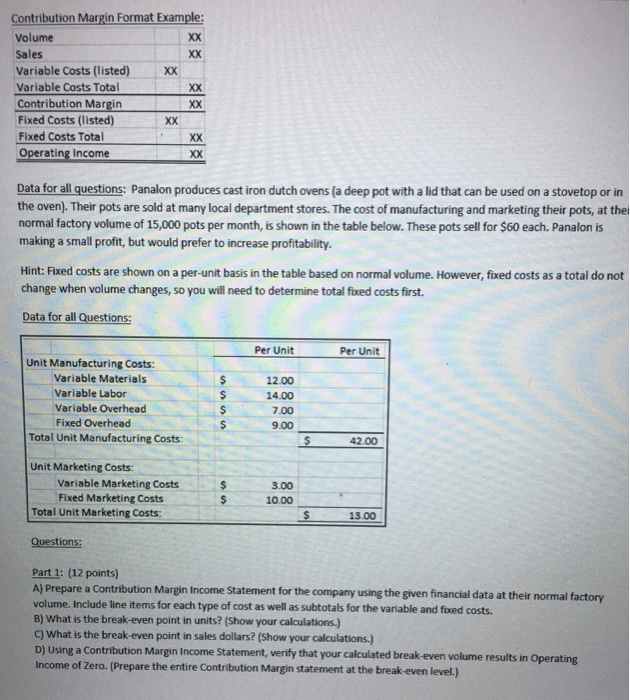

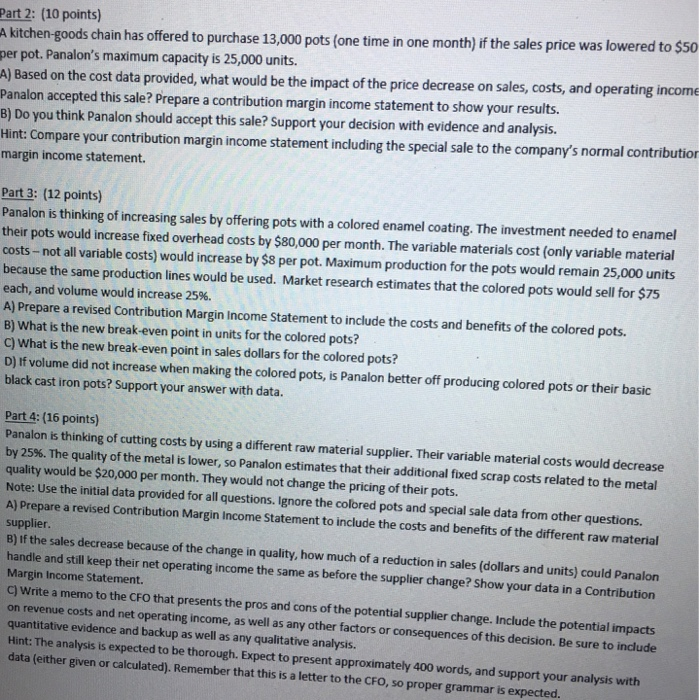

Contribution Margin Format Example Volume Sales variable costs (listed) xx Contribution Margin Fixed Costs (listed) Fixed Costs Total Operating Income Data for all questions: Panalon produces cast iron dutch ovens (a deep pot with a lid that can be used on a stovetop or in the oven). Their pots are sold at many local department stores. The cost of manufacturing and marketing their pots, at thei normal factory volume of 15,000 pots per month, is shown in the table below. These pots sell for $60 each. Panalon is making a small profit, but would prefer to increase profitability Hint: Fixed costs are shown on a per-unit basis in the table based on normal volume. However, fixed costs as a total do not change when volume changes, so you will need to determine total foxed costs first Data for all Questions: Per Unit Per Unit Unit Manufacturing Costs: Variable Materials Variable Labor Variable Overhead Fixed Overhead 14.00 7.00 9.00 Total Unit Manufacturing Costs: 42.00 Unit Marketing Costs: Variable Marketing Costs Fixed Marketing Costs 3.00 s 10.00o Total Unit Marketing Costs: 13.00 Questions: Part 1: (12 points) A) Prepare a Contribution Margin Income Statement volume. Include line items for each type of cost as well as subtotals for the variable and fixed costs. B) What is the break-even point in units? (Show your calculations.) C) What is the break -even point in sales dollars? (Show your calculations.) D) Using a Contribution Margin Income Statement, verify that your calculated break-even volume results in Operating Income of Zero. (Prepare the entire Contribution Margin statement at the break-even level) for the company using the given financial data at their normal factory Part 2: (10 points) A kitchen-goods chain has offered to purchase 13,000 pots (one time in one month) if the sales price was lowered to per pot. Panalon's maximum capacity is 25,000 units. A) Based on the cos Panalon accepted this sale? Prepare a contribution margin income statement to show your results. 8) Do you think Panalon should accept this sale? Support your decision with evidence and analysis Hint: Compare your contribution margin income statement including the special sale to the company's normal contri margin income statement. $50 t data provided, what would be the impact of the price decrease on sales, costs, and operating income Part 3: (12 points) Panalon is thinking of increasing sales by offering pots with a colored enamel coating. The investment needed to enamel their pots would increase fixed overhead costs by $80,000 per month. The variable materials cost (only variable material costs- not all variable costs) would increase by $8 per pot. Maximum production for the pots would remain 25,000 units because the same production lines would be used. Market research estimates that the colored pots would sell for $75 each, and volume would increase 25%. A) Prepare a revised Contribution Margin Income Statement to include the costs and benefits of the colored pots B) What is the new break-even point in units for the colored pots? C) What is the new break-even point in sales dollars for the colored pots? ) If volume did not increase when making the colored pots, is Panalon better off producing colored pots or their basic black cast iron pots? Support your answer with data. Part 4: (16 points) Panalon is thinking of cutting costs by using a different raw material supplier. Their variable material costs would decrease by 25%. The quality of the metal is lower, so Panalon estimates that their additional fixed scrap costs related to the metal quality would be $20,000 per month. They would not change the pricing of their pots Note: Use the initial data provided for all questions. Ignore the colored pots and special sale data from other questions. A) Prepare a revised Contribution Margin Income Statement to include the costs and benefits of the different raw material supplier decrease because of the change in quality, how much of a reduction in sales (dollars and units) could Panalon and still keep their net operating income the same as before the supplier change? Show your data in a Margin Income Statement. on revenue costs and net operating income, as well as quantitative evidence and backup as well as any qualitative analysis. a memo to the cFO that presents the pros and cons of the potential supplier change. Include the potential impacts any other factors or consequences of this decision. Be sure to include t: The analysis is expected to be thorough. Expect to present approximately 400 words, and support your data (either given or calculated). Remember that this is a letter t o the CFO, so proper grammar is expected