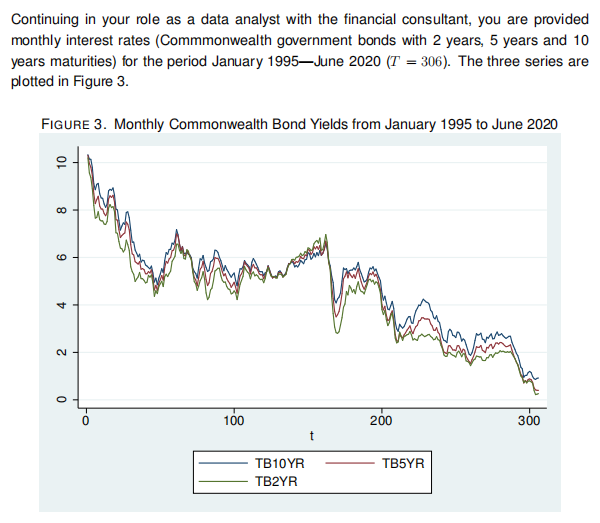

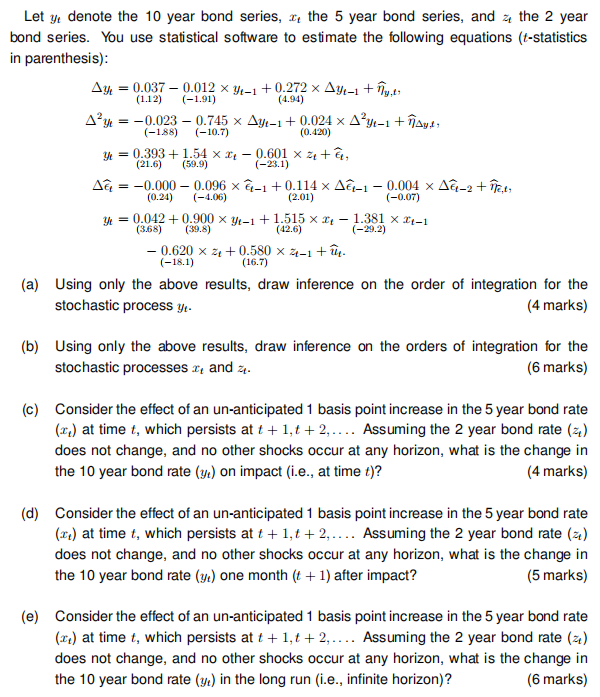

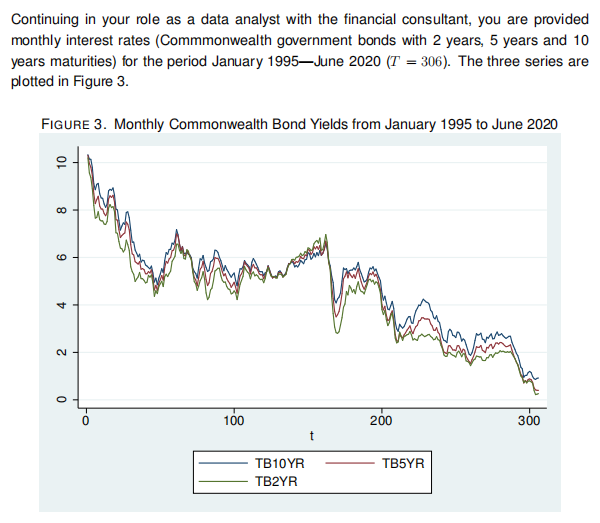

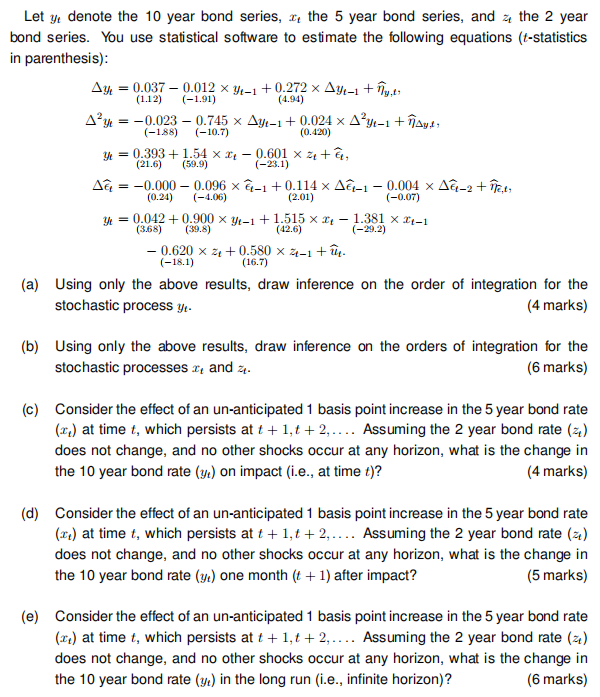

Continuing in your role as a data analyst with the financial consultant, you are provided monthly interest rates (Commmonwealth government bonds with 2 years, 5 years and 10 years maturities) for the period January 1995June 2020 (T = 306). The three series are plotted in Figure 3. FIGURE 3. Monthly Commonwealth Bond Yields from January 1995 to June 2020 10 8 9 4 2 0 100 200 300 t TB5YR TB10 YR TB2YR Let ye denote the 10 year bond series, De the 5 year bond series, and ze the 2 year bond series. You use statistical software to estimate the following equations (t-statistics in parenthesis): Ay 0.037 -0.012 x y-1 +0.272 x Ay-1 + lies (1.12) (-1.91) (4.94) (-188) (-10.7) Aye = -0.023 0.745 x Aye-1 + 0.024 x Aye-1 + lay, (0.420) y = 0.393 +1.54 x 4 -0.601 x 2 + , (21.6) A = -0.000 - 0.096 x 6-1 + 0.114 x A&-1 -0.004 x A&-2 +Tiet, (59.9) (-23.1) (0.24) (-4.06) (2.01) (-0.07) (42.6) (-29.2) y = 0.042 + 0.900 X Yt-1 + 1.515 x L - 1.381 x 2-1 (3.68) (39.8) 0.620 x 7+0.580 x 4-1+. (-18.1) (16.7) (a) Using only the above results, draw inference on the order of integration for the stochastic process y (4 marks) (b) Using only the above results, draw inference on the orders of integration for the stochastic processes De and zz. (6 marks) (c) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (22) at time t, which persists at t +1,6 +2.... Assuming the 2 year bond rate (2) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) on impact (i.e., at time t)? (4 marks) (d) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (22) at time t, which persists at t +1,1 + 2 .... Assuming the 2 year bond rate (2) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) one month (t + 1) after impact? (5 marks) (e) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate () at time t, which persists at t+1,t + 2,.... Assuming the 2 year bond rate (21) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) in the long run (i.e., infinite horizon)? (6 marks) Continuing in your role as a data analyst with the financial consultant, you are provided monthly interest rates (Commmonwealth government bonds with 2 years, 5 years and 10 years maturities) for the period January 1995June 2020 (T = 306). The three series are plotted in Figure 3. FIGURE 3. Monthly Commonwealth Bond Yields from January 1995 to June 2020 10 8 9 4 2 0 100 200 300 t TB5YR TB10 YR TB2YR Let ye denote the 10 year bond series, De the 5 year bond series, and ze the 2 year bond series. You use statistical software to estimate the following equations (t-statistics in parenthesis): Ay 0.037 -0.012 x y-1 +0.272 x Ay-1 + lies (1.12) (-1.91) (4.94) (-188) (-10.7) Aye = -0.023 0.745 x Aye-1 + 0.024 x Aye-1 + lay, (0.420) y = 0.393 +1.54 x 4 -0.601 x 2 + , (21.6) A = -0.000 - 0.096 x 6-1 + 0.114 x A&-1 -0.004 x A&-2 +Tiet, (59.9) (-23.1) (0.24) (-4.06) (2.01) (-0.07) (42.6) (-29.2) y = 0.042 + 0.900 X Yt-1 + 1.515 x L - 1.381 x 2-1 (3.68) (39.8) 0.620 x 7+0.580 x 4-1+. (-18.1) (16.7) (a) Using only the above results, draw inference on the order of integration for the stochastic process y (4 marks) (b) Using only the above results, draw inference on the orders of integration for the stochastic processes De and zz. (6 marks) (c) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (22) at time t, which persists at t +1,6 +2.... Assuming the 2 year bond rate (2) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) on impact (i.e., at time t)? (4 marks) (d) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (22) at time t, which persists at t +1,1 + 2 .... Assuming the 2 year bond rate (2) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) one month (t + 1) after impact? (5 marks) (e) Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate () at time t, which persists at t+1,t + 2,.... Assuming the 2 year bond rate (21) does not change, and no other shocks occur at any horizon, what is the change in the 10 year bond rate (y) in the long run (i.e., infinite horizon)? (6 marks)