Answered step by step

Verified Expert Solution

Question

1 Approved Answer

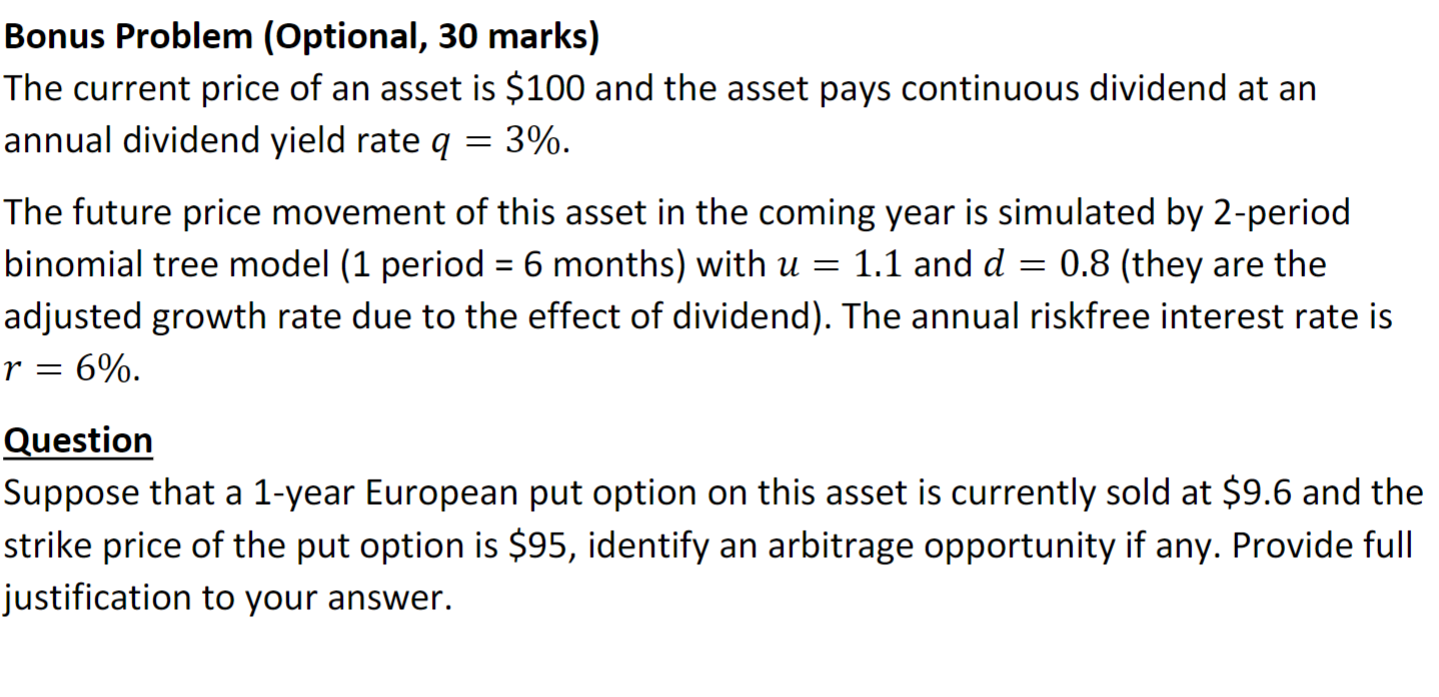

Continuous compounding is used. Continuous compounding is used. Continuous compounding is used. Continuous compounding is used. Bonus Problem (Optional, 30 marks) The current price of

Continuous compounding is used.

Continuous compounding is used.

Continuous compounding is used.

Continuous compounding is used.

Continuous compounding is used.

Bonus Problem (Optional, 30 marks) The current price of an asset is $100 and the asset pays continuous dividend at an annual dividend yield rate q=3% The future price movement of this asset in the coming year is simulated by 2-period binomial tree model (1 period =6 months) with u=1.1 and d=0.8 (they are the adjusted growth rate due to the effect of dividend). The annual riskfree interest rate is r=6% Question Suppose that a 1-year European put option on this asset is currently sold at $9.6 and the strike price of the put option is $95, identify an arbitrage opportunity if any. Provide full justification to your answer. Bonus Problem (Optional, 30 marks) The current price of an asset is $100 and the asset pays continuous dividend at an annual dividend yield rate q=3% The future price movement of this asset in the coming year is simulated by 2-period binomial tree model (1 period =6 months) with u=1.1 and d=0.8 (they are the adjusted growth rate due to the effect of dividend). The annual riskfree interest rate is r=6% Question Suppose that a 1-year European put option on this asset is currently sold at $9.6 and the strike price of the put option is $95, identify an arbitrage opportunity if any. Provide full justification to yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started