Answered step by step

Verified Expert Solution

Question

1 Approved Answer

continue on as 1 question. Cameron Payne and Michael Draper formed a partnership on July 12022 by investing $330,000 and $280,000 respectively. At the end

continue on as 1 question.

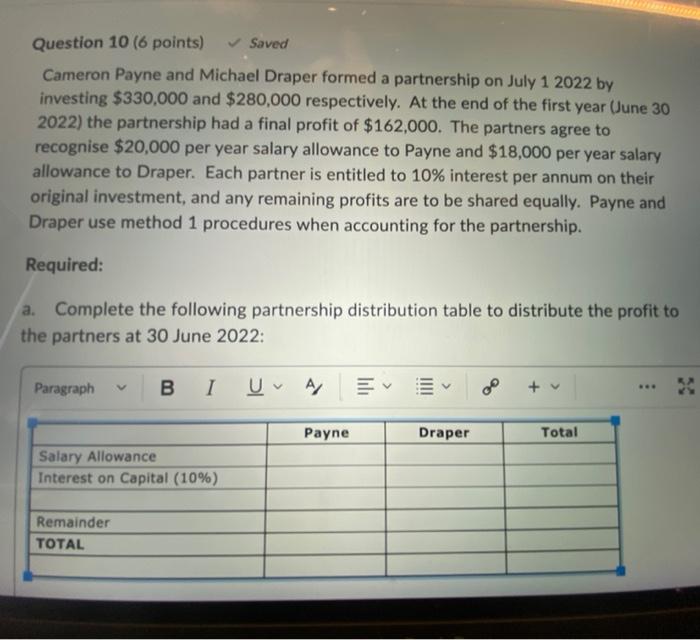

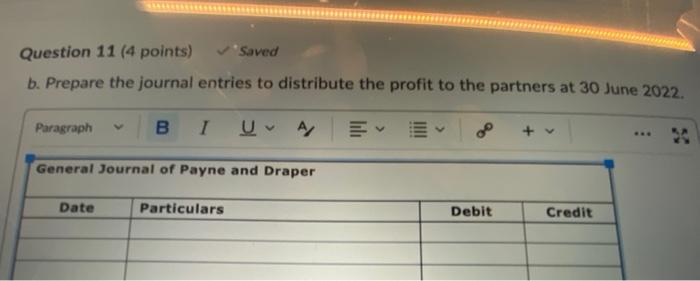

Cameron Payne and Michael Draper formed a partnership on July 12022 by investing $330,000 and $280,000 respectively. At the end of the first year (June 30 2022) the partnership had a final profit of $162,000. The partners agree to recognise $20,000 per year salary allowance to Payne and $18,000 per year salary allowance to Draper. Each partner is entitled to 10% interest per annum on their original investment, and any remaining profits are to be shared equally. Payne and Draper use method 1 procedures when accounting for the partnership. Required: a. Complete the following partnership distribution table to distribute the profit to the partners at 30 June 2022 : Question 11 (4 points) V Saved b. Prepare the journal entries to distribute the profit to the partners at 30 June 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started