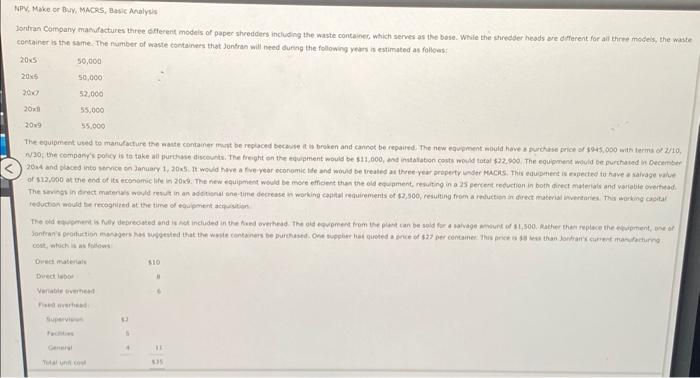

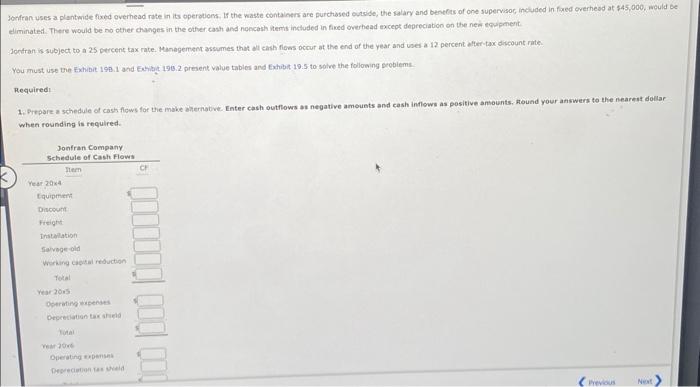

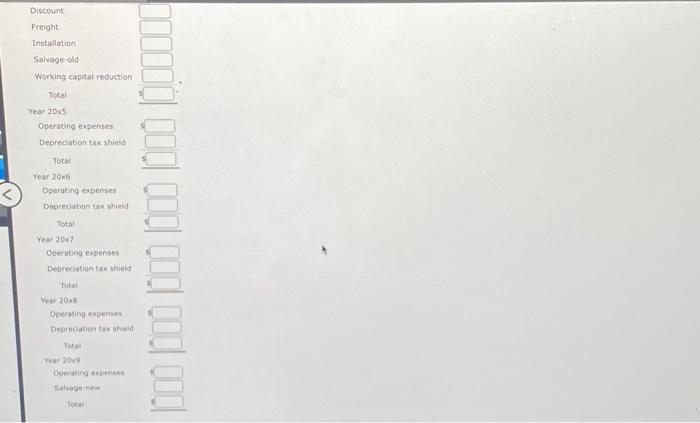

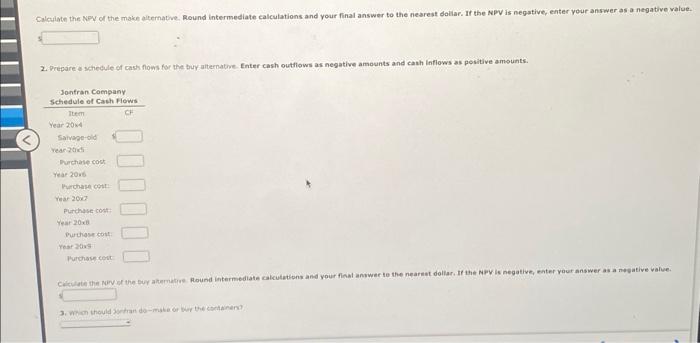

container is the same- The number of waste coetainers that Jontran will heed during the following years is estimated as follows: Cobe, atuch is at fillews Jonfran uses a plantwide fixed overhead rate in its operotions. Is the waste containers are purchased eutsibe, the salary and bentfas of one supervisoc, included in fixed overhesd at 545 , 000, would be eliminated. There would be no other changes in the other cast and noncash ntems included in fixed overhead except depreciabon on the neni equphent. Jontran is subject to a 25 percent tax rate. Management assumes that al cash fiows pccur at the end of the year and uses a 12 percent after-tax divcount rate. Required 1. Prepare a schedule of cass flows for the moke ahernotive. Enter cash outhows au negative amounts and cash inflows as positive ansounts. Hound your answers to the nearent dollar when rounding is required. Discount Freight: Installation: Salvage-old Working capital reduction Total Year 20xs Operating expenses Depreciation tax shiela Total Yeer 206 Operating expenses Oegrecistion tax shiela Total. Year 20n? Operatiog expenses Depreciation tax shield Total. Year 20xll Operating expenses Depreciation tar sheld Fotal Tear 209 Operating expenses Selvage-new Total. 2. Prepare schecule of cash flows for the buy aiternathe. Enter cash outlows as negative amounts and canh inflows as positive amounts. container is the same- The number of waste coetainers that Jontran will heed during the following years is estimated as follows: Cobe, atuch is at fillews Jonfran uses a plantwide fixed overhead rate in its operotions. Is the waste containers are purchased eutsibe, the salary and bentfas of one supervisoc, included in fixed overhesd at 545 , 000, would be eliminated. There would be no other changes in the other cast and noncash ntems included in fixed overhead except depreciabon on the neni equphent. Jontran is subject to a 25 percent tax rate. Management assumes that al cash fiows pccur at the end of the year and uses a 12 percent after-tax divcount rate. Required 1. Prepare a schedule of cass flows for the moke ahernotive. Enter cash outhows au negative amounts and cash inflows as positive ansounts. Hound your answers to the nearent dollar when rounding is required. Discount Freight: Installation: Salvage-old Working capital reduction Total Year 20xs Operating expenses Depreciation tax shiela Total Yeer 206 Operating expenses Oegrecistion tax shiela Total. Year 20n? Operatiog expenses Depreciation tax shield Total. Year 20xll Operating expenses Depreciation tar sheld Fotal Tear 209 Operating expenses Selvage-new Total. 2. Prepare schecule of cash flows for the buy aiternathe. Enter cash outlows as negative amounts and canh inflows as positive amounts