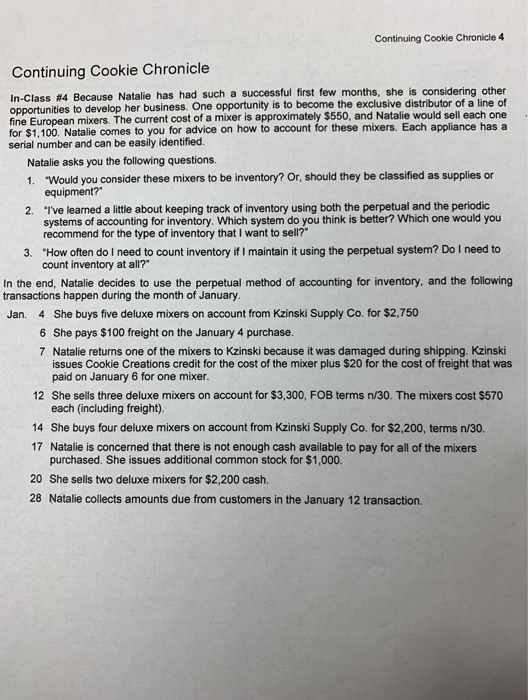

Continuing Cookie Chronicle 4 Continuing Cookie Chronicle In-Class #4 Because Natalie has had such a successful first few months, she is considering other op portunities to develop her business. One opportunity is to become the exclusive distributor of a line of fine European mixers. The current cost of a mixer is approximately $550, and Natalie would sell each one for $1,100. Natalie comes to you for advice on how to account for these mixers. Each appliance has a serial number and can be easily identified. Natalie asks you the following questions 1. "Would you consider these mixers to be inventory? Or, should they be classified as supplies or equipment?" "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 2. 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" In the end, Natalie decides to use the perpetual method of accounting for inventory, and the following transactions happen during the month of January 4 She buys five deluxe mixers on account from Kzinski Supply Co. for $2,750 6 She pays $100 freight on the January 4 purchase. 7 Natalie returns one of the mixers to Kzinski because it was damaged during shipping. Kzinski Jan. issues Cookie Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer 12 She sells three deluxe mixers on account for $3,300, FOB terms n/30. The mixers cost $570 each (including freight). 14 She buys four deluxe mixers on account from Kzinski Supply Co. for $2,200, terms n/30. 17 Natalie is concerned that there is not enough cash available to pay for all of the mixers purchased. She issues additional common stock for $1,000. 20 She sells two deluxe mixers for $2,200 cash. 28 Natalie collects amounts due from customers in the January 12 transaction. Continuing Cookie Chronicle 4 Continuing Cookie Chronicle In-Class #4 Because Natalie has had such a successful first few months, she is considering other op portunities to develop her business. One opportunity is to become the exclusive distributor of a line of fine European mixers. The current cost of a mixer is approximately $550, and Natalie would sell each one for $1,100. Natalie comes to you for advice on how to account for these mixers. Each appliance has a serial number and can be easily identified. Natalie asks you the following questions 1. "Would you consider these mixers to be inventory? Or, should they be classified as supplies or equipment?" "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 2. 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" In the end, Natalie decides to use the perpetual method of accounting for inventory, and the following transactions happen during the month of January 4 She buys five deluxe mixers on account from Kzinski Supply Co. for $2,750 6 She pays $100 freight on the January 4 purchase. 7 Natalie returns one of the mixers to Kzinski because it was damaged during shipping. Kzinski Jan. issues Cookie Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer 12 She sells three deluxe mixers on account for $3,300, FOB terms n/30. The mixers cost $570 each (including freight). 14 She buys four deluxe mixers on account from Kzinski Supply Co. for $2,200, terms n/30. 17 Natalie is concerned that there is not enough cash available to pay for all of the mixers purchased. She issues additional common stock for $1,000. 20 She sells two deluxe mixers for $2,200 cash. 28 Natalie collects amounts due from customers in the January 12 transaction