continuation

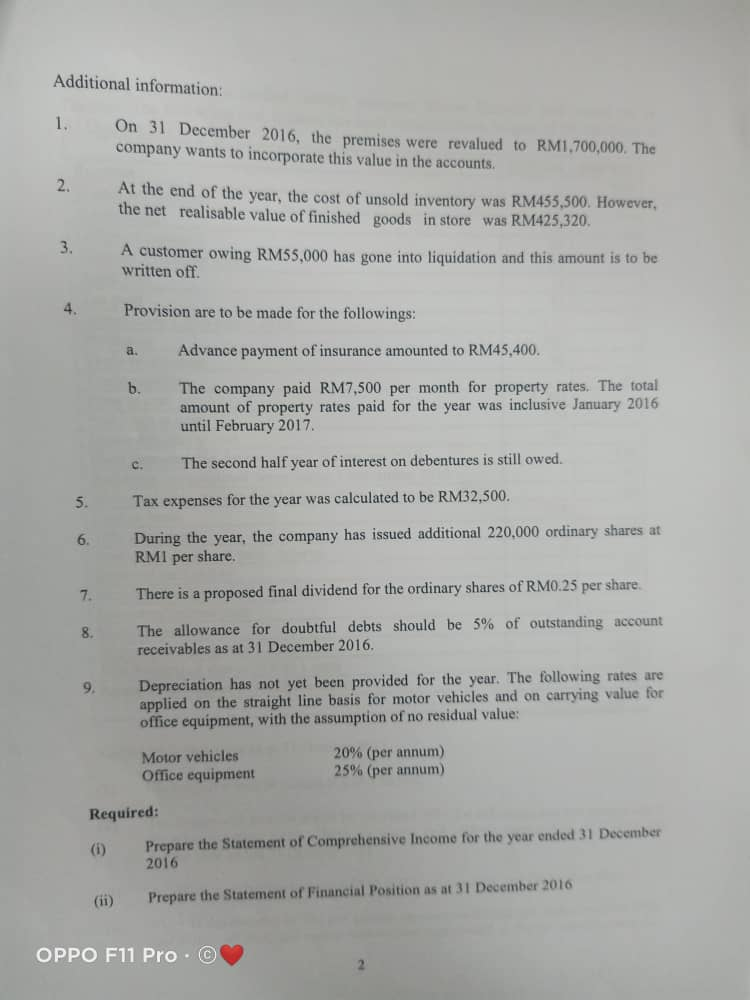

Additional information: 1. On 31 December 2016, the premises were revalued to RM1,700,000. The company wants to incorporate this value in the accounts. 2. At the end of the year, the cost of unsold inventory was RM455,500. However, the net realisable value of finished goods in store was RM425,320 3. A customer owing RM55,000 has gone into liquidation and this amount is to be written off. 4. Provision are to be made for the followings: a. Advance payment of insurance amounted to RM45,400. b. The company paid RM7,500 per month for property rates. The total amount of property rates paid for the year was inclusive January 2016 until February 2017 The second half year of interest on debentures is still owed. 5. Tax expenses for the year was calculated to be RM32,500. 6. During the year, the company has issued additional 220,000 ordinary shares at RMI per share. 7. There is a proposed final dividend for the ordinary shares of RM0.25 per share. 8. The allowance for doubtful debts should be 5% of outstanding account receivables as at 31 December 2016. 9. Depreciation has not yet been provided for the year. The following rates are applied on the straight line basis for motor vehicles and on carrying value for office equipment, with the assumption of no residual value: Motor vehicles Office equipment 20% (per annum) 25% (per annum) Required: (1) Prepare the Statement of Comprehensive Income for the year ended 31 December 2016 Prepare the Statement of Financial Position as at 31 December 2016 OPPO F11 Pro. Additional information: 1. On 31 December 2016, the premises were revalued to RM1,700,000. The company wants to incorporate this value in the accounts. 2. At the end of the year, the cost of unsold inventory was RM455,500. However, the net realisable value of finished goods in store was RM425,320 3. A customer owing RM55,000 has gone into liquidation and this amount is to be written off. 4. Provision are to be made for the followings: a. Advance payment of insurance amounted to RM45,400. b. The company paid RM7,500 per month for property rates. The total amount of property rates paid for the year was inclusive January 2016 until February 2017 The second half year of interest on debentures is still owed. 5. Tax expenses for the year was calculated to be RM32,500. 6. During the year, the company has issued additional 220,000 ordinary shares at RMI per share. 7. There is a proposed final dividend for the ordinary shares of RM0.25 per share. 8. The allowance for doubtful debts should be 5% of outstanding account receivables as at 31 December 2016. 9. Depreciation has not yet been provided for the year. The following rates are applied on the straight line basis for motor vehicles and on carrying value for office equipment, with the assumption of no residual value: Motor vehicles Office equipment 20% (per annum) 25% (per annum) Required: (1) Prepare the Statement of Comprehensive Income for the year ended 31 December 2016 Prepare the Statement of Financial Position as at 31 December 2016 OPPO F11 Pro