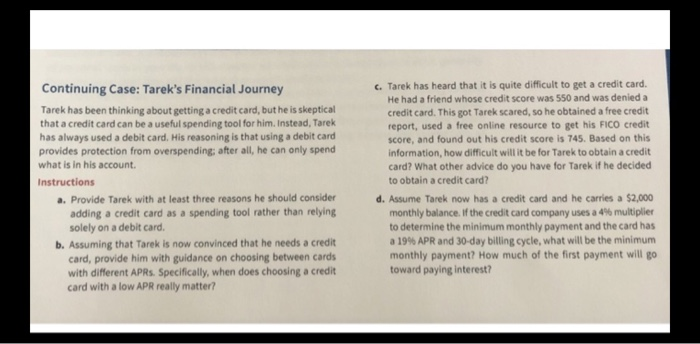

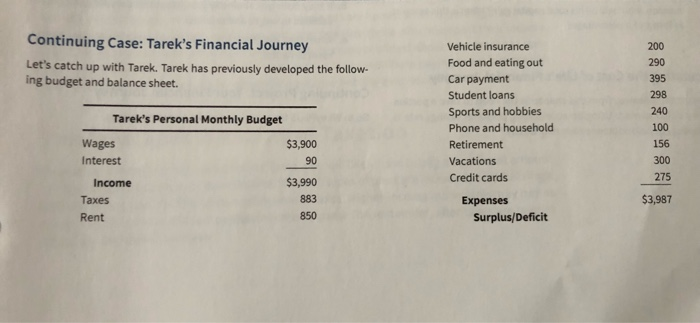

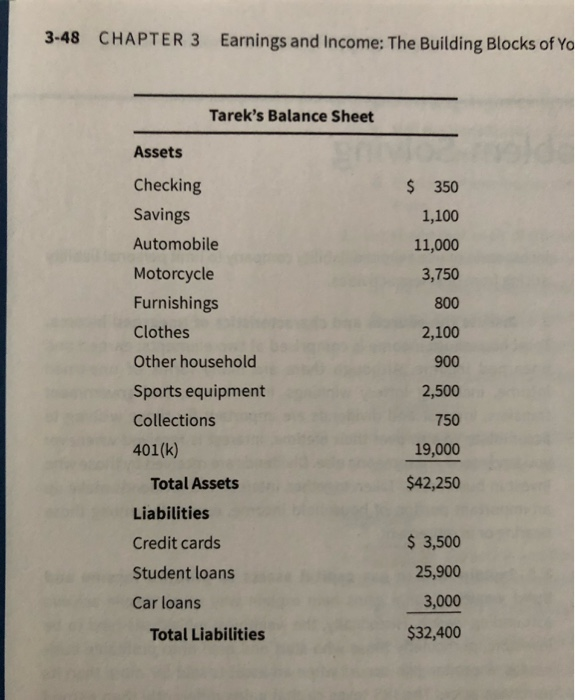

Continuing Case: Tarek's Financial Journey Tarek has been thinking about getting a credit card, but he is skeptical that a credit card can be a useful spending tool for him. Instead, Tarek has always used a debit card. His reasoning is that using a debit card provides protection from overspending after all, he can only spend what is in his account. Instructions a. Provide Tarek with at least three reasons he should consider adding a credit card as a spending tool rather than relying solely on a debit card b. Assuming that Tarek is now convinced that he needs a credit card, provide him with guidance on choosing between cards with different APRs. Specifically, when does choosing a credit card with a low APR really matter? C. Tarek has heard that it is quite difficult to get a credit card. He had a friend whose credit score was 550 and was denied a credit card. This got Tarek scared, so he obtained a free credit report, used a free online resource to get his FICO credit score, and found out his credit score is 745. Based on this information, how difficult will it be for Tarek to obtain a credit card? What other advice do you have for Tarek if he decided to obtain a credit card? d. Assume Tarek now has a credit card and he carries a $2,000 monthly balance. If the credit card company uses a 4% multiplier to determine the minimum monthly payment and the card has a 19% APR and 30-day billing cycle, what will be the minimum monthly payment? How much of the first payment will go toward paying interest? Continuing Case: Tarek's Financial Journey Let's catch up with Tarek. Tarek has previously developed the follow. ing budget and balance sheet. 290 Vehicle insurance Food and eating out Car payment Student loans Sports and hobbies Phone and household Retirement Vacations Credit cards Tarek's Personal Monthly Budget Wages Interest $3,900 90 100 156 300 275 $3,987 $3,990 Income Taxes Rent 883 850 Expenses Surplus/Deficit 3-48 CHAPTER 3 Earnings and Income: The Building Blocks of Yo Tarek's Balance Sheet Assets Checking Savings Automobile Motorcycle Furnishings Clothes Other household Sports equipment Collections 401(k) Total Assets Liabilities Credit cards Student loans Car loans Total Liabilities $ 350 1,100 11,000 3,750 800 2,100 900 2,500 750 19,000 $42,250 $ 3,500 25,900 3,000 $32,400 Continuing Case: Tarek's Financial Journey Tarek has been thinking about getting a credit card, but he is skeptical that a credit card can be a useful spending tool for him. Instead, Tarek has always used a debit card. His reasoning is that using a debit card provides protection from overspending after all, he can only spend what is in his account. Instructions a. Provide Tarek with at least three reasons he should consider adding a credit card as a spending tool rather than relying solely on a debit card b. Assuming that Tarek is now convinced that he needs a credit card, provide him with guidance on choosing between cards with different APRs. Specifically, when does choosing a credit card with a low APR really matter? C. Tarek has heard that it is quite difficult to get a credit card. He had a friend whose credit score was 550 and was denied a credit card. This got Tarek scared, so he obtained a free credit report, used a free online resource to get his FICO credit score, and found out his credit score is 745. Based on this information, how difficult will it be for Tarek to obtain a credit card? What other advice do you have for Tarek if he decided to obtain a credit card? d. Assume Tarek now has a credit card and he carries a $2,000 monthly balance. If the credit card company uses a 4% multiplier to determine the minimum monthly payment and the card has a 19% APR and 30-day billing cycle, what will be the minimum monthly payment? How much of the first payment will go toward paying interest? Continuing Case: Tarek's Financial Journey Let's catch up with Tarek. Tarek has previously developed the follow. ing budget and balance sheet. 290 Vehicle insurance Food and eating out Car payment Student loans Sports and hobbies Phone and household Retirement Vacations Credit cards Tarek's Personal Monthly Budget Wages Interest $3,900 90 100 156 300 275 $3,987 $3,990 Income Taxes Rent 883 850 Expenses Surplus/Deficit 3-48 CHAPTER 3 Earnings and Income: The Building Blocks of Yo Tarek's Balance Sheet Assets Checking Savings Automobile Motorcycle Furnishings Clothes Other household Sports equipment Collections 401(k) Total Assets Liabilities Credit cards Student loans Car loans Total Liabilities $ 350 1,100 11,000 3,750 800 2,100 900 2,500 750 19,000 $42,250 $ 3,500 25,900 3,000 $32,400