Answered step by step

Verified Expert Solution

Question

1 Approved Answer

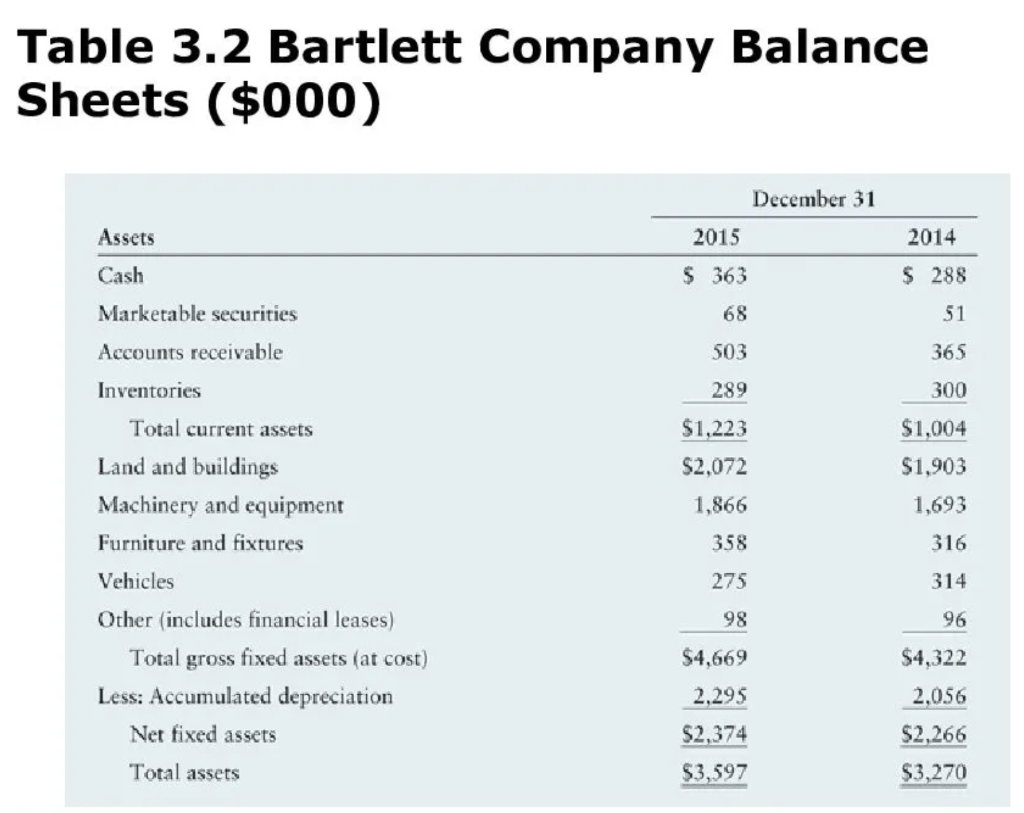

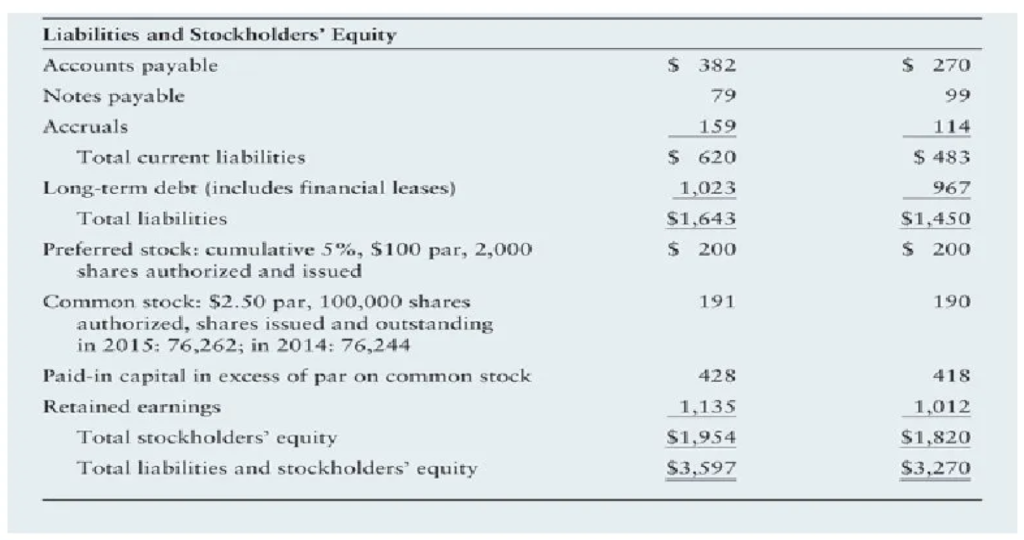

continuation of balance sheet.... income statements ($000) Provide the statement of cash flow for Barttlet Company and please explain how it was prepared. Thank you!

continuation of balance sheet....

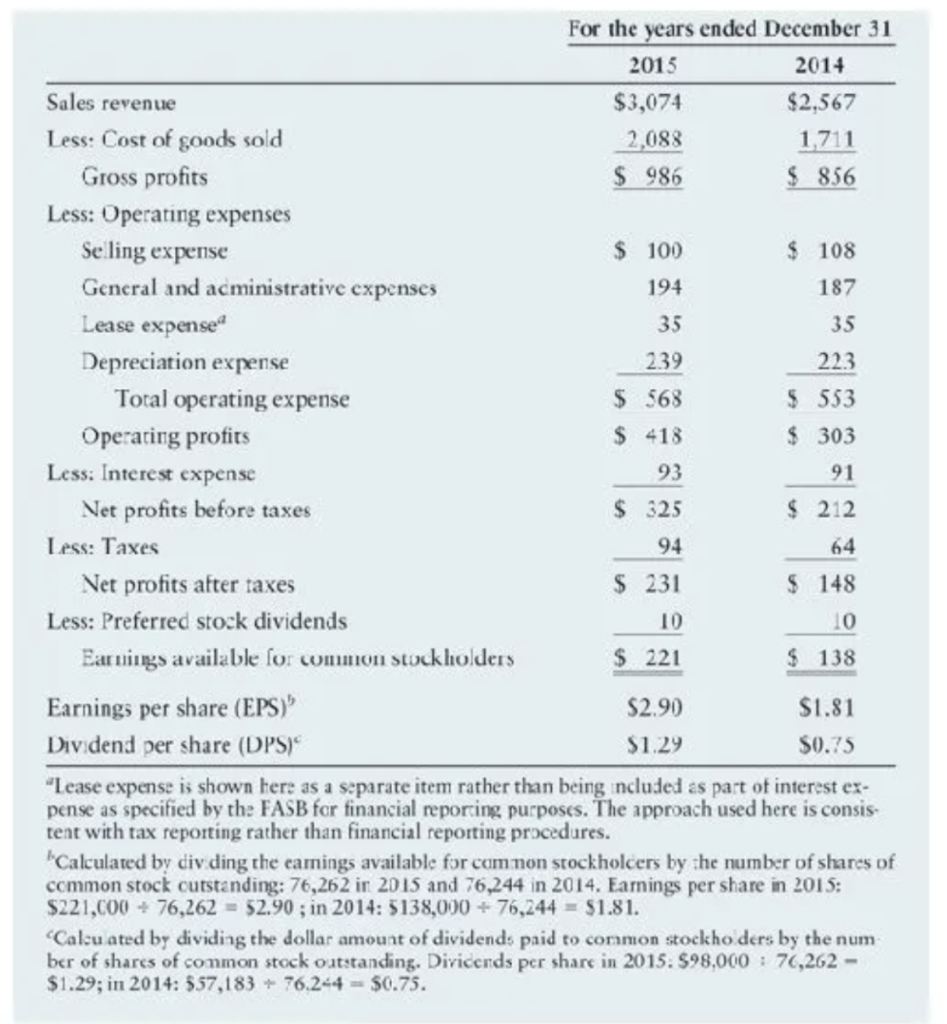

income statements ($000)

Provide the statement of cash flow for Barttlet Company and please explain how it was prepared. Thank you!

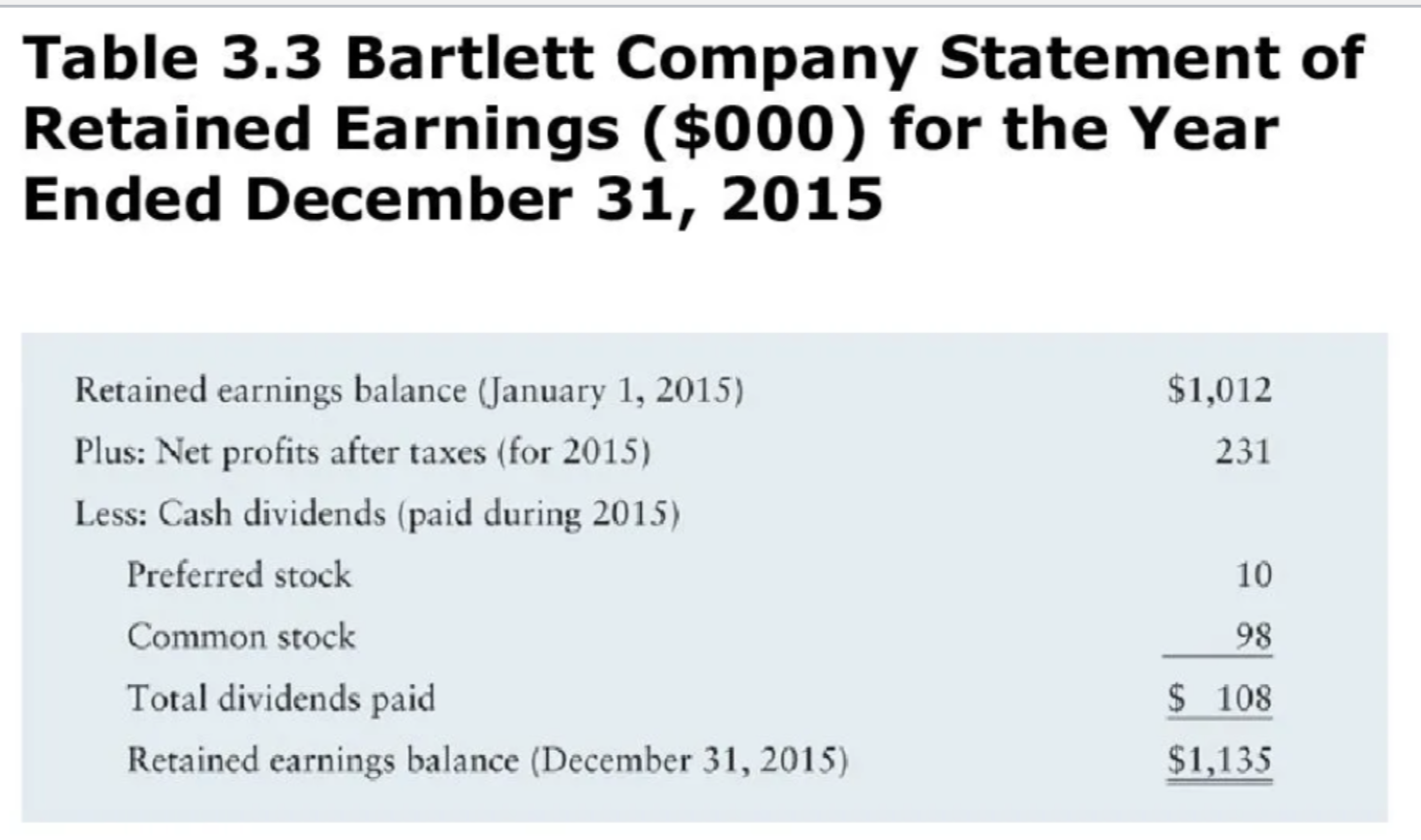

Table 3.2 Bartlett Company Balance Sheets ($000) December 31 2015 2014 $363 $ 288 68 51 503 365 289 300 $1,223 $2,072 $1,004 $1,903 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Land and buildings Machinery and equipment Furniture and fixtures Vehicles Other (includes financial leases) Total gross fixed assets (at cost) Less: Accumulated depreciation Net fixed assets Total assets 1,866 1,693 358 316 275 314 98 96 $4,669 $4,322 2.295 2,056 $2,374 $2,266 $3,270 $3,597 $ 382 $ 270 99 79 159 114 $ 620 $ 483 967 Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt (includes financial leases) Total liabilities Preferred stock: cumulative 5%, $100 par, 2,000 shares authorized and issued Common stock: $2.50 par, 100,000 shares authorized, shares issued and outstanding in 2015: 76,262; in 2014: 76,244 Paid-in capital in excess of par on common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 1,023 $1,643 $ 200 $1,450 $ 200 191 190 428 418 1,135 $1,954 $3,597 1,012 $1,820 $3,270 Table 3.3 Bartlett Company Statement of Retained Earnings ($000) for the Year Ended December 31, 2015 $1,012 231 Retained earnings balance (January 1, 2015) Plus: Net profits after taxes (for 2015) Less: Cash dividends (paid during 2015) Preferred stock Common stock Total dividends paid Retained earnings balance (December 31, 2015) 10 98 $ 108 $1,135 For the years ended December 31 2015 2014 Sales revenue $3,074 $2,567 Less: Cost of goods sold 2,088 1,711 Gross profits $ 986 $ 856 Less: Operating expenses Se ling expense $ 100 $ 108 General and acministrative expenses 194 187 Lease expense 35 35 Depreciation expense 239 223 Total operating expense $ 563 $ 553 Operating profits $ 418 $ 303 Less: Interest expense 93 91 Net profits before taxes $ 325 $ 212 Less: Taxes 94 Net profits after taxes $ 231 $ 148 Less: Preferred stock dividends 10 10 Earnings available for common stockholders $ 221 $ 138 Earnings per share (EPS) $2.90 $1.81 Dividend per share (DPS) $1.29 $0.75 "Lease expense is shown here as a separate item rather than being included as part of interest ex- pense as specified by the FASB for financial reporting purposes. The approach used here is consis- tent with tax reporting rather than financial reporting procedures. Calculated by div ding the camings available for cam non stockholcers by the number of shares of common stock cutstanding: 76,262 in 2015 and 76,244 in 2014. Earnings per share in 2015: $221,000 + 76,262 = 52.90 ; in 2014: 5138,000 + 76,244 = $1.81. Caleu ated by dividing the dollar amount of dividends paid to cormon stockho ders by the num ber of shares of common stock outstanding. Divicerds per share in 2015. $98,000 : 76,262 - $1.29; in 2014: 557,183 + 76.244 - $0.75Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started