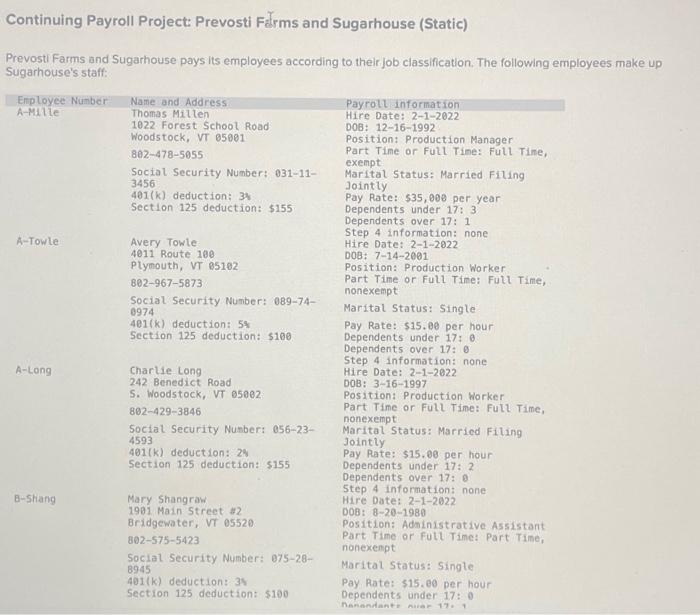

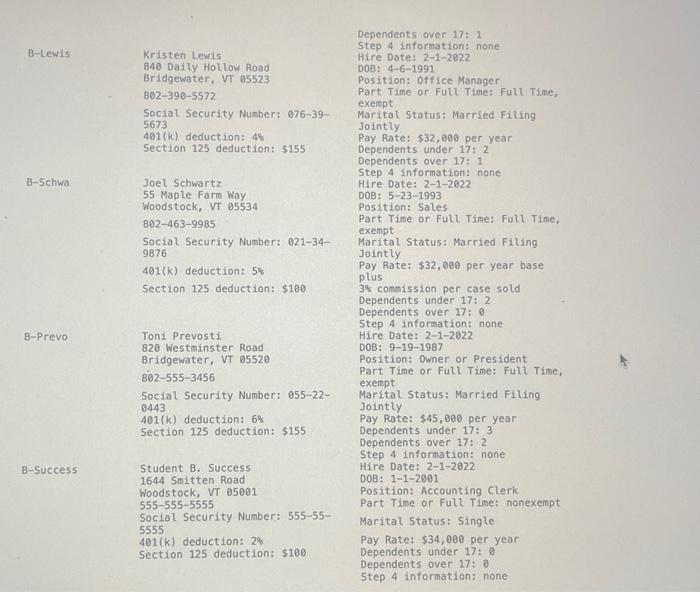

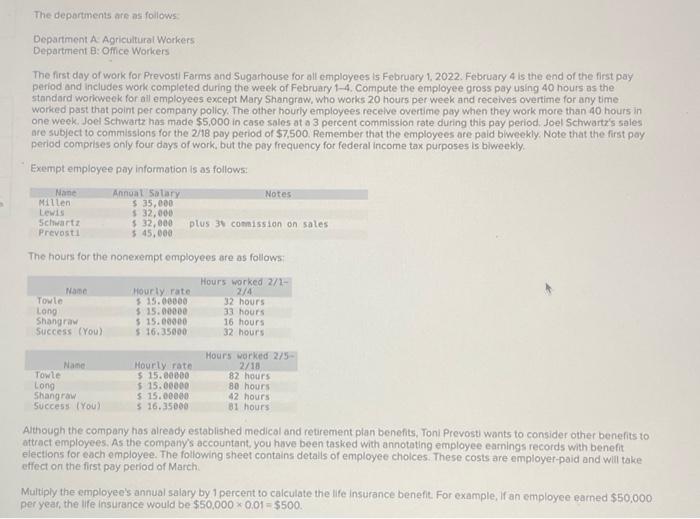

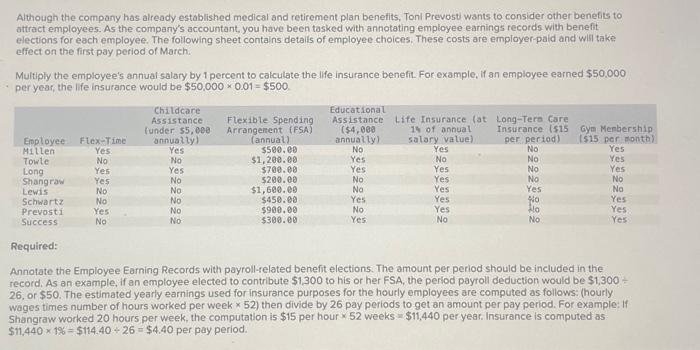

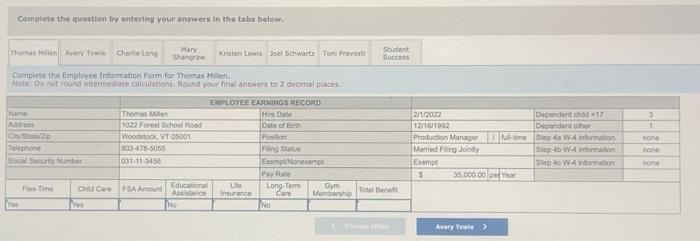

Continuing Payroll Project: Prevosti Ftrms and Sugarhouse (Static) Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: The deportments are as follows: Department A Agricultural Workers Department B: Office Workers The firt day of work for Prevostl Farms and Sugarhouse for all employees is February 1, 2022. February 4 is the end of the first pay period and includes work completed during the week of February 1-4. Compute the employee gross pay using 40 hours as the standard worikweek for all employees except Mary Shangraw, who works 20 hours per week and receives overtime for any time worked past that point per company policy. The other hourly employees recelve overtime pay when they work more than 40 hours in one week. Joel Sctwartz has made $5,000 in case sales at a 3 percent commission rate during this pay period. Joel Schwart's sales are subject to commissions for the 2/8 pay period of $7,500. Remember that the employees are paid biweekly. Note that the first poy period comprises only four days of work, but the pay frequency for federal income tax purposes is biweekly. Exempt employee pay information is as follows: The hours for the nonexempt employees are as follows: Although the company has already established medical and retirement plan benefits, Toni Prevosti wants to consider other benefits to attract employees. As the company's accountant, you have been tasked with annotating employee earnings records with benefit elections for each employee. The following sheet contains detalls of emplovee cholces. These costs are employer-paid and will tolic effect on the first pay period of March. Multiply the employee's annual salary by 1 percent to calculate the life insurance benefit for example, if an employee earned $50,000 per year, the life insurance would be $50,0000,01=$500. Although the company has already established medical and retirement plan benefits, Toni Prevosti wants to consider other benefits to attract employees. As the company's accountant, you have been tasked with annotating employee earnings records with benefit elections for each employee. The following sheet contains details of employee choices, These costs are employer-pald and wili take effect on the first pay period of March. Multiply the employee's annual salary by 1 percent to calculate the life insurance benefit. For example, if an employee earned $50,000 per year, the life insurance would be $50,0000.01=$500 Required: Annotate the Employee Earning Records with payroll-related benefit elections. The amount per period should be included in the record. As an example, if an employee elected to contribute $1,300 to his or her FSA, the period payroll deduction would be $1,300 26, or $50. The estimated yearly earnings used for insurance purposes for the hourly employees are computed as follows: (hourly wages times number of hours worked per week 52 ) then divide by 26 pay periods to get an amount per pay period. For example: If Shangraw worked 20 hours per week, the computation is $15 per hour 52 weeks =$11,440 per year. Insurance is computed as $11.4401%=$114.4026=$4.40 per pay period. Complete the question by entering your anmwers in the tabs below. Cocrplete the Employee- Information Form for Theous Molen