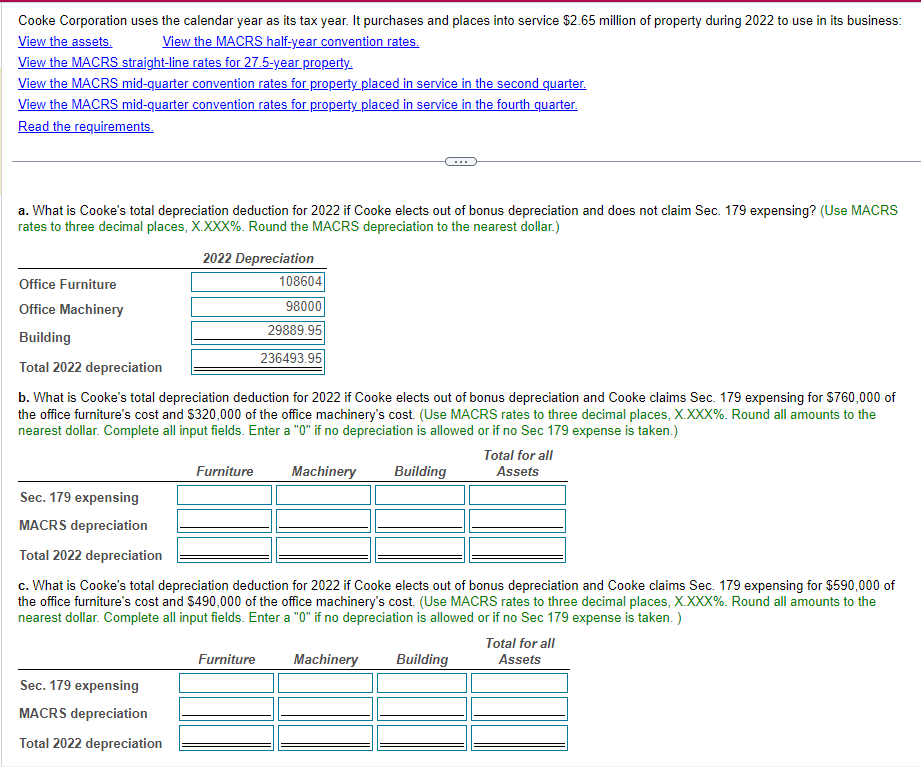

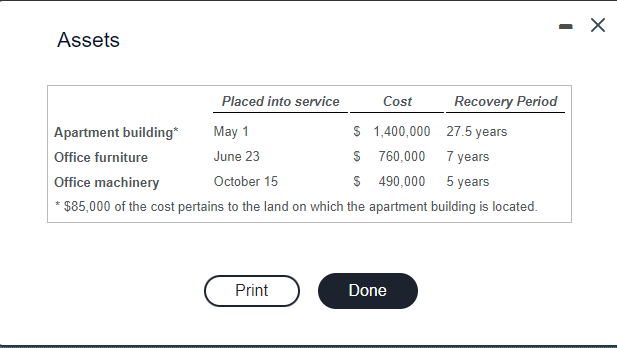

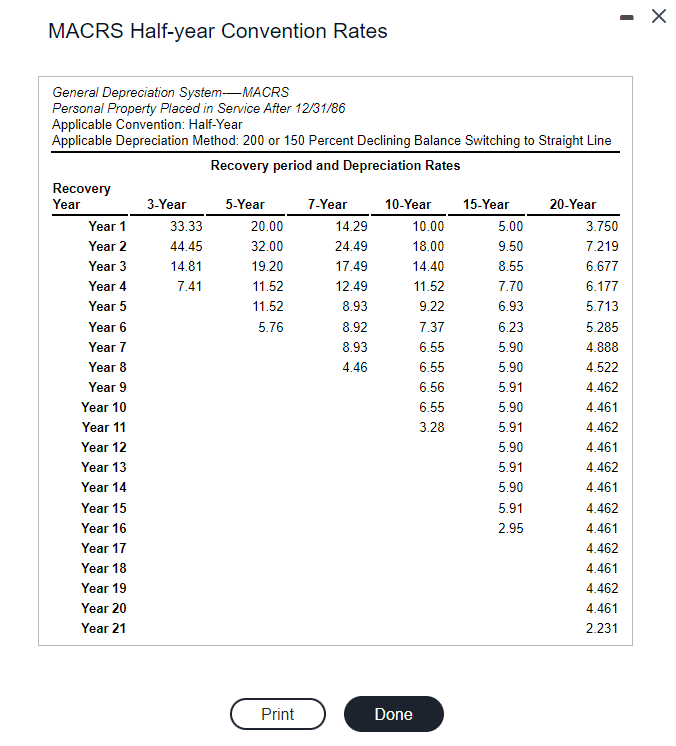

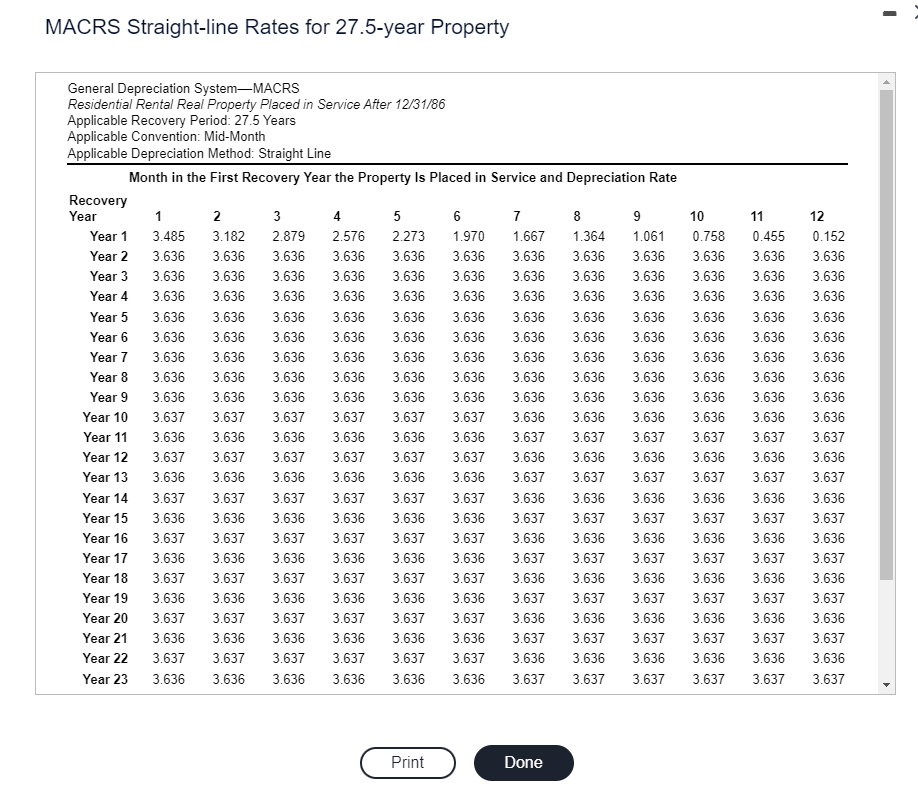

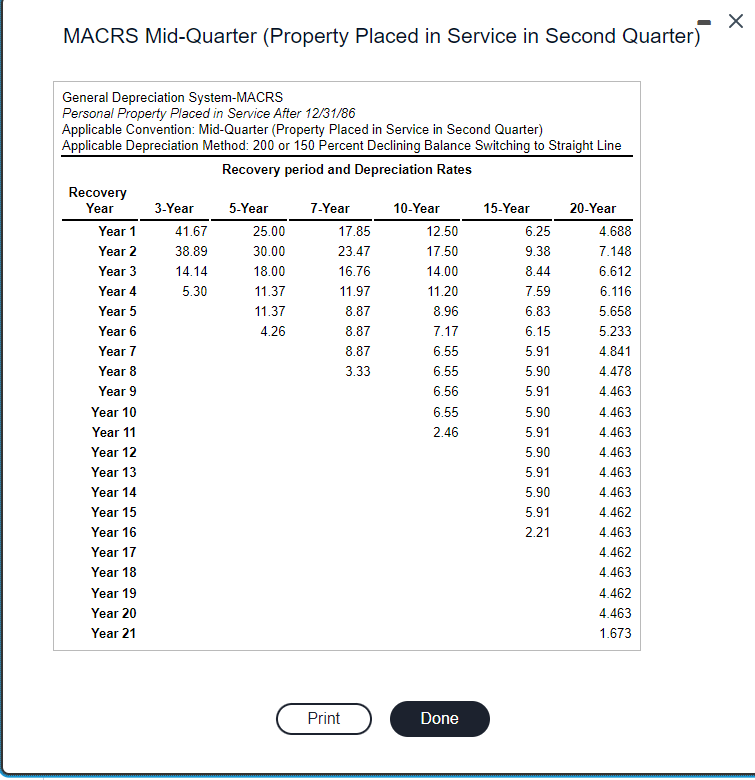

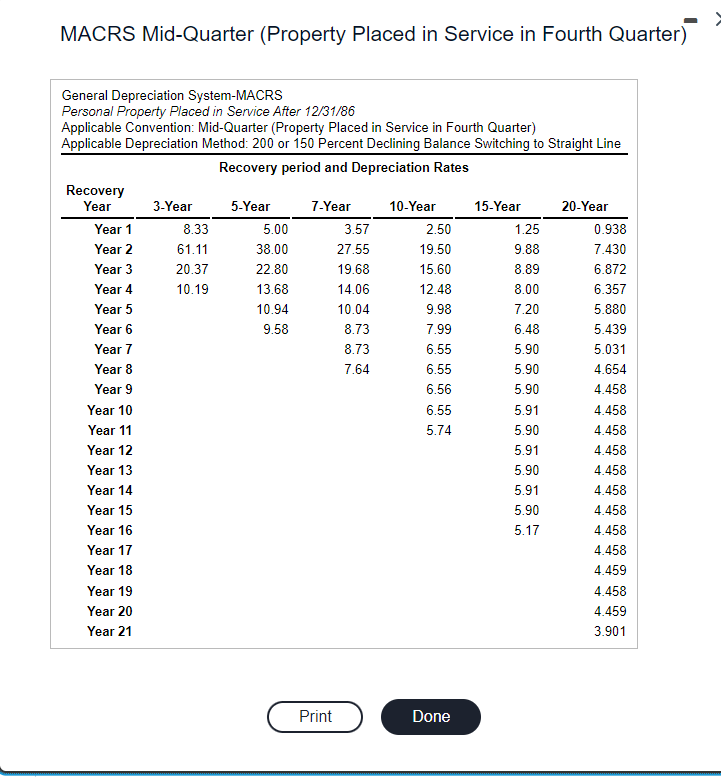

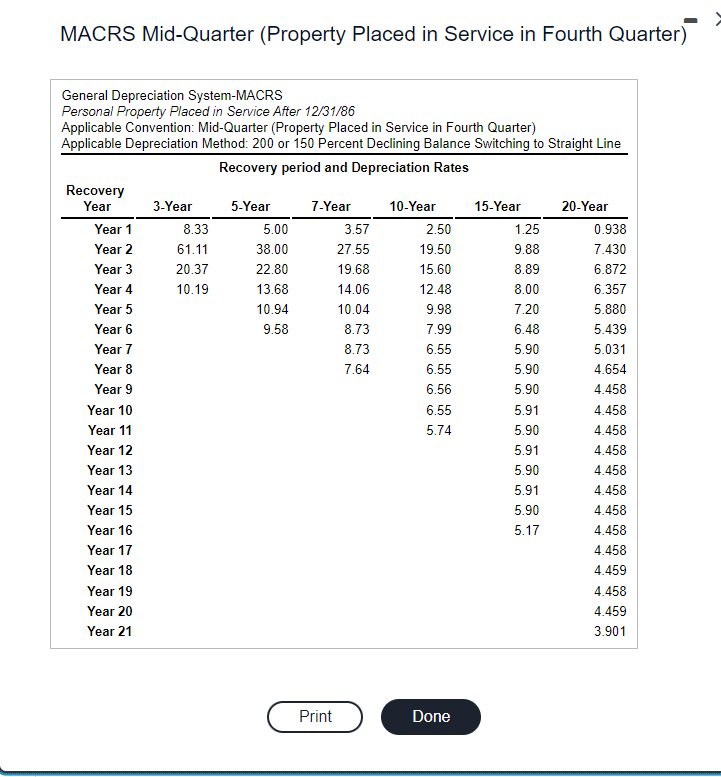

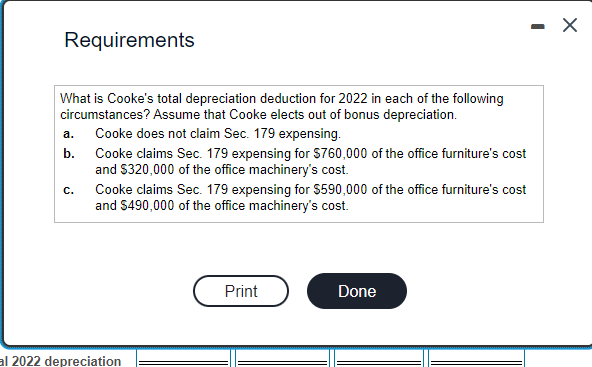

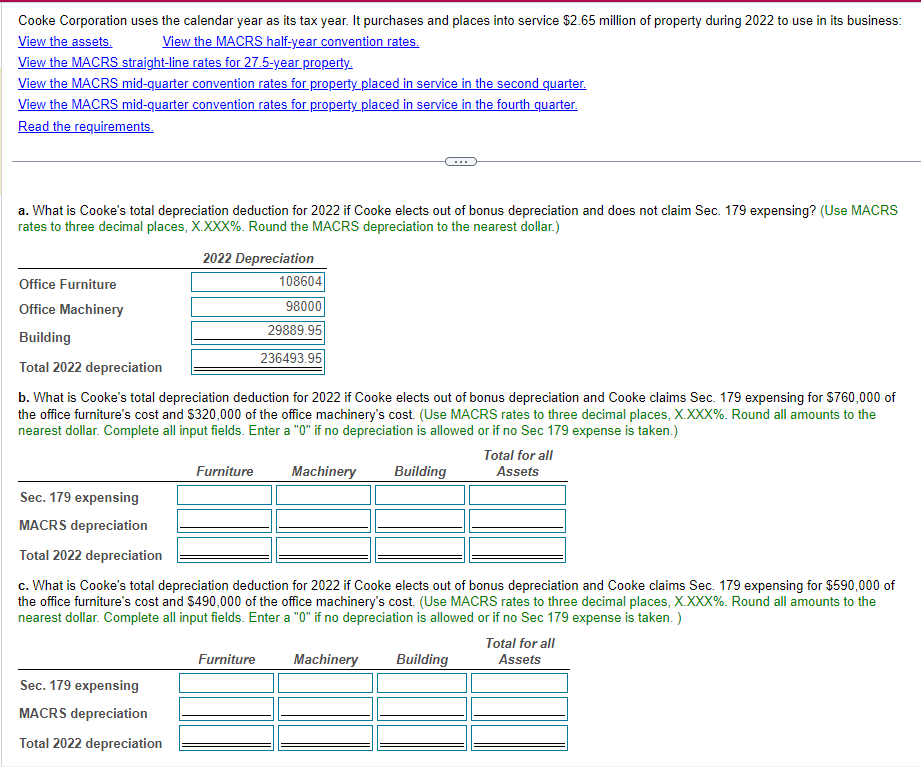

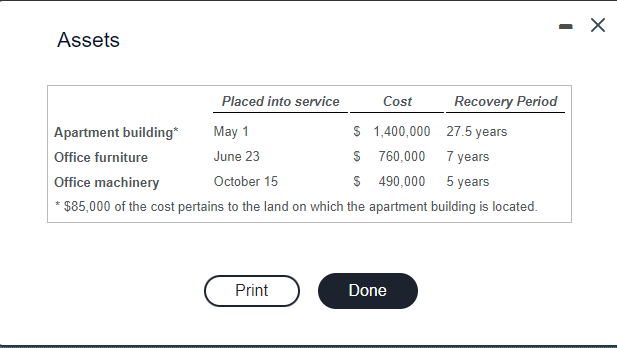

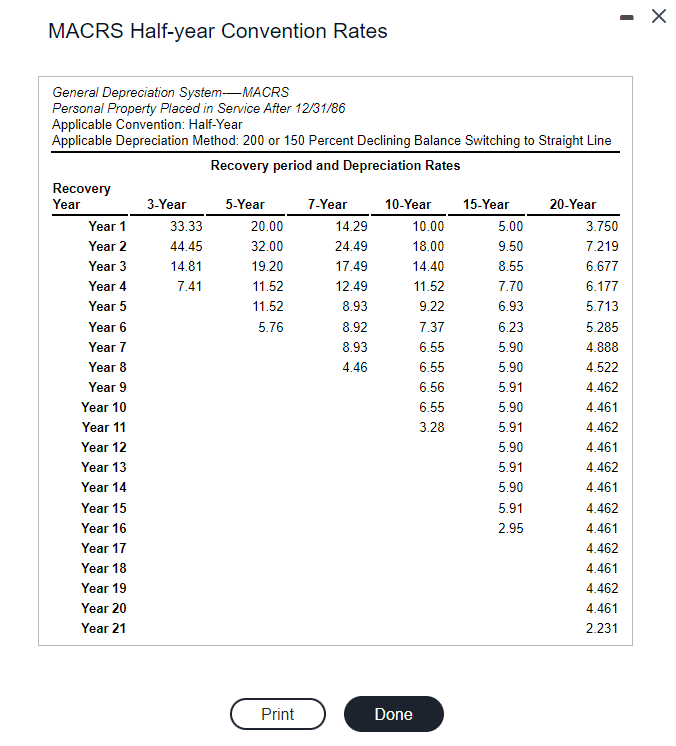

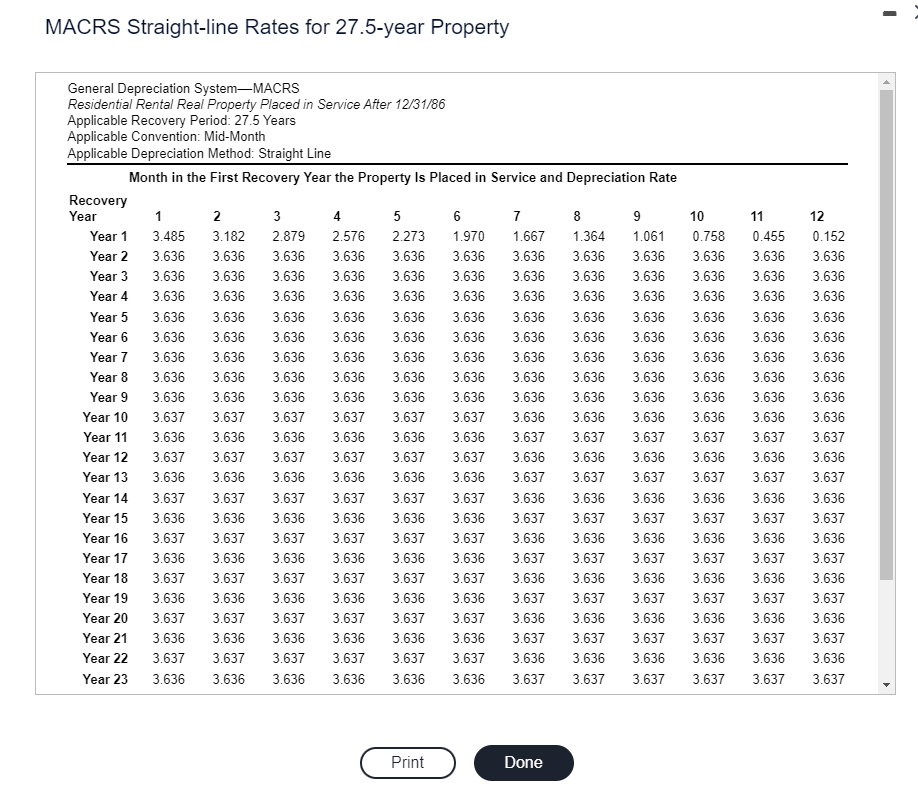

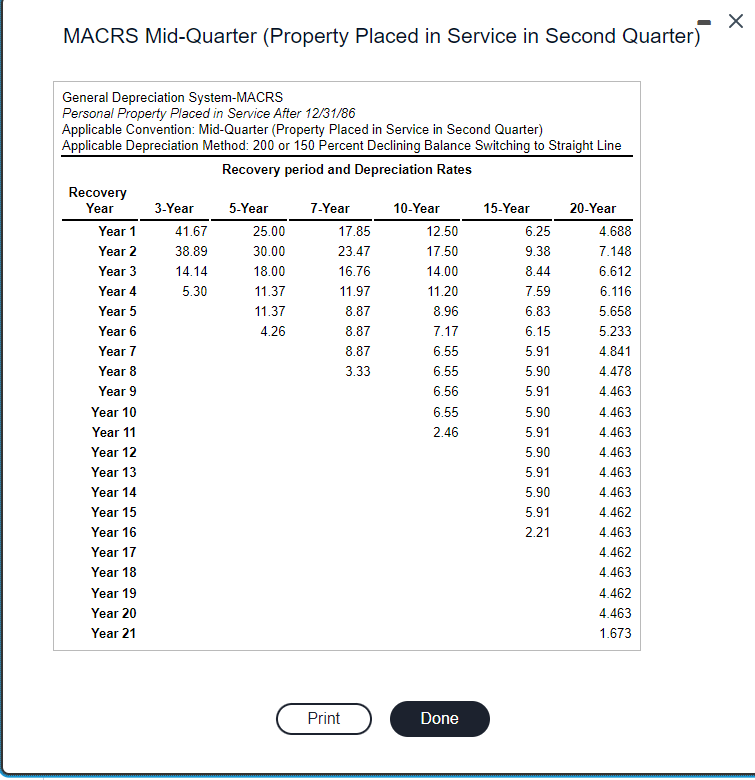

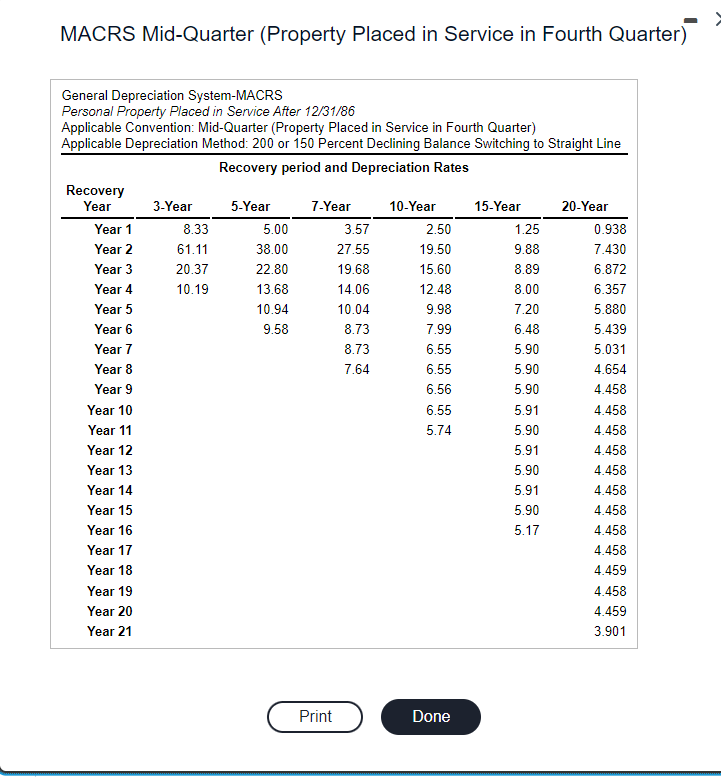

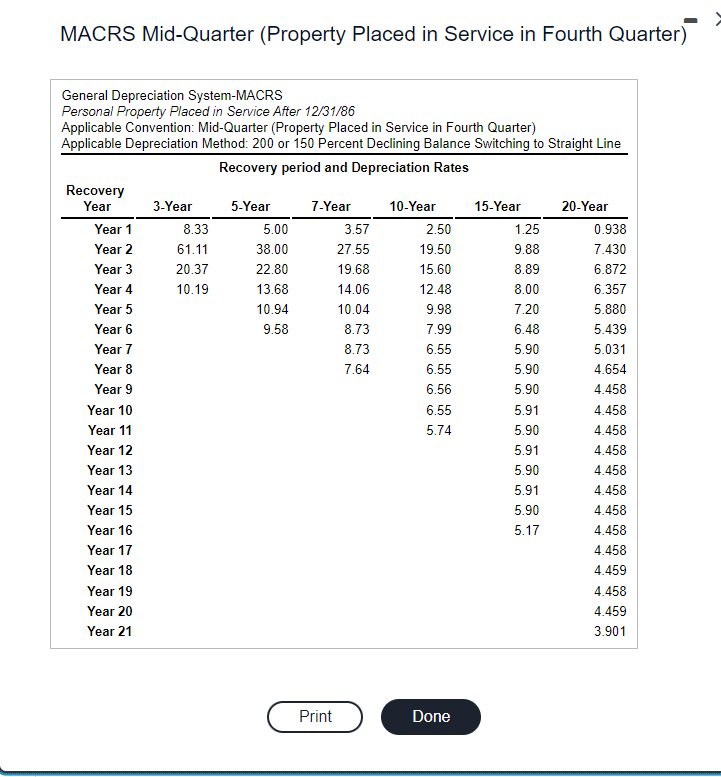

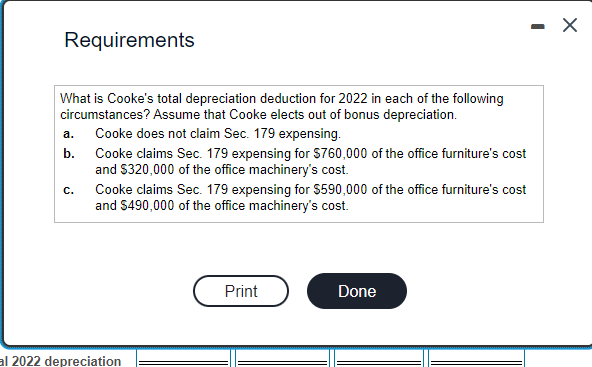

Cooke Corporation uses the calendar year as its tax year. It purchases and places into service $2.65 million of property during 2022 to use in its business: View the assets. View the MACRS half-year convention rates. View the MACRS straight-line rates for 27.5-year property. View the MACRS mid-quarter convention rates for property_placed in service in the second quarter. View the MACRS mid-quarter convention rates for property_placed in service in the fourth quarter. Read the requirements. a. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar.) b. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and Cooke claims Sec. 179 expensing for $760,000 of the office furniture's cost and $320,000 of the office machinery's cost. (Use MACRS rates to three decimal places, X.XXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no depreciation is allowed or if no Sec 179 expense is taken.) c. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and Cooke claims Sec. 179 expensing for $590,000 of the office furniture's cost and $490,000 of the office machinery's cost. (Use MACRS rates to three decimal places, X.XXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no depreciation is allowed or if no Sec 179 expense is taken. ) Assets MACRS Half-year Convention Rates General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Convention: Half-Year MACRS Straight-line Rates for 27.5-year Property General Depreciation System-MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years MACRS Mid-Quarter (Property Placed in Service in Second Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 MACRS Mid-Quarter (Property Placed in Service in Fourth Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) MACRS Mid-Quarter (Property Placed in Service in Fourth Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Requirements What is Cooke's total depreciation deduction for 2022 in each of the following circumstances? Assume that Cooke elects out of bonus depreciation. a. Cooke does not claim Sec. 179 expensing. b. Cooke claims Sec. 179 expensing for $760,000 of the office furniture's cost and $320,000 of the office machinery's cost. c. Cooke claims Sec. 179 expensing for $590,000 of the office furniture's cost and $490,000 of the office machinery's cost. Cooke Corporation uses the calendar year as its tax year. It purchases and places into service $2.65 million of property during 2022 to use in its business: View the assets. View the MACRS half-year convention rates. View the MACRS straight-line rates for 27.5-year property. View the MACRS mid-quarter convention rates for property_placed in service in the second quarter. View the MACRS mid-quarter convention rates for property_placed in service in the fourth quarter. Read the requirements. a. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and does not claim Sec. 179 expensing? (Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar.) b. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and Cooke claims Sec. 179 expensing for $760,000 of the office furniture's cost and $320,000 of the office machinery's cost. (Use MACRS rates to three decimal places, X.XXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no depreciation is allowed or if no Sec 179 expense is taken.) c. What is Cooke's total depreciation deduction for 2022 if Cooke elects out of bonus depreciation and Cooke claims Sec. 179 expensing for $590,000 of the office furniture's cost and $490,000 of the office machinery's cost. (Use MACRS rates to three decimal places, X.XXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no depreciation is allowed or if no Sec 179 expense is taken. ) Assets MACRS Half-year Convention Rates General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Convention: Half-Year MACRS Straight-line Rates for 27.5-year Property General Depreciation System-MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years MACRS Mid-Quarter (Property Placed in Service in Second Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 MACRS Mid-Quarter (Property Placed in Service in Fourth Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) MACRS Mid-Quarter (Property Placed in Service in Fourth Quarter) General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Requirements What is Cooke's total depreciation deduction for 2022 in each of the following circumstances? Assume that Cooke elects out of bonus depreciation. a. Cooke does not claim Sec. 179 expensing. b. Cooke claims Sec. 179 expensing for $760,000 of the office furniture's cost and $320,000 of the office machinery's cost. c. Cooke claims Sec. 179 expensing for $590,000 of the office furniture's cost and $490,000 of the office machinery's cost