Question

con't appendix: Negative externalities The following negative externalities are taken into account: the cost of noise, odors, aesthetic and landscape impact. These negative impacts are

con't appendix:

Negative externalities The following negative externalities are taken into account: the cost of noise, odors, aesthetic and landscape impact. These negative impacts are valued by means of a hedonic price, assuming that the real estate in the nearby area is depreciated. The hedonic price is assumed to be equal to the difference between the market value of the rent for the buildings in the area before the factory was built and the rent value after the factory was built. Assuming a mean building density in the impact area (an area, centered on the plant, of about 700 m of radius) of 0.50 m3/m2, a depreciation of 30% of a yearly rent of about 52.2 /m2 (corrected) leads to a hedonic price of 340,000 in Year 3. The hedonic price is assumed to increase at a rate of 1% per year. Positive externalities The positive externalities that are taken into account include reduction/prevention of pollution caused by wastewater. In addition, over recent decades, several studies indicate significant and beneficial health impacts associated with improving water and sanitation facilities such as reduction in water-borne and water-washed diseases (e.g. infectious diarrhea). The shadow price of the water pollution avoided is assumed to be 0.5 /m3 of total wastewater and the price is assumed to stay fixed during the 30-year period. In addition, it is estimated that the savings in the medical cost because of the reduction in incidence rates in Year 3 is 118,000, and it is further assumed that these savings increase at a rate of 2% per year.

A municipality in Europe proposes to build a new wastewater treatment plant to treat urban waste (grey) water for reuse and for other subproducts. The urban waste (grey) water in the municipality is currently discharged into the sea after a simple purification process, which is causing environmental problems and cannot bring any economic benefits. Thus, the do-nothing scenario is discarded at the beginning of the project. The proposed investment is funded 100% by the local government, and the project horizon is fixed at 30 years, including time for design, erection, and operating of the plant. The proposed service catchment area consists of an urban area of about 120,000 inhabitants. The plant takes up a total area of 19,500 square meters. After various plant locations were tested and various technological solutions were examined, the best solution was selected for CBA. Then, the task of CBA was outsourced to a local consulting company. The project definition and assumptions of the calculations adopted by the consulting company are outlined in the Appendix.

What's the NPV, BCR,IRR and Payback period?

that's all information I got.

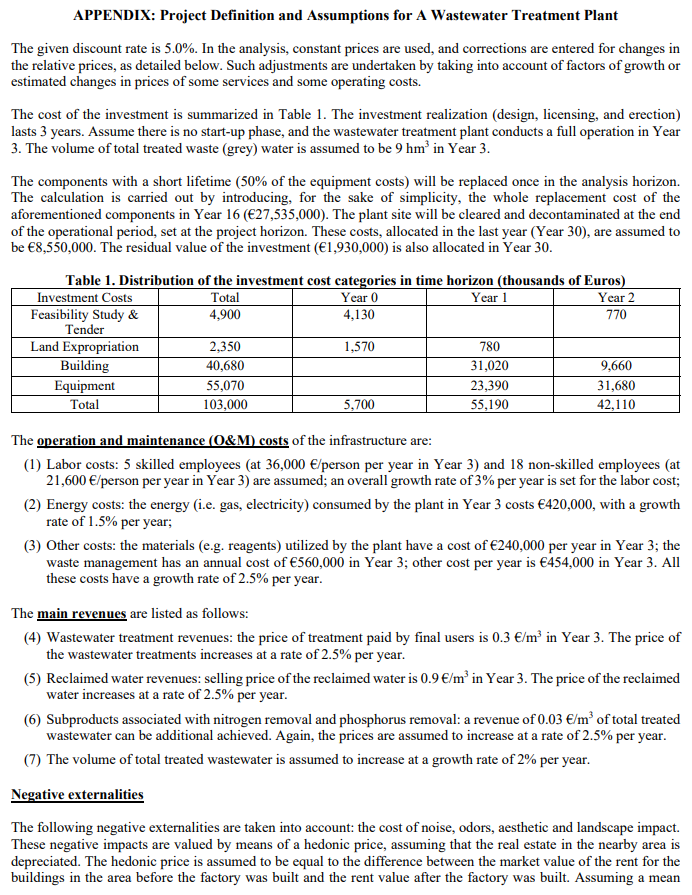

APPENDIX: Project Definition and Assumptions for A Wastewater Treatment Plant The given discount rate is 5.0%. In the analysis, constant prices are used, and corrections are entered for changes in the relative prices, as detailed below. Such adjustments are undertaken by taking into account of factors of growth or estimated changes in prices of some services and some operating costs. The cost of the investment is summarized in Table 1. The investment realization (design, licensing, and erection) lasts 3 years. Assume there is no start-up phase, and the wastewater treatment plant conducts a full operation in Year 3. The volume of total treated waste (grey) water is assumed to be 9 hm in Year 3. The components with a short lifetime (50% of the equipment costs) will be replaced once in the analysis horizon. The calculation is carried out by introducing, for the sake of simplicity, the whole replacement cost of the aforementioned components in Year 16 (27,535,000). The plant site will be cleared and decontaminated at the end of the operational period, set at the project horizon. These costs, allocated in the last year (Year 30), are assumed to be 8,550,000. The residual value of the investment (1,930,000) is also allocated in Year 30. Table 1. Distribution of the investment cost categories in time horizon (thousands of Euros) Investment Costs Total Year 0 Year 1 Year 2 Feasibility Study & 4,900 4,130 770 Tender Land Expropriation 2,350 1,570 780 Building 40,680 31,020 9,660 Equipment 55,070 23,390 31,680 Total 103,000 5,700 55,190 42,110 The operation and maintenance (O&M) costs of the infrastructure are: (1) Labor costs: 5 skilled employees (at 36,000 /person per year in Year 3) and 18 non-skilled employees (at 21,600 /person per year in Year 3) are assumed; an overall growth rate of 3% per year is set for the labor cost; (2) Energy costs: the energy (i.e. gas, electricity) consumed by the plant in Year 3 costs 420,000, with a growth rate of 1.5% per year; (3) Other costs: the materials (e.g. reagents) utilized by the plant have a cost of 240,000 per year in Year 3; the waste management has an annual cost of 560,000 in Year 3; other cost per year is 454,000 in Year 3. All these costs have a growth rate of 2.5% per year. The main revenues are listed as follows: (4) Wastewater treatment revenues: the price of treatment paid by final users is 0.3 /m in Year 3. The price of the wastewater treatments increases at a rate of 2.5% per year. (5) Reclaimed water revenues: selling price of the reclaimed water is 0.9/min Year 3. The price of the reclaimed water increases at a rate of 2.5% per year. (6) Subproducts associated with nitrogen removal and phosphorus removal: a revenue of 0.03 /m of total treated wastewater can be additional achieved. Again, the prices are assumed to increase at a rate of 2.5% per year. (1) The volume of total treated wastewater is assumed to increase at a growth rate of 2% per year. Negative externalities The following negative externalities are taken into account the cost of noise, odors, aesthetic and landscape impact. These negative impacts are valued by means of a hedonic price, assuming that the real estate in the nearby area is depreciated. The hedonic price is assumed to be equal to the difference between the market value of the rent for the buildings in the area before the factory was built and the rent value after the factory was built. Assuming a mean APPENDIX: Project Definition and Assumptions for A Wastewater Treatment Plant The given discount rate is 5.0%. In the analysis, constant prices are used, and corrections are entered for changes in the relative prices, as detailed below. Such adjustments are undertaken by taking into account of factors of growth or estimated changes in prices of some services and some operating costs. The cost of the investment is summarized in Table 1. The investment realization (design, licensing, and erection) lasts 3 years. Assume there is no start-up phase, and the wastewater treatment plant conducts a full operation in Year 3. The volume of total treated waste (grey) water is assumed to be 9 hm in Year 3. The components with a short lifetime (50% of the equipment costs) will be replaced once in the analysis horizon. The calculation is carried out by introducing, for the sake of simplicity, the whole replacement cost of the aforementioned components in Year 16 (27,535,000). The plant site will be cleared and decontaminated at the end of the operational period, set at the project horizon. These costs, allocated in the last year (Year 30), are assumed to be 8,550,000. The residual value of the investment (1,930,000) is also allocated in Year 30. Table 1. Distribution of the investment cost categories in time horizon (thousands of Euros) Investment Costs Total Year 0 Year 1 Year 2 Feasibility Study & 4,900 4,130 770 Tender Land Expropriation 2,350 1,570 780 Building 40,680 31,020 9,660 Equipment 55,070 23,390 31,680 Total 103,000 5,700 55,190 42,110 The operation and maintenance (O&M) costs of the infrastructure are: (1) Labor costs: 5 skilled employees (at 36,000 /person per year in Year 3) and 18 non-skilled employees (at 21,600 /person per year in Year 3) are assumed; an overall growth rate of 3% per year is set for the labor cost; (2) Energy costs: the energy (i.e. gas, electricity) consumed by the plant in Year 3 costs 420,000, with a growth rate of 1.5% per year; (3) Other costs: the materials (e.g. reagents) utilized by the plant have a cost of 240,000 per year in Year 3; the waste management has an annual cost of 560,000 in Year 3; other cost per year is 454,000 in Year 3. All these costs have a growth rate of 2.5% per year. The main revenues are listed as follows: (4) Wastewater treatment revenues: the price of treatment paid by final users is 0.3 /m in Year 3. The price of the wastewater treatments increases at a rate of 2.5% per year. (5) Reclaimed water revenues: selling price of the reclaimed water is 0.9/min Year 3. The price of the reclaimed water increases at a rate of 2.5% per year. (6) Subproducts associated with nitrogen removal and phosphorus removal: a revenue of 0.03 /m of total treated wastewater can be additional achieved. Again, the prices are assumed to increase at a rate of 2.5% per year. (1) The volume of total treated wastewater is assumed to increase at a growth rate of 2% per year. Negative externalities The following negative externalities are taken into account the cost of noise, odors, aesthetic and landscape impact. These negative impacts are valued by means of a hedonic price, assuming that the real estate in the nearby area is depreciated. The hedonic price is assumed to be equal to the difference between the market value of the rent for the buildings in the area before the factory was built and the rent value after the factory was built. Assuming a meanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started