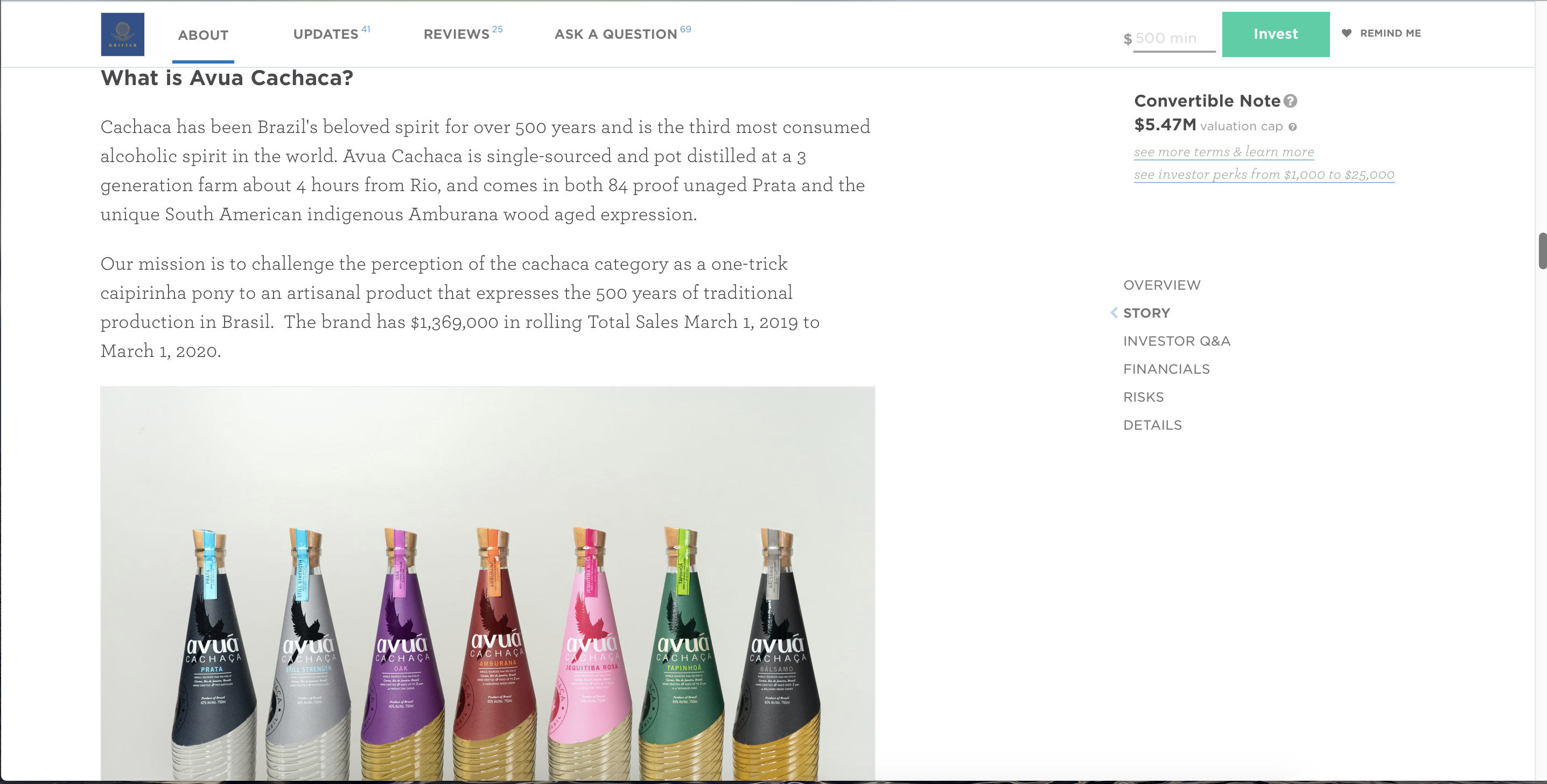

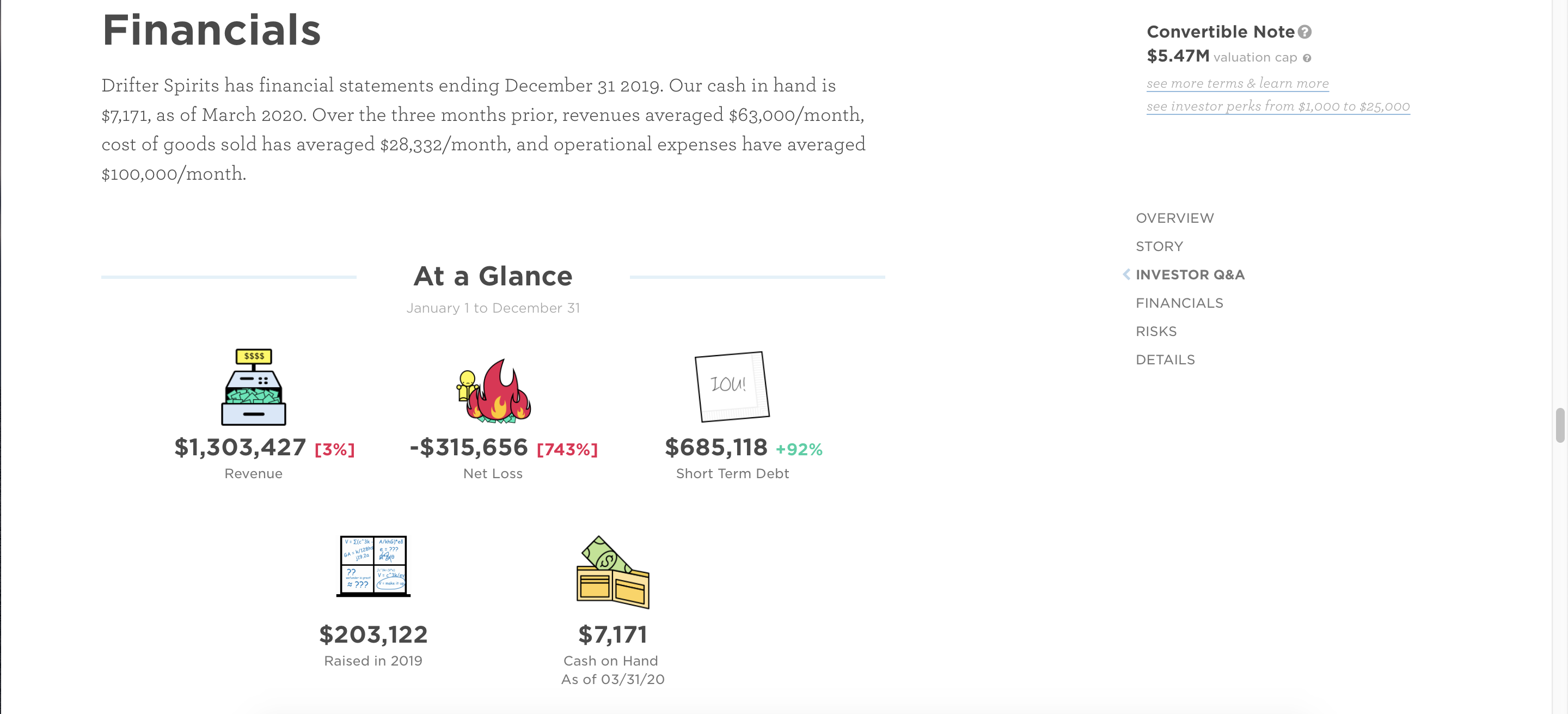

Convertible NoteO $5.47M valuation cap 0 see more terms & learn more see mveszor Eerks from $1,013on $25,000 Why you may want to invest in us... Strong executive team with experience in brand management at Red Bull, and legal at Goldman Sachs. Advisory board and investors include SVPs at Pernod Ricard, William Grant; President of Red Bull NA. OVERVIEW 2019 Revenue of $1.3m. Lifetime revenue of $4.3m and 2013-201910x growth STORY m revenue. INVESTOR Q&A Internationally recognized products: Avua Cachaca won Double Gold / Best in F'NANC'ALS Category at SF Spirit. RISKS DETAILS With our second brand (Svol Aquavit), we did in 6 months what took us 2 years to achieve with Avua. Craft spirits growing at a 24% CAGR and make up more than 5% of total spirits with lots more runway Many recent exits in the craft sector at 10x multiples. Assuming this we would be valued at $13M+ Vision to build a portfolio of 10 spirits brands that would drive >$1OM in revenue by 2025. Drifter Spirits is a unique route to market for craft spirits Drifter is a portfolio of global spirits for the modern bar. We scour the world for historically relevant, uniquely crafted products for the modern bar. We use our strength in the on premise channel and key relationships with major national distributors and key bars, restaurant and hotels to build an efficient route to market. In the rapidly growing craft spirit space we serve as the sales and marketing agency and route to market for Avua Cachaca (our lead brand that has over $1.3MM in sales in 2019), Svol Aquavit (launch in June 2019 to much fanfare and over $150k in revenue in 2019) and this summer Gagliardo Bitter Radicale (a 5th generation Italian producer). Convertible Notee $5.47M vaiuation cap a see mole terms & learn more see investor gerks from $1,000 to 325,000 $10MM in revenue top-line and >$2MM in net income. FINANCIALS RISKS Why did you choose this idea? DETAILS We went to Brazil in 2011, and fell in love with cachaca, its native spirit. We launched Avua Cachaca, and quickly grew it to the category leader. But then we realized that the strong route to market could be leveraged for other spirits brands too. We successfully launched Svol Aquavit in 2019, and will be rolling out a third brand Gagliardo soon! What's new about what you're making? How is it different? One of the first to release native Brazilian wood-aged cachaca with a resolute focus on craft, we have a combination of category-leading product and entrancing consumer brand focused on 1950's Rio de Janeiro - bossa nova, Pan Am flights, and Copacabana beach exploding. This has allowed us to build outsize influence in the on premise channels and with key national distributors for other products in the Drifter portfolio.Financials Drifter Spirits has financial statements ending December 31 2019. Our cash in hand is $7,171, as of March 2020' Over the three months prior, revenues averaged $63,000/month, cost of goods sold has averaged $28,332/month, and operational expenses have averaged $100,000/month. At a Glance January 1 to December 31 $1,303,427 [3%] -$315,656 [743%] $685,118 +92% Revenue Net Loss Short Term Debt $203,122 $7,171 Raised in 2019 Cash on Hand As of 03/31/20 Convertible Noteo $5.47M vamamon cap a see more terms 3; learn more see Investor gez'ks om $1,130on 325,000 OVERVIEW STORY INVESTOR ORA FINANCIALS RISKS DETAILS - ABOUT UPDATES '1 REVIEWS 25 ASK A QUESTION 59 S m v nsmun ME Convertible Noteo $5.47M valuation cap 0 see more terms & learn more R u s ks sue mvcstoy gcrks from $1,000 to $25,000 l The premium spirits market, despite being an active and stable market, is exposed to macroeconomic risk, as consumers may choose to trade down to less premium OVERVIEW cachacas if there is a macroeconomic downturn. STORY INVESTOR Q&A The growth of the spirits represented by Drifter Spirits, including Ayua Cachaca 'i FINANCIALS has, in large part, been linked to the growth of the "craft cocktail" movement in the mSKS on-premise. While this type of channel has been growing, there is no certainty DETAILS about the rate that it will continue to grow and whether consumers will continue to shift towards niche spirits and craft cocktails. There exists some risk that the challenges of the COVID pandemic will diminish the medium term universe of points of distribution in craft cocktail-focused on premise establishments. Drifter and Avua's growth is dependent upon its distributor partners. There has been significant consolidation in the U.S. distribution market, which may adversely affect the amount of attention smaller suppliers may receive from the distributor partners. European importers for smaller craft spirits remain underdeveloped and it is not certain that the trend of improved distribution solutions within the EU will continue