide information about the total revenues over the life of the project. OThe cost-to-cost method is an acceptable method under GAAP for contracts spanning more than one accounting period. The cost-to-cost method does not provide a good estimate of the revenue and income earned in each period. OThe cost-to-cost method is not useful because it is so dependent upon the completion estimate used by the company and can be easily manipulated