Question

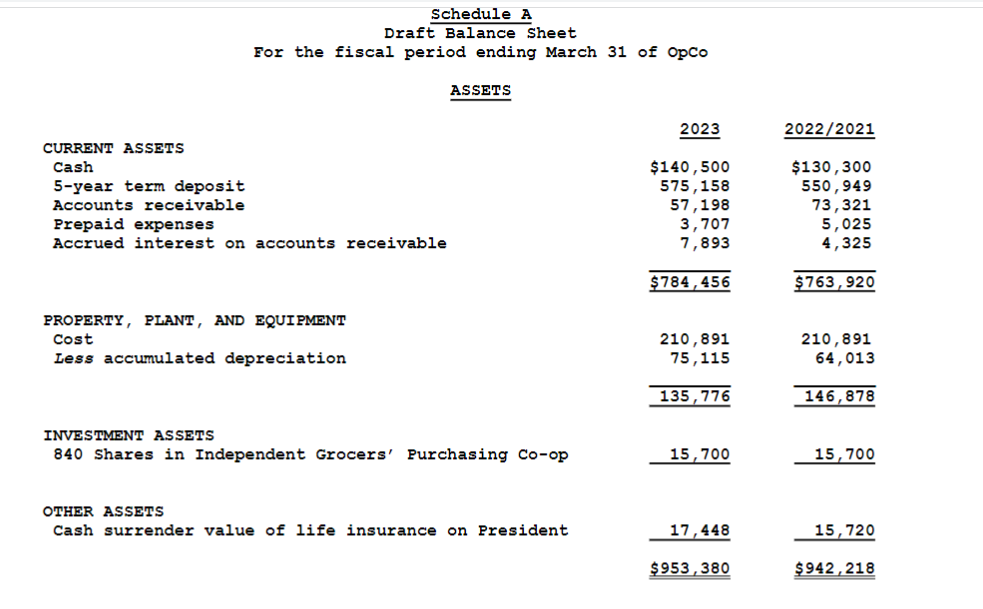

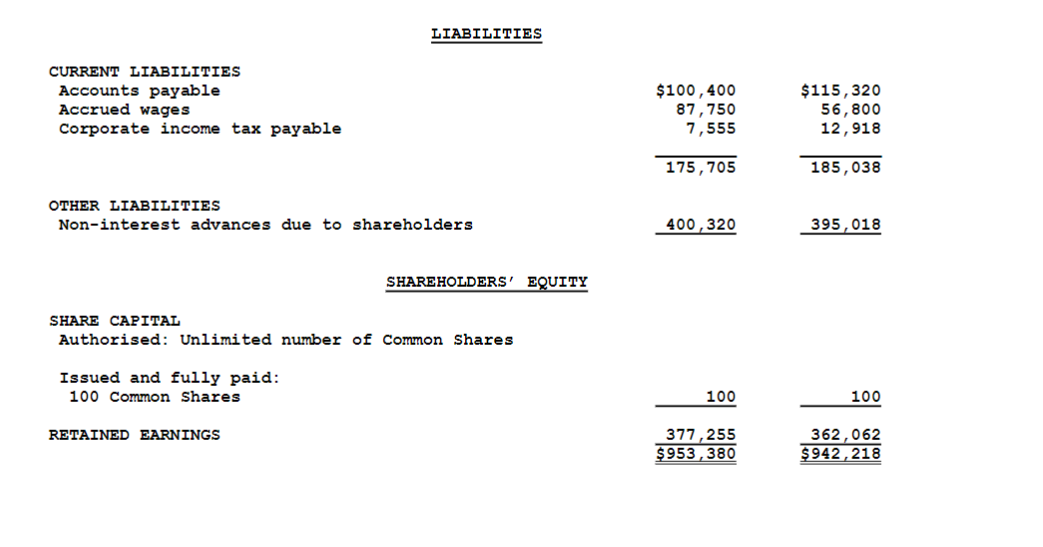

Consult the attached Schedule A on page CLXXVIII below, which represents the March 31, 2023 Draft Balance Sheet for OpCo, including comparative numbers for the

Consult the attached Schedule A on page CLXXVIII below, which represents the March 31, 2023 Draft Balance Sheet for OpCo, including comparative numbers for the March 31, 2022 taxation year (and which shall be assumed to be identical to the March 31, 2021 taxation year). OpCo is a CCPC carrying on a grocery store operation in Toronto, Ontario, that earns net ABI eligible for the SBD Amount. Mr. X has owned all the shares of OpCo since 2002. Mr. X proposes to sell the shares of OpCo on April 1, 2023 (with no change in the assets or liabilities, unless otherwise indicated below) Assume that: (a) the fair market value of the Property, Plant, and Equipment is $300,000, which has remained consistent for the past three years; (b) the fair market value of all other assets is equal to their respective net book value; (c) the shares of Independent Grocers Purchasing Co- op are active business assets;

(d) Independent Grocers Purchasing Co-op is not connected with (or to) OpCo; and (e) the life insurance policy is not an active business asset

Question:1. Assume that the Cash of $140,500 is not an active business asset. (a) Is OpCo a small business corporation on April 1, 2023? Yes or No (b) What is the percentage (rounded to two decimal places)?

2.Continue with Question 1 above; however, assume that: (i) the 5-year term deposit will be used in its entirety to satisfy (in part) OpCos liabilities on March 30, 2023; (ii) $90,000 of the Cash is, in fact, needed by OpCo for working capital and, thus, that amount represents an active business asset; and (iii) the balance of the Cash in excess of $90,000 is not an active business asset. (a) Would OpCo now be a small business corporation on April 1, 2023? Yes or No (b) What is the percentage (rounded to two decimal places)?

3.Continue with Question 1 and Question 2 above; however, assume that $50,000 of the Cash is distributed via a taxable dividend to Mr. X on March 31, 2023. (a) Would OpCo now be a small business corporation on April 1, 2023? Yes or No (b) What is the percentage (rounded to two decimal places)?

(c) Would OpCo satisfy the Basic Asset Test (50% Test) on April 1, 2023? Yes or No (d) What is the percentage (rounded to two decimal places)?

4.Continue with part 1, part 2, and part 3 above. OpCos external CPA claims that the shares of OpCo WILL qualify as QSBCS on April 1, 2023, given that the value of OpCos goodwill, which is an unrecorded (off-balance-sheet) active business asset, has not yet been considered. What is the MINIMUM fair market value (always rounded UPWARDS to the nearest whole dollar regardless of the two decimal places for monetary purposes in this instance) of this goodwill that will allow the shares of OpCo to qualify as QSBCS? The numerical answer alone is sufficient.

ASSETS CURRENT ASSETS \begin{tabular}{lrr} Cash & $140,500 & $130,300 \\ 5-year term deposit & 575,158 & 550,949 \\ Accounts receivable & 57,198 & 73,321 \\ Prepaid expenses & 3,707 & 5,025 \\ Accrued interest on accounts receivable & 7,893 & 4,325 \\ & $784,456 & $763,920 \\ \hline \end{tabular} PROPERTY, PLANT, AND EQUIPMENT Cost INVESTMENT ASSETS 840 Shares in Independent Grocers' Purchasing Co-op 15,70015,700 OTHER ASSETS Cash surrender value of life insurance on President \begin{tabular}{rr} 17,448 & 15,720 \\ $953,380 & $942,218 \\ \hline \end{tabular} LIABIIITIES CURRENT IIABILITIES Accounts payable Accrued wages Corporate income tax payable \begin{tabular}{rr} $100,400 & $115,320 \\ 87,750 & 56,800 \\ 7,555 & 12,918 \\ \hline 175,705 & 185,038 \end{tabular} OTHER LIABIIITIES Non-interest advances due to shareholders 400,320 395,018 SHAREHOLDERS' EQUITY SHARE CAPITAI Authorised: Unlimited number of Common Shares Issued and fully paid: 100 Common Shares RETAINED EARNINGS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started