Answered step by step

Verified Expert Solution

Question

1 Approved Answer

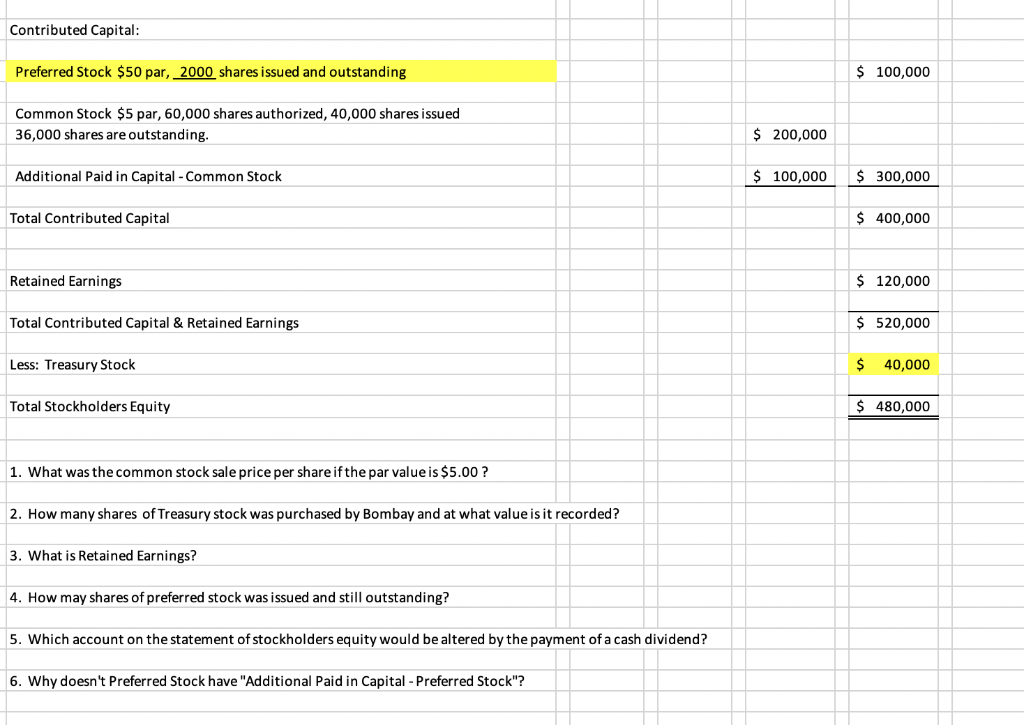

Contributed Capital: Preferred Stock $50 par, 2000 shares issued and outstanding Common Stock $5 par, 60,000 shares authorized, 40,000 shares issued 36,000 shares are

Contributed Capital: Preferred Stock $50 par, 2000 shares issued and outstanding Common Stock $5 par, 60,000 shares authorized, 40,000 shares issued 36,000 shares are outstanding. Additional Paid in Capital - Common Stock Total Contributed Capital Retained Earnings Total Contributed Capital & Retained Earnings Less: Treasury Stock Total Stockholders Equity 1. What was the common stock sale price per share if the par value is $5.00 ? 2. How many shares of Treasury stock was purchased by Bombay and at what value is it recorded? 3. What is Retained Earnings? 4. How may shares of preferred stock was issued and still outstanding? 5. Which account on the statement of stockholders equity would be altered by the payment of a cash dividend? 6. Why doesn't Preferred Stock have "Additional Paid in Capital - Preferred Stock"? $ 200,000 $ 100,000 $ 100,000 $ 300,000 $ 400,000 $ 120,000 $ 520,000 $ 40,000 $ 480,000

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The common stock sale price per share if the par Value is500 Sale Price of Common Stock Common Sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started