Answered step by step

Verified Expert Solution

Question

1 Approved Answer

continuous process improvement (798) controller (796) controlling (798) conversion costs (803) cost (799) cost object (800) cost of goods manufactured (806) cost of merchandise sold

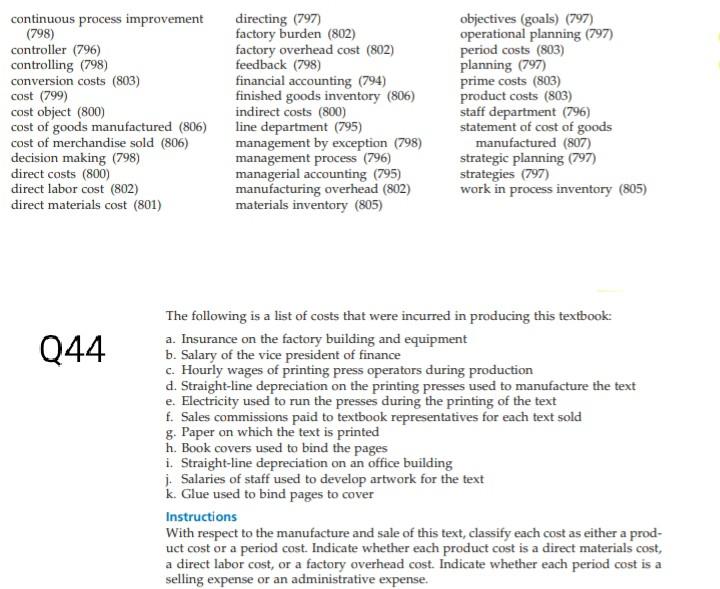

continuous process improvement (798) controller (796) controlling (798) conversion costs (803) cost (799) cost object (800) cost of goods manufactured (806) cost of merchandise sold (806) decision making (798) direct costs (800) direct labor cost (802) direct materials cost (801) directing (797) factory burden (802) factory overhead cost (802) feedback (798) financial accounting (794) finished goods inventory (806) indirect costs (800) line department (795) management by exception (798) management process (796) managerial accounting (795) manufacturing overhead (802) materials inventory (805) objectives (goals) (797) operational planning (797) period costs (803) planning (797) prime costs (803) product costs (803) staff department (796) statement of cost of goods manufactured (807) strategic planning (797) strategies (797) work in process inventory (805) Q44 The following is a list of costs that were incurred in producing this textbook: a. Insurance on the factory building and equipment b. Salary of the vice president of finance c. Hourly wages of printing press operators during production d. Straight-line depreciation on the printing presses used to manufacture the text e. Electricity used to run the presses during the printing of the text f. Sales commissions paid to textbook representatives for each text sold g. Paper on which the text is printed h. Book covers used to bind the pages i. Straight-line depreciation on an office building j. Salaries of staff used to develop artwork for the text k. Glue used to bind pages to cover Instructions With respect to the manufacture and sale of this text, classify each cost as either a prod- uct cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started