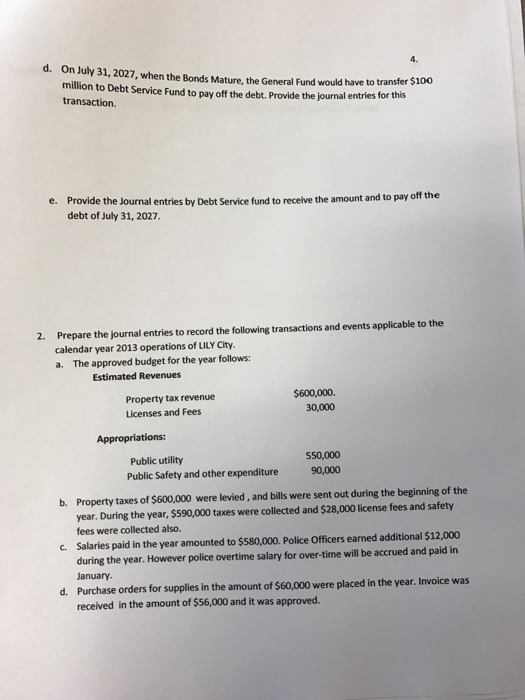

Continuation of previous question...

On July 31, 2027, when the Bonds Mature, the General Fund would have to transfer $100 million to Debt Service Fund to pay off the debt. Provide the journal entries for this transaction. Provide the Journal entries by Debt Service fund to receive the amount and to pay off the debt of July 31, 2027. Prepare the journal entries to record the following transactions and events applicable to the calendar year 2013 operations of LILY City. a. The approved budget for the year follows: Estimated Revenues Property tax revenue $600,000. Licenses and Fees 30,000 Appropriations: Public utility 550,000 Public Safety and other expenditure 90,000 b. Property taxes of $600,000 were levied, and bills were sent out during the beginning of the year. During the year, $590,000 taxes were collected and $28.000 license fees and safety fees were collected also. $12,000 c. Salaries paid in the year amounted to $580,000. Police officers earned additional $12,000 during the year. However police overtime salary for over-time will be accrued and paid in January. d. Purchase orders for supplies in the amount of $60,000 were placed in the year. Invoice was received in the amount of $56,000 and it was approved. On July 31, 2027, when the Bonds Mature, the General Fund would have to transfer $100 million to Debt Service Fund to pay off the debt. Provide the journal entries for this transaction. Provide the Journal entries by Debt Service fund to receive the amount and to pay off the debt of July 31, 2027. Prepare the journal entries to record the following transactions and events applicable to the calendar year 2013 operations of LILY City. a. The approved budget for the year follows: Estimated Revenues Property tax revenue $600,000. Licenses and Fees 30,000 Appropriations: Public utility 550,000 Public Safety and other expenditure 90,000 b. Property taxes of $600,000 were levied, and bills were sent out during the beginning of the year. During the year, $590,000 taxes were collected and $28.000 license fees and safety fees were collected also. $12,000 c. Salaries paid in the year amounted to $580,000. Police officers earned additional $12,000 during the year. However police overtime salary for over-time will be accrued and paid in January. d. Purchase orders for supplies in the amount of $60,000 were placed in the year. Invoice was received in the amount of $56,000 and it was approved