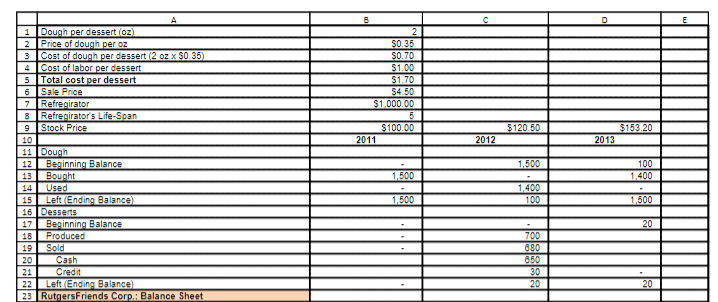

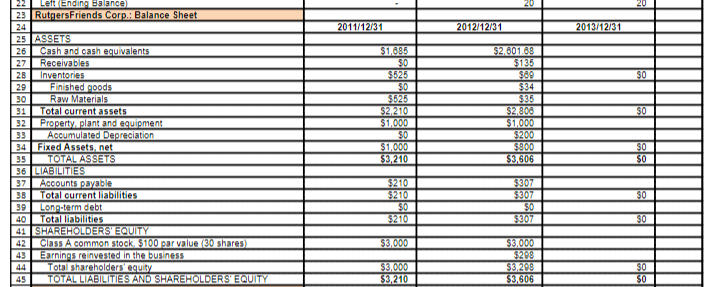

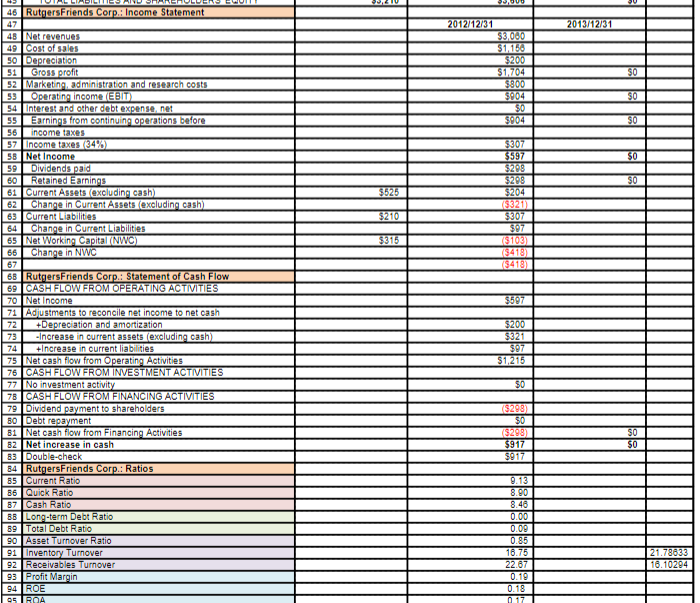

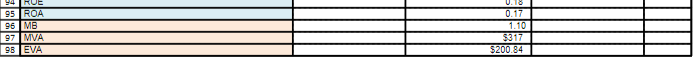

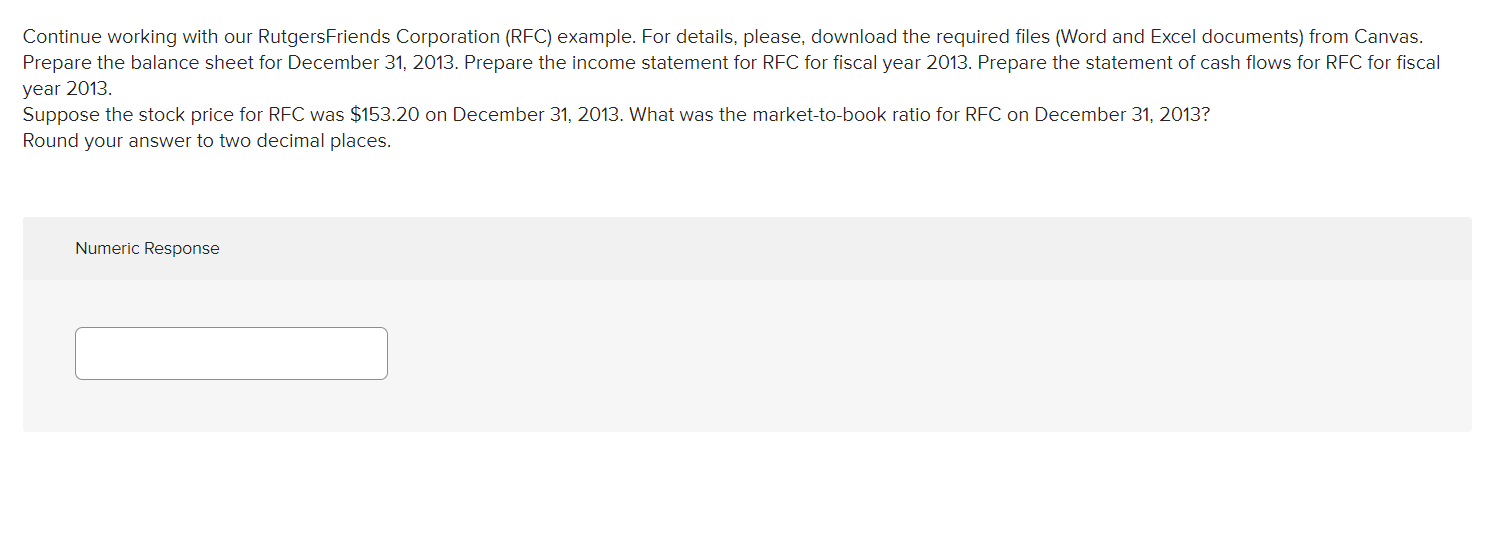

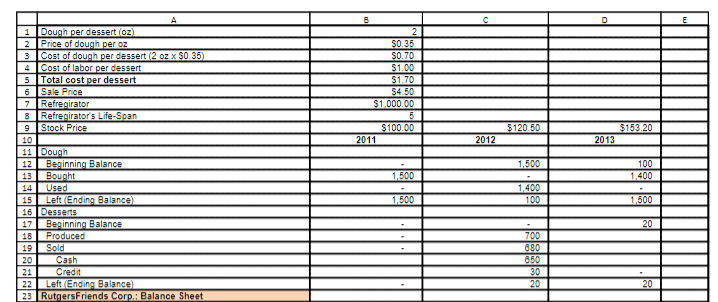

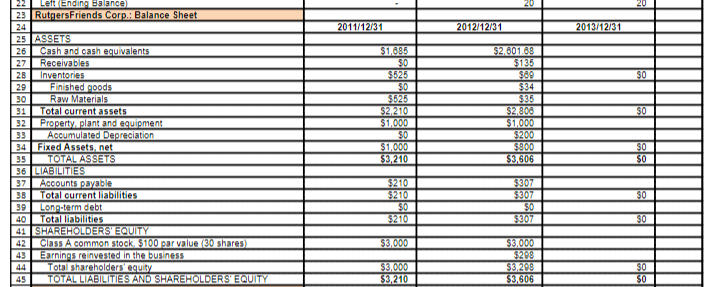

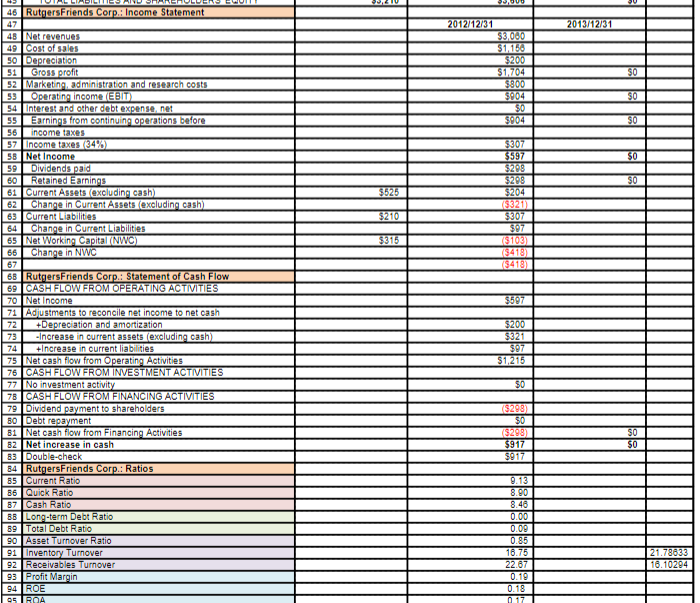

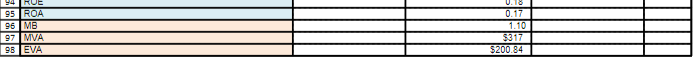

Continue working with our RutgersFriends Corporation (RFC) example. For details, please, download the required files (Word and Excel documents) from Canvas. Prepare the balance sheet for December 31, 2013. Prepare the income statement for RFC for fiscal year 2013. Prepare the statement of cash flows for RFC for fiscal year 2013 Suppose the stock price for RFC was $153.20 on December 31, 2013. What was the market-to-book ratio for RFC on December 31, 2013? Round your answer to two decimal places. Numeric Response C $0.35 SO 70 $1.00 $1.70 $4.50 $1.000.00 5 $100.00 2011 $120.50 $153 20 2012 2013 A 1 Dough per dessert (oz) 2 Price of dough per oz 3 Cost of dough per dessert (2 oz x $0.35) 4 Cost of labor per dessert 5 Total cost per dessert 6 Sale Price 7 Refregirator 8 Refregirator's Life-Span 9 Stock Price 10 11 Dough 12 Beginning Balance 13 Bought 14 Used 15 Left Ending Balance) 16 Desserts 17 Beginning Balance 18 Produced 19 Sold 20 Cash 21 Credit 22 Left Ending Balance) 23 RutgersFriends Corp.: Balance Sheet 1.500 100 1,400 1.500 1.400 1.500 100 1,500 20 700 880 650 30 20 20 20 20 2011/12/31 2012/12/31 2013/12/31 SO Left Ending Balance 23 Rutgers Friends Corp.: Balance Sheet 24 25 ASSETS 26 Cash and cash equivalents 27 Receivables 28 Inventories 29 Finished goods 30 Raw Materials 31 Total current assets 32 Property plant and equipment 33 Accumulated Depreciation 34 Fixed Assets, net 35 TOTAL ASSETS 36 LIABILITIES 37 Accounts payable 3B Total current liabilities 39 Lonc-term debt 40 Total liabilities SHAREHOLDERS' EQUITY 42 Class A common stock $100 par value (30 shares 43 Earnings reinvested in the business 44 Total shareholders' equity 45 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $1,685 $0 $525 $0 $525 $2.210 $1,000 $0 $1,000 $3,210 $2.801.88 $135 $89 $34 $35 $2,800 $1,000 $200 $800 $3,606 $0 $0 $0 $0 $210 $210 $0 $210 $307 $307 $0 $307 $0 $3,000 $3,000 $3,210 $3,000 $208 $3,299 $3,606 SO $0 2013/12/31 2012/12/31 $3,000 $1,150 $200 $1,704 $900 $904 $0 $904 $0 $0 $0 $307 $597 $208 lelle 5525 $204 $210 $307 3:2 16103 184181 (8418 $597 46 RutgersFriends Corp.: Income Statement 47 48 Net revenues 49 Cost of sales 50 Depreciation 51 Gross profit 52 Marketing, administration and research costs 53 Operating income EBIT 54 Interest and other debt expense.net 55 Earnings from continuing operations before 56 income taxes 57 Income taxes 34% 58 Net Income 59 Dividends paid 60 Retained Earnings 61 Current Assets excluding cash 62 Change in Current Assets (excluding cash 63 Current Liabilities 64 Change in Current Liabilities 65 Net Working Capital (NWO) 66 Change in NWC 67 68 RutgersFriends Corp.: Statement of Cash Flow 69 CASH FLOW FROM OPERATING ACTIVITIES 70 Net Income 71 Adjustments to reconcile net income to net cash 72 +Depreciation and amortization 73 - Increase in current assets (excluding cash) 74 +Increase in current liabilities 75 Net cash flow from Operating Activities 76 CASH FLOW FROM INVESTMENT ACTIVITIES 77 No investment activity 78 CASH FLOW FROM FINANCING ACTIVITIES 79 Dividend payment to shareholders 80 Debt repayment 31 Net cash flow from Financing Activities B2 Net increase in cash 83 Double-check 84 RutgersFriends Corp.: Ratios 85 Current Ratio B6Quick Ratio 87 Cash Ratio BB Long-term Debt Ratio 89 Total Debt Ratio 90 Asset Turnover Ratio 91 Inventory Turnover 92 Receivables Turnover 93 Profit Margin 94 ROE C5 THUA $200 $97 $1,215 50 (5293 50 (5299) $917 $917 SO $0 2.13 8.90 8.46 0.00 0.09 0.85 16.75 22.67 0.19 0.18 0 17 21.78633 16.10294 4 RUE 95 ROA 96 MB 97 MVA 98 EVA U18 0.17 1.10 $317 $200.84 Continue working with our RutgersFriends Corporation (RFC) example. For details, please, download the required files (Word and Excel documents) from Canvas. Prepare the balance sheet for December 31, 2013. Prepare the income statement for RFC for fiscal year 2013. Prepare the statement of cash flows for RFC for fiscal year 2013 Suppose the stock price for RFC was $153.20 on December 31, 2013. What was the market-to-book ratio for RFC on December 31, 2013? Round your answer to two decimal places. Numeric Response C $0.35 SO 70 $1.00 $1.70 $4.50 $1.000.00 5 $100.00 2011 $120.50 $153 20 2012 2013 A 1 Dough per dessert (oz) 2 Price of dough per oz 3 Cost of dough per dessert (2 oz x $0.35) 4 Cost of labor per dessert 5 Total cost per dessert 6 Sale Price 7 Refregirator 8 Refregirator's Life-Span 9 Stock Price 10 11 Dough 12 Beginning Balance 13 Bought 14 Used 15 Left Ending Balance) 16 Desserts 17 Beginning Balance 18 Produced 19 Sold 20 Cash 21 Credit 22 Left Ending Balance) 23 RutgersFriends Corp.: Balance Sheet 1.500 100 1,400 1.500 1.400 1.500 100 1,500 20 700 880 650 30 20 20 20 20 2011/12/31 2012/12/31 2013/12/31 SO Left Ending Balance 23 Rutgers Friends Corp.: Balance Sheet 24 25 ASSETS 26 Cash and cash equivalents 27 Receivables 28 Inventories 29 Finished goods 30 Raw Materials 31 Total current assets 32 Property plant and equipment 33 Accumulated Depreciation 34 Fixed Assets, net 35 TOTAL ASSETS 36 LIABILITIES 37 Accounts payable 3B Total current liabilities 39 Lonc-term debt 40 Total liabilities SHAREHOLDERS' EQUITY 42 Class A common stock $100 par value (30 shares 43 Earnings reinvested in the business 44 Total shareholders' equity 45 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $1,685 $0 $525 $0 $525 $2.210 $1,000 $0 $1,000 $3,210 $2.801.88 $135 $89 $34 $35 $2,800 $1,000 $200 $800 $3,606 $0 $0 $0 $0 $210 $210 $0 $210 $307 $307 $0 $307 $0 $3,000 $3,000 $3,210 $3,000 $208 $3,299 $3,606 SO $0 2013/12/31 2012/12/31 $3,000 $1,150 $200 $1,704 $900 $904 $0 $904 $0 $0 $0 $307 $597 $208 lelle 5525 $204 $210 $307 3:2 16103 184181 (8418 $597 46 RutgersFriends Corp.: Income Statement 47 48 Net revenues 49 Cost of sales 50 Depreciation 51 Gross profit 52 Marketing, administration and research costs 53 Operating income EBIT 54 Interest and other debt expense.net 55 Earnings from continuing operations before 56 income taxes 57 Income taxes 34% 58 Net Income 59 Dividends paid 60 Retained Earnings 61 Current Assets excluding cash 62 Change in Current Assets (excluding cash 63 Current Liabilities 64 Change in Current Liabilities 65 Net Working Capital (NWO) 66 Change in NWC 67 68 RutgersFriends Corp.: Statement of Cash Flow 69 CASH FLOW FROM OPERATING ACTIVITIES 70 Net Income 71 Adjustments to reconcile net income to net cash 72 +Depreciation and amortization 73 - Increase in current assets (excluding cash) 74 +Increase in current liabilities 75 Net cash flow from Operating Activities 76 CASH FLOW FROM INVESTMENT ACTIVITIES 77 No investment activity 78 CASH FLOW FROM FINANCING ACTIVITIES 79 Dividend payment to shareholders 80 Debt repayment 31 Net cash flow from Financing Activities B2 Net increase in cash 83 Double-check 84 RutgersFriends Corp.: Ratios 85 Current Ratio B6Quick Ratio 87 Cash Ratio BB Long-term Debt Ratio 89 Total Debt Ratio 90 Asset Turnover Ratio 91 Inventory Turnover 92 Receivables Turnover 93 Profit Margin 94 ROE C5 THUA $200 $97 $1,215 50 (5293 50 (5299) $917 $917 SO $0 2.13 8.90 8.46 0.00 0.09 0.85 16.75 22.67 0.19 0.18 0 17 21.78633 16.10294 4 RUE 95 ROA 96 MB 97 MVA 98 EVA U18 0.17 1.10 $317 $200.84