Answered step by step

Verified Expert Solution

Question

1 Approved Answer

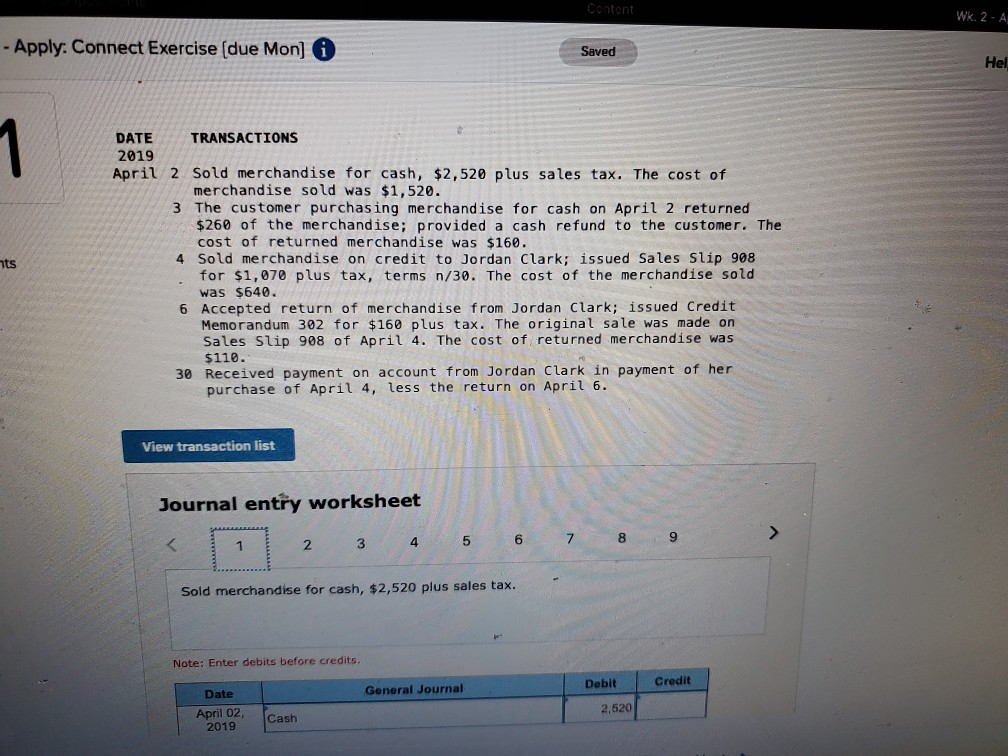

Content Wk. 2 - A - Apply: Connect Exercise (due Mon] 6 Saved Hel 1 DATE 2019 April 2 Sold merchandise for cash, $2,520 plus

Content Wk. 2 - A - Apply: Connect Exercise (due Mon] 6 Saved Hel 1 DATE 2019 April 2 Sold merchandise for cash, $2,520 plus sales tax. The cost of TRANSACTIONS merchandise sold was $1,520. 3 The customer purchasing merchandise for cash on April 2 returned $260 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $160. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,070 plus tax, terms n/30. The cost of the merchandise sold hts was $640. 6 Accepted return of merchandise from Jordan Clark; issued Credit Memorandum 302 for $160 plus tax. The original sale was made on Sales Slip 908 of April 4. The cost of returned merchandise was $110. 30 Received payment on account from Jordan Clark in payment of her purchase of April 4, less the return on April 6. View transaction list Journal entry worksheet 6 5 3 Sold merchandise for cash, $2,520 plus sales tax. Note: Enter debits before credits. Credit Debit General Journal Date 2,520 April 02, 2019 Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started