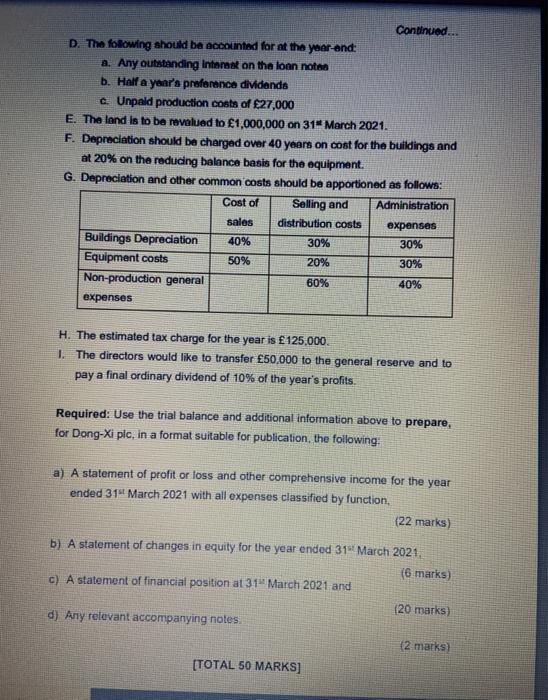

Continued... D. The following should be accounted for at the year and a. Any outstanding Interest on the loan notre b. Half a year's preference dividends c. Unpald production costs of 27,000 E. The land is to be revalued to 1,000,000 on 31 March 2021. F. Depreciation should be charged over 40 years on cost for the buildings and at 20% on the reducing balance basis for the equipment. G. Depreciation and other common costs should be apportioned as follows: Cost of Selling and Administration sales distribution costs expenses Buildings Depreciation 40% 30% 30% Equipment costs 50% 20% 30% Non-production general 60% 40% expenses H. The estimated tax charge for the year is 125,000 1. The directors would like to transfer 50,000 to the general reserve and to pay a final ordinary dividend of 10% of the year's profits. Required: Use the trial balance and additional information above to prepare, for Dong-Xi plc, in a format suitable for publication, the following: a) A statement of profit or loss and other comprehensive income for the year ended 314 March 2021 with all expenses classified by function, (22 marks) b) A statement of changes in equity for the year ended 314 March 2021, (6 marks) c) A statement of financial position at 31 March 2021 and (20 marks) d) Any relevant accompanying notes (2 marks) [TOTAL 50 MARKS] Continued... D. The following should be accounted for at the year and a. Any outstanding Interest on the loan notre b. Half a year's preference dividends c. Unpald production costs of 27,000 E. The land is to be revalued to 1,000,000 on 31 March 2021. F. Depreciation should be charged over 40 years on cost for the buildings and at 20% on the reducing balance basis for the equipment. G. Depreciation and other common costs should be apportioned as follows: Cost of Selling and Administration sales distribution costs expenses Buildings Depreciation 40% 30% 30% Equipment costs 50% 20% 30% Non-production general 60% 40% expenses H. The estimated tax charge for the year is 125,000 1. The directors would like to transfer 50,000 to the general reserve and to pay a final ordinary dividend of 10% of the year's profits. Required: Use the trial balance and additional information above to prepare, for Dong-Xi plc, in a format suitable for publication, the following: a) A statement of profit or loss and other comprehensive income for the year ended 314 March 2021 with all expenses classified by function, (22 marks) b) A statement of changes in equity for the year ended 314 March 2021, (6 marks) c) A statement of financial position at 31 March 2021 and (20 marks) d) Any relevant accompanying notes (2 marks) [TOTAL 50 MARKS]