Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Construction contract On 1 October 2009 Mocca entered into a construction contract that was expected to take 27 months and therefore be completed on

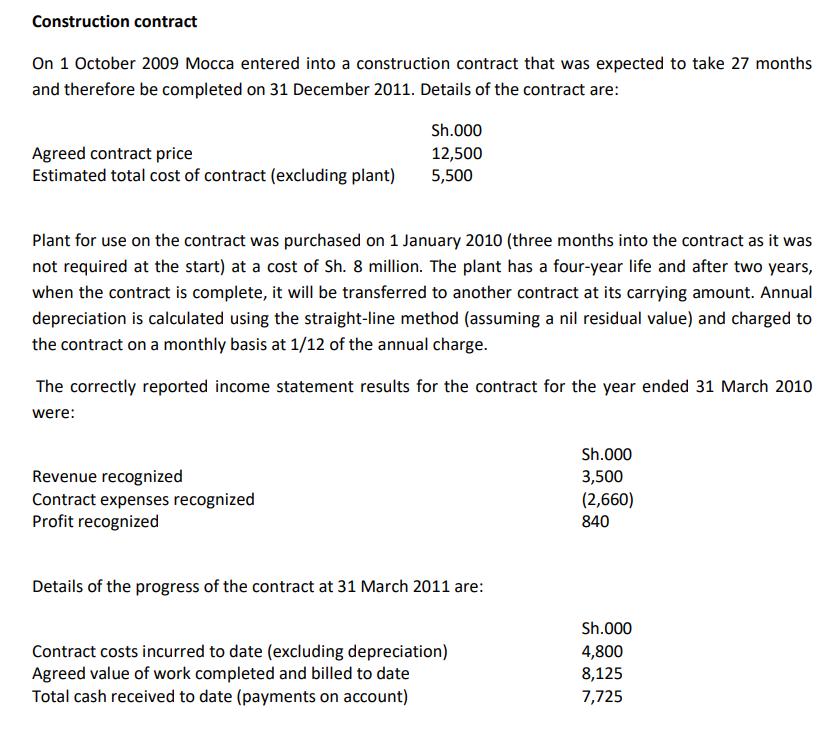

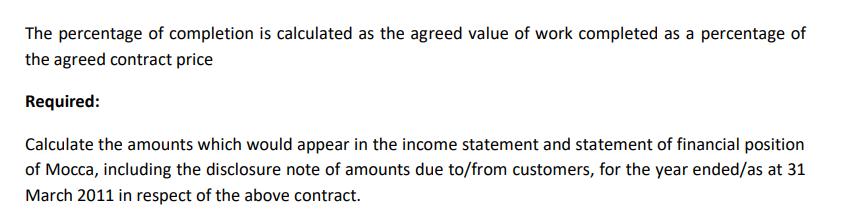

Construction contract On 1 October 2009 Mocca entered into a construction contract that was expected to take 27 months and therefore be completed on 31 December 2011. Details of the contract are: Agreed contract price Sh.000 12,500 Estimated total cost of contract (excluding plant) 5,500 Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of Sh. 8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge. The correctly reported income statement results for the contract for the year ended 31 March 2010 were: Revenue recognized Contract expenses recognized Profit recognized Details of the progress of the contract at 31 March 2011 are: Contract costs incurred to date (excluding depreciation) Agreed value of work completed and billed to date Total cash received to date (payments on account) Sh.000 3,500 (2,660) 840 Sh.000 4,800 8,125 7,725 The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price Required: Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started