Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cool Lope, Inc. - Tropical Smoothies and Shaved Ice Cool Lope, Inc. Consolidated Statements of Earnings For the Years Ended December 31, 20X3, 20X2, 20X1

| Cool Lope, Inc. - Tropical Smoothies and Shaved Ice | |||

| Cool Lope, Inc. | |||

| Consolidated Statements of Earnings | |||

| For the Years Ended December 31, 20X3, 20X2, 20X1 | |||

| 20X3 | 20X2 | 20X1 | |

| Net sales | $21,560 | $16,400 | $15,180 |

| Cost of goods sold | $12,946 | $10,297 | $9,670 |

| ?Gross profit | $8,614 | $6,103 | $5,510 |

| Selling and administrative expenses | $4,572 | $3,349 | $3,276 |

| Advertising | $1,425 | $1,079 | $954 |

| Depreciation and amortization | $250 | $250 | $250 |

| ?Operating profit | $2,218 | $1,377 | $1,030 |

| Other income (expense) | |||

| Interest expense | ($130) | ($130) | ($130) |

| ?Earnings before income taxes | $2,348 | $1,507 | $1,160 |

| ?Provision for income taxes | $517 | $332 | $255 |

| ??Net earnings | $1,831 | $1,175 | $905 |

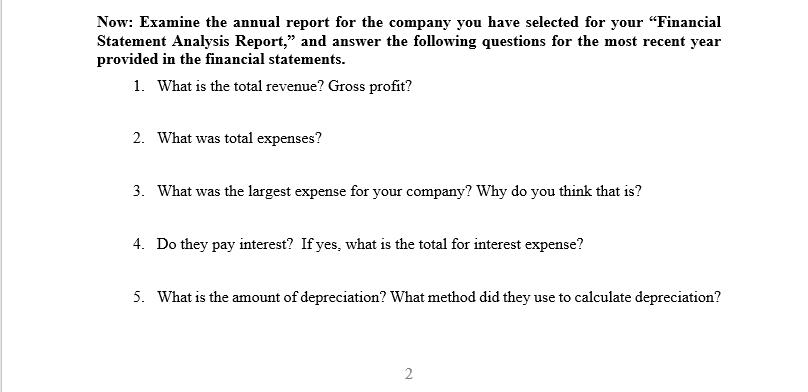

Now: Examine the annual report for the company you have selected for your "Financial Statement Analysis Report," and answer the following questions for the most recent year provided in the financial statements. 1. What is the total revenue? Gross profit? 2. What was total expenses? 3. What was the largest expense for your company? Why do you think that is? 4. Do they pay interest? If yes, what is the total for interest expense? 5. What is the amount of depreciation? What method did they use to calculate depreciation? 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information from the Consolidated Statements of Earnings for Cool Lope Inc here are the answers to the questions What is the tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbf76e0d84_962724.pdf

180 KBs PDF File

663dbf76e0d84_962724.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started