Question

Convertible bonds payable with a carrying and par value of $500,000 were exchanged for uninsured common stock with a par value of $100.000 The net

Convertible bonds payable with a carrying and par value of $500,000 were exchanged for uninsured common stock with a par value of $100.000 The net income for the year was $1,250,000 Depreciation charged on the building and equipment was $491,000. Five delivery vehicles were traded in on the purchase of a fork lift and the following entry was made: The Gain on Disposal of Plant Assets was credited to current operations as ordinary income: Dividends in the amount of $200.000 declared in 2024 were paid during the current year in addition dividends of 5100000 were declared and paid during the current year. Show by journal entries the adjustments that would be made on a worksheet for a statement of cash flow.

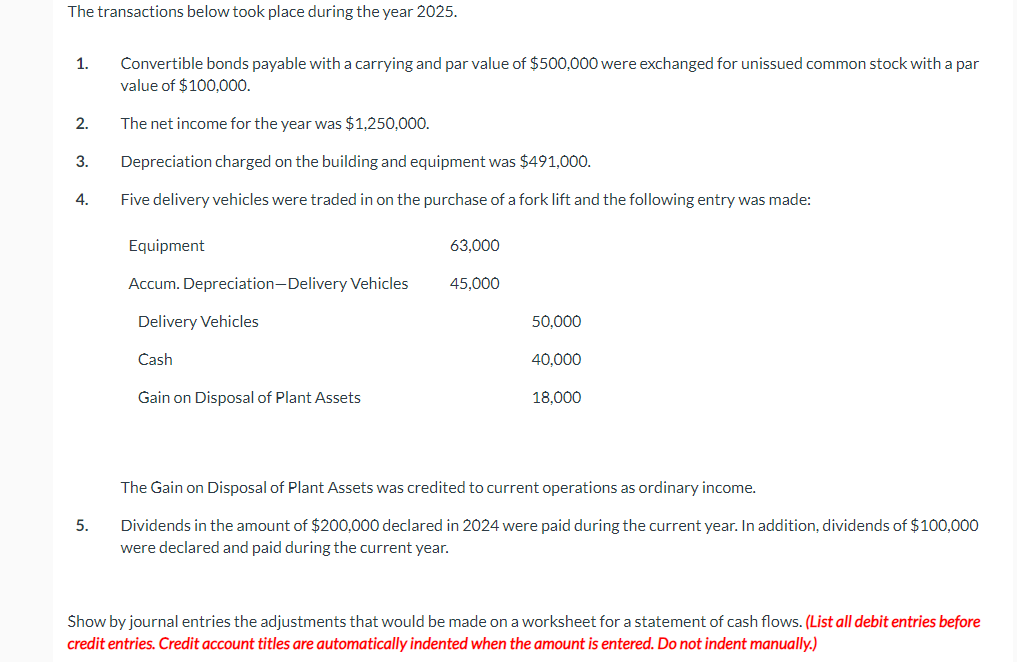

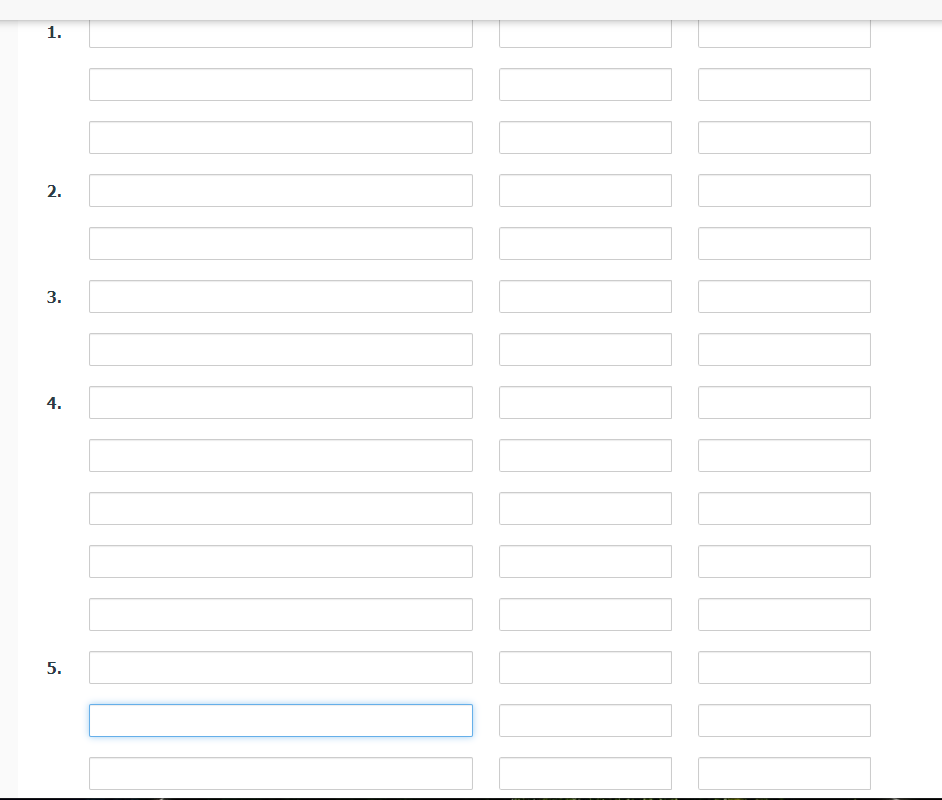

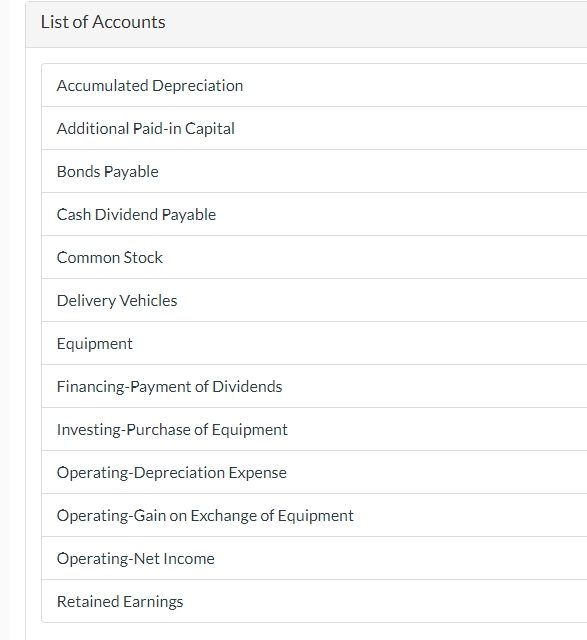

The transactions below took place during the year 2025 . 1. Convertible bonds payable with a carrying and par value of $500,000 were exchanged for unissued common stock with a par value of $100,000. 2. The net income for the year was $1,250,000. 3. Depreciation charged on the building and equipment was $491,000. 4. Five delivery vehicles were traded in on the purchase of a fork lift and the following entry was made: The Gain on Disposal of Plant Assets was credited to current operations as ordinary income. 5. Dividends in the amount of $200,000 declared in 2024 were paid during the current year. In addition, dividends of $100,000 were declared and paid during the current year. Show by journal entries the adjustments that would be made on a worksheet for a statement of cash flows. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. 2. 3. 4. . 5. List of Accounts Accumulated Depreciation Additional Paid-in Capital Bonds Payable Cash Dividend Payable Common Stock Delivery Vehicles Equipment Financing-Payment of Dividends Investing-Purchase of Equipment Operating-Depreciation Expense Operating-Gain on Exchange of Equipment Operating-Net Income Retained Earnings The transactions below took place during the year 2025 . 1. Convertible bonds payable with a carrying and par value of $500,000 were exchanged for unissued common stock with a par value of $100,000. 2. The net income for the year was $1,250,000. 3. Depreciation charged on the building and equipment was $491,000. 4. Five delivery vehicles were traded in on the purchase of a fork lift and the following entry was made: The Gain on Disposal of Plant Assets was credited to current operations as ordinary income. 5. Dividends in the amount of $200,000 declared in 2024 were paid during the current year. In addition, dividends of $100,000 were declared and paid during the current year. Show by journal entries the adjustments that would be made on a worksheet for a statement of cash flows. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. 2. 3. 4. . 5. List of Accounts Accumulated Depreciation Additional Paid-in Capital Bonds Payable Cash Dividend Payable Common Stock Delivery Vehicles Equipment Financing-Payment of Dividends Investing-Purchase of Equipment Operating-Depreciation Expense Operating-Gain on Exchange of Equipment Operating-Net Income Retained EarningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started