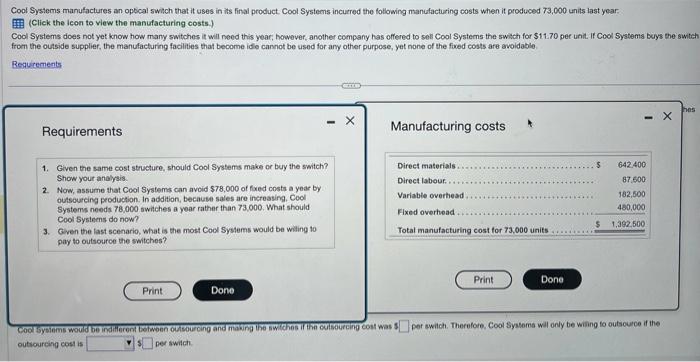

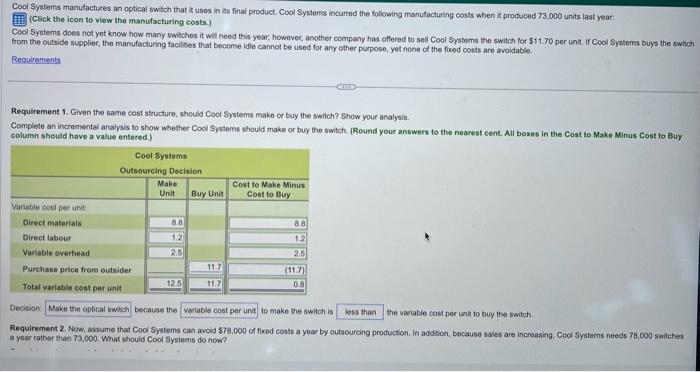

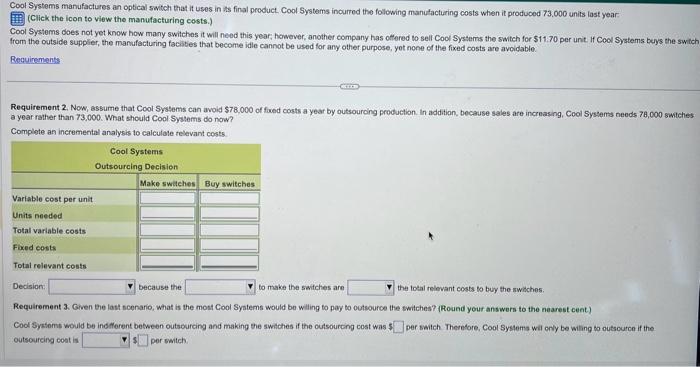

Cool Systems manufactures an optcal swich that it uses in its final product. Cool Systems incuered the following manufacturing costs when it produced 73,000 units last year. (Click the icon to view the manufacturing costs) Cool Systems does not yet know how many switches it will need this year; however, another company has offered to sell Cool Systerns the swith for $1170 per unit. If Cool Systems buys the swith from the outside supplier, the manufacturing facilities that become idio cannot be used for any other purpose, yet none of the fixed costs are avoidable. Requirements Manufacturing costs 1. Given the same cost structure, should Cool Systems make or buy the switch? Show yout andy ysis. 2. Now, assume that Cool Systema can avoid $78,000 of freed costs a year by outsourcing production. In addition, becaube sales are increasing, Cool Systems needs 78,000 swiches a year rather than 73,000 . What should Cool Systems do now? 3. Gien the last scenario, what is the most Cool Systems would be witing to pay to outsource the switches? outiourcing cost is per swich Cool Systems manutactures an optical switch that it uses in ins final product Cool Systems incurred the following manufacturing costs when is produced 73,000 units last year: (Click the icon to view the manufacturing costs.) Cool Systems does not yet know how many swilches it will need this year, howover, another company has offered to sell Cool Systems the switch for $11.70 per unit. If Cool Systems buys the switch from the outside supplier, the manufacturing focilines that become idie cannot be used for ary other purpose, yet none of the fored costs are avoldable Requirement 1. Given the same cost structuro, should Cool Systems make or buy the switch? Show your analysis. Complete an incremental analysis to show whether Cool Systerss should make or buy the switch (Round your answers to the nearest cent. All boxes in the Cost to Make Minus Cost to Buy column should have a value entered.) Decision: because the to make the switch is the variabie cost per una to buy the switch Requirement 2. Now, assume that Cool Systems can avoid 578,000 of fixod costs a year by outsourcing producton. In addibon, because salos are incraasing, Cool Systems needs 78,000 swithes a year rather than 73,000. What should Coot Systems do now? Cool Systems manufactures an optical switch that it uses in is final product. Cool Systems incurred the following manufacturing costs when it produced 73.000 units last year (Click the icon to view the manufacturing costs.) Cool Systems does not yet know how many switches it will need this year, however, another company has oltered to sell Cool Systems the switch for $11.70 per unit. If Cool Systems beys the switch from the outside supplier, the manufacturing facibes that become idle cannot be used for any other purpose, yet none of the fixed costs are avoldable. Requirement 2. Now, assume that Cool Systems can avoid $78,000 of fixed costs a year by outsouroing production. In addition, because sales are increasing, Cool Systens neods 78,000 switches a year rather than 73,000 . What should Cool Systems do now? Complote an incremental analysis to calculole televant costs Dedision: because the to make the switches are the todal relevant costs to buy the rwibches. Requirement 3. Given tee last scenario, what is the most Cool Syntems would be willing to poy to outsource the switches? (Round your answers to the naarest cent) Cool Syatomb would be indiflerent between outsourcing and making the switches if the outsourcing cost was I per switch Therefore, Cool Systems wil only be willing to outsource if the outsourcing cost is per switch