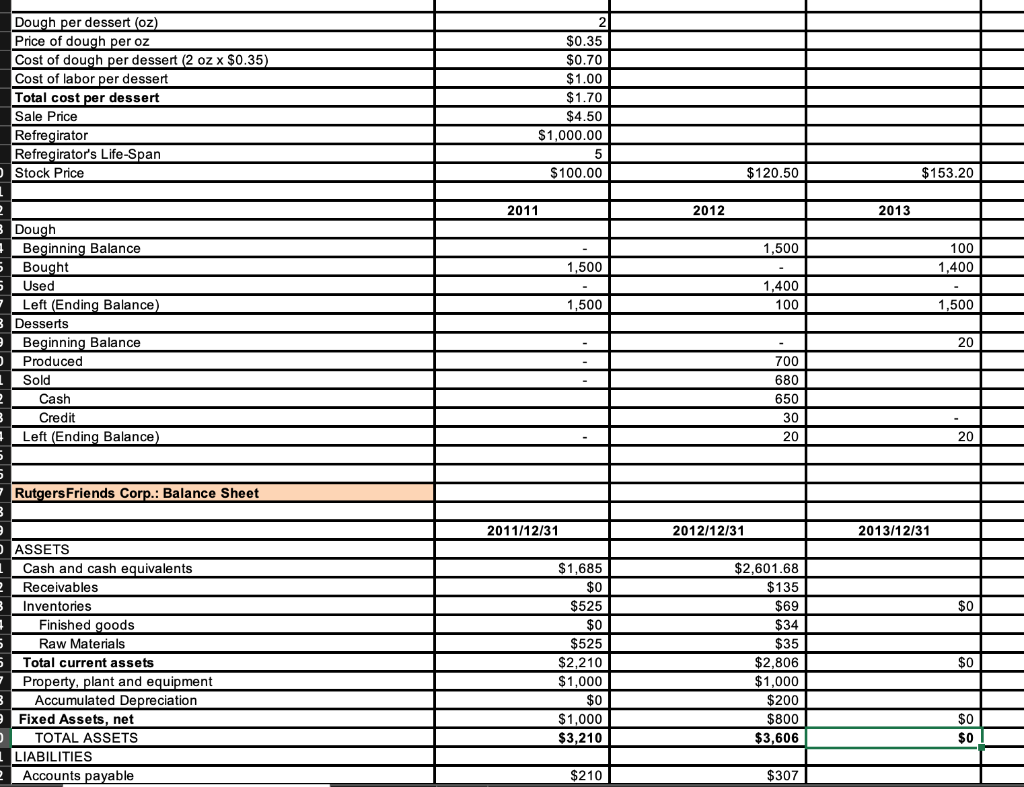

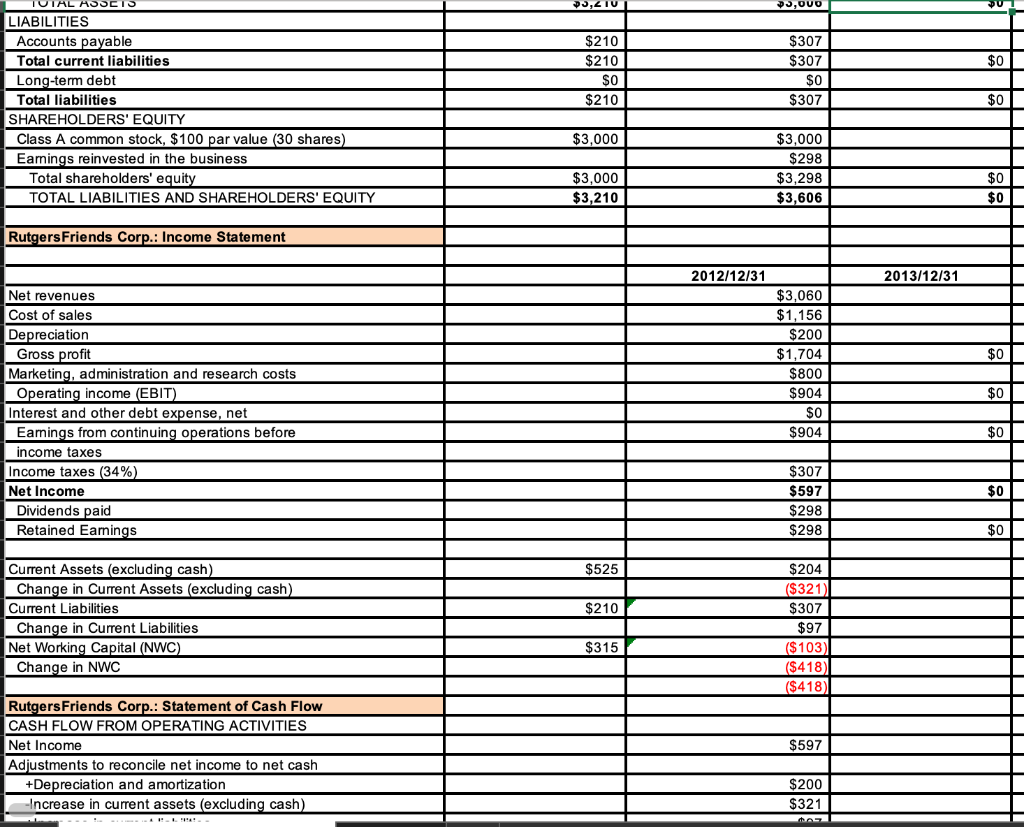

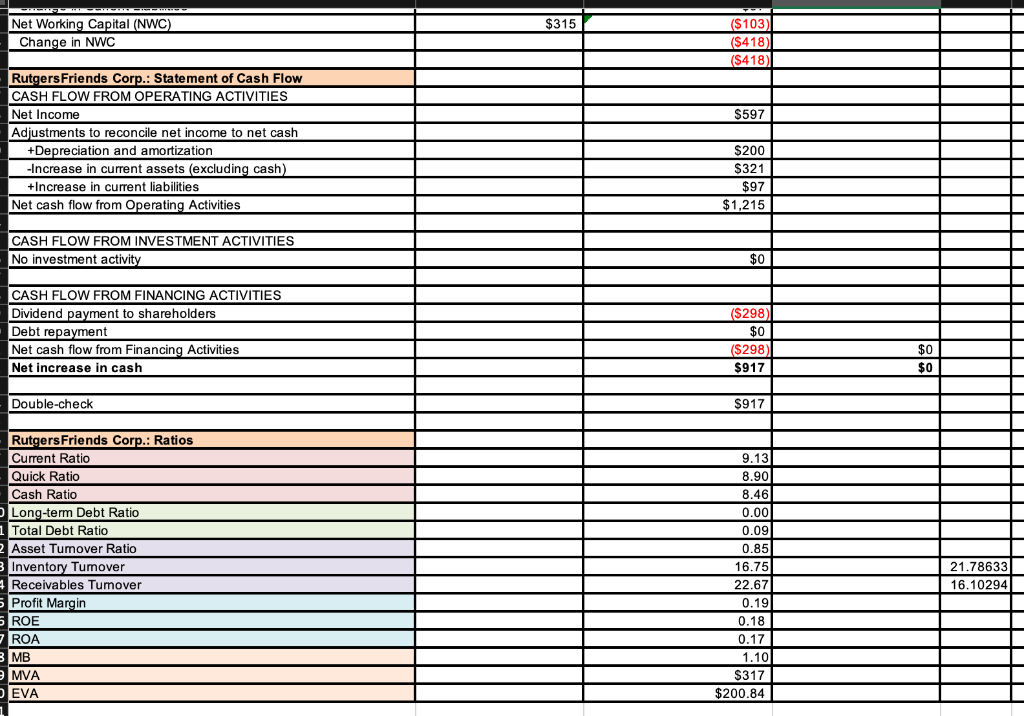

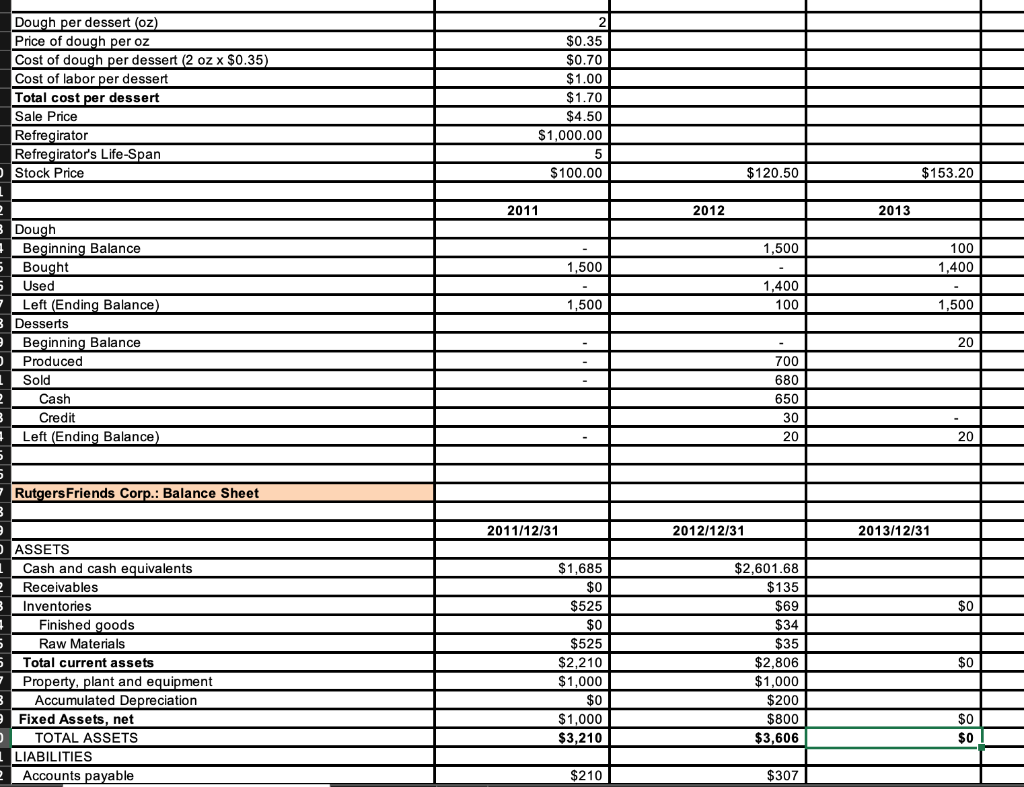

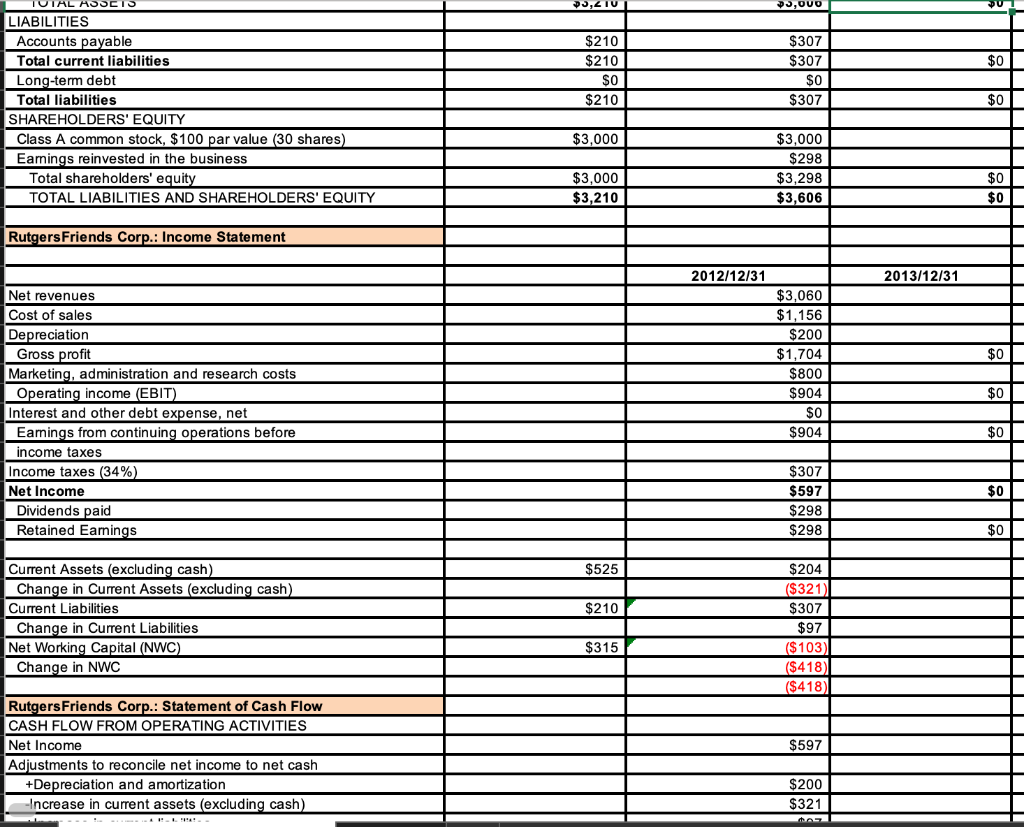

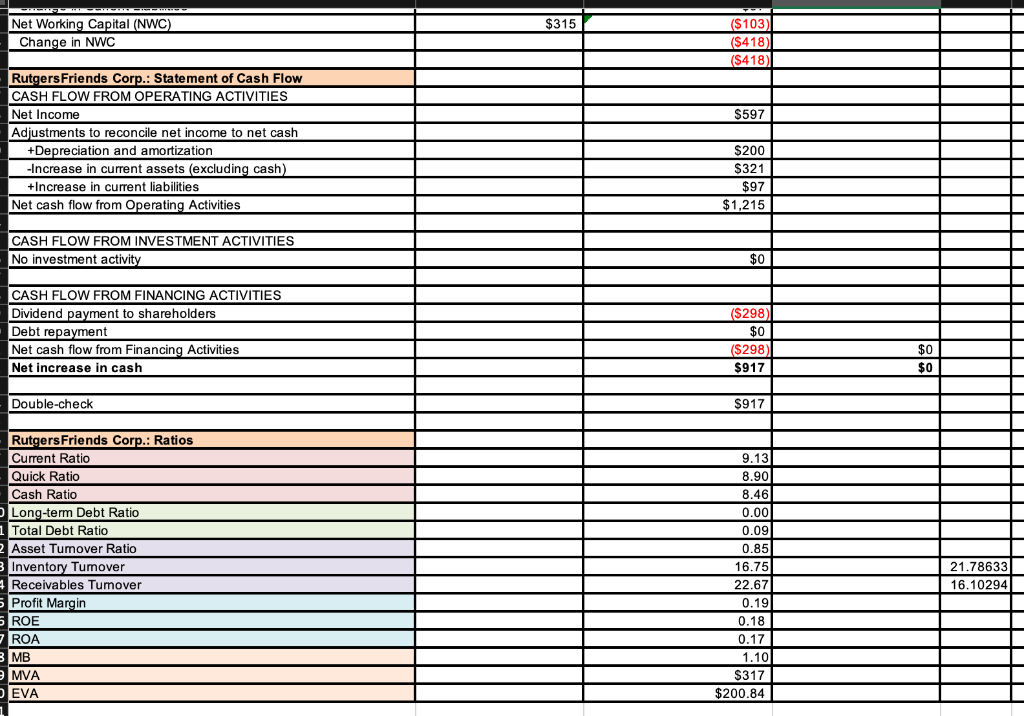

Continue working with our RutgersFriends Corporation (RFC) example. For details, please, download the required files (Word and Excel documents) from Canvas. Prepare the balance sheet for December 31, 2013. Prepare the income statement for RFC for fiscal year 2013. Prepare the statement of cash flows for RFC for fiscal year 2013. What was the quick ratio for RFC on December 31, 2013? Round your answer to two decimal places. Numeric Response Dough per dessert (oz) Price of dough per oz Cost of dough per dessert (2 oz x $0.35) Cost of labor per dessert Total cost per dessert Sale Price Refregirator Refregirator's Life-Span Stock Price $0.35 $0.70 $1.00 $1.70 $4.50 $1,000.00 5 $100.00 $120.50 $153.20 2011 2012 2013 1,500 100 1,400 1,500 1,400 100 1,500 1,500 Dough Beginning Balance 5 Bought Used Left (Ending Balance) Desserts Beginning Balance Produced Sold Cash Credit Left (Ending Balance) 20 700 680 650 30 20 20 Rutgers Friends Corp.: Balance Sheet 2011/12/31 2012/12/31 2013/12/31 $0 ASSETS Cash and cash equivalents Receivables Inventories Finished goods Raw Materials Total current assets Property, plant and equipment Accumulated Depreciation Fixed Assets, net TOTAL ASSETS LIABILITIES 2 Accounts payable $1,685 $0 $525 $0 $525 $2,210 $1,000 $0 $1,000 $3,210 $2,601.68 $135 $69 $34 $35 $2,806 $1,000 $200 $800 $3,606 $0 $0 $0 $210 $307 DS,LIU DJ, OVO $0 TUTAL ADICTS LIABILITIES Accounts payable Total current liabilities Long-term debt Total liabilities SHAREHOLDERS' EQUITY Class A common stock, $100 par value (30 shares) Earnings reinvested in the business Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $210 $210 SO $210 $307 $307 $0 $307 $0 $3,000 $3,000 $298 $3,298 $3,606 $3,000 $3,210 $0 $0 Rutgers Friends Corp.: Income Statement 2013/12/31 2012/12/31 $3,060 $1,156 $200 $1,704 $800 $904 $0 $904 $0 Net revenues Cost of sales Depreciation Gross profit Marketing, administration and research costs Operating income (EBIT) Interest and other debt expense, net Eamings from continuing operations before income taxes Income taxes (34%) Net Income Dividends paid Retained Eamings $0 $0 $307 $597 $298 $298 $0 $0 $525 $204 ($321) $210 Current Assets (excluding cash) Change in Current Assets (excluding cash) Current Liabilities Change in Current Liabilities Net Working Capital (NWC) Change in NWC $315 $307 $97 ($103) ($418) ($418) $597 Rutgers Friends Corp.: Statement of Cash Flow CASH FLOW FROM OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to net cash +Depreciation and amortization Increase in current assets (excluding cash) $200 $321 $315 Net Working Capital (NWC) Change in NWC ($103) ($418 ($418) $597 Rutgers Friends Corp.: Statement of Cash Flow CASH FLOW FROM OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to net cash +Depreciation and amortization -Increase in current assets (excluding cash) +Increase in current liabilities Net cash flow from Operating Activities $200 $321 $97 $1,215 CASH FLOW FROM INVESTMENT ACTIVITIES No investment activity $0 CASH FLOW FROM FINANCING ACTIVITIES Dividend payment to shareholders Debt repayment Net cash flow from Financing Activities Net increase in cash ($298) $0 ($298 $917 $0 $0 Double-check $917 Rutgers Friends Corp.: Ratios Current Ratio Quick Ratio Cash Ratio Long-term Debt Ratio Total Debt Ratio Asset Tumover Ratio Inventory Tumover Receivables Tumover Profit Margin ROE ROA MB MVA EVA 9.13 8.90 8.46 0.00 0.09 0.85 16.75 22.67 0.19 0.18 0.17 1.10 $317 $200.84 21.78633 16.10294 Continue working with our RutgersFriends Corporation (RFC) example. For details, please, download the required files (Word and Excel documents) from Canvas. Prepare the balance sheet for December 31, 2013. Prepare the income statement for RFC for fiscal year 2013. Prepare the statement of cash flows for RFC for fiscal year 2013. What was the quick ratio for RFC on December 31, 2013? Round your answer to two decimal places. Numeric Response Dough per dessert (oz) Price of dough per oz Cost of dough per dessert (2 oz x $0.35) Cost of labor per dessert Total cost per dessert Sale Price Refregirator Refregirator's Life-Span Stock Price $0.35 $0.70 $1.00 $1.70 $4.50 $1,000.00 5 $100.00 $120.50 $153.20 2011 2012 2013 1,500 100 1,400 1,500 1,400 100 1,500 1,500 Dough Beginning Balance 5 Bought Used Left (Ending Balance) Desserts Beginning Balance Produced Sold Cash Credit Left (Ending Balance) 20 700 680 650 30 20 20 Rutgers Friends Corp.: Balance Sheet 2011/12/31 2012/12/31 2013/12/31 $0 ASSETS Cash and cash equivalents Receivables Inventories Finished goods Raw Materials Total current assets Property, plant and equipment Accumulated Depreciation Fixed Assets, net TOTAL ASSETS LIABILITIES 2 Accounts payable $1,685 $0 $525 $0 $525 $2,210 $1,000 $0 $1,000 $3,210 $2,601.68 $135 $69 $34 $35 $2,806 $1,000 $200 $800 $3,606 $0 $0 $0 $210 $307 DS,LIU DJ, OVO $0 TUTAL ADICTS LIABILITIES Accounts payable Total current liabilities Long-term debt Total liabilities SHAREHOLDERS' EQUITY Class A common stock, $100 par value (30 shares) Earnings reinvested in the business Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $210 $210 SO $210 $307 $307 $0 $307 $0 $3,000 $3,000 $298 $3,298 $3,606 $3,000 $3,210 $0 $0 Rutgers Friends Corp.: Income Statement 2013/12/31 2012/12/31 $3,060 $1,156 $200 $1,704 $800 $904 $0 $904 $0 Net revenues Cost of sales Depreciation Gross profit Marketing, administration and research costs Operating income (EBIT) Interest and other debt expense, net Eamings from continuing operations before income taxes Income taxes (34%) Net Income Dividends paid Retained Eamings $0 $0 $307 $597 $298 $298 $0 $0 $525 $204 ($321) $210 Current Assets (excluding cash) Change in Current Assets (excluding cash) Current Liabilities Change in Current Liabilities Net Working Capital (NWC) Change in NWC $315 $307 $97 ($103) ($418) ($418) $597 Rutgers Friends Corp.: Statement of Cash Flow CASH FLOW FROM OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to net cash +Depreciation and amortization Increase in current assets (excluding cash) $200 $321 $315 Net Working Capital (NWC) Change in NWC ($103) ($418 ($418) $597 Rutgers Friends Corp.: Statement of Cash Flow CASH FLOW FROM OPERATING ACTIVITIES Net Income Adjustments to reconcile net income to net cash +Depreciation and amortization -Increase in current assets (excluding cash) +Increase in current liabilities Net cash flow from Operating Activities $200 $321 $97 $1,215 CASH FLOW FROM INVESTMENT ACTIVITIES No investment activity $0 CASH FLOW FROM FINANCING ACTIVITIES Dividend payment to shareholders Debt repayment Net cash flow from Financing Activities Net increase in cash ($298) $0 ($298 $917 $0 $0 Double-check $917 Rutgers Friends Corp.: Ratios Current Ratio Quick Ratio Cash Ratio Long-term Debt Ratio Total Debt Ratio Asset Tumover Ratio Inventory Tumover Receivables Tumover Profit Margin ROE ROA MB MVA EVA 9.13 8.90 8.46 0.00 0.09 0.85 16.75 22.67 0.19 0.18 0.17 1.10 $317 $200.84 21.78633 16.10294