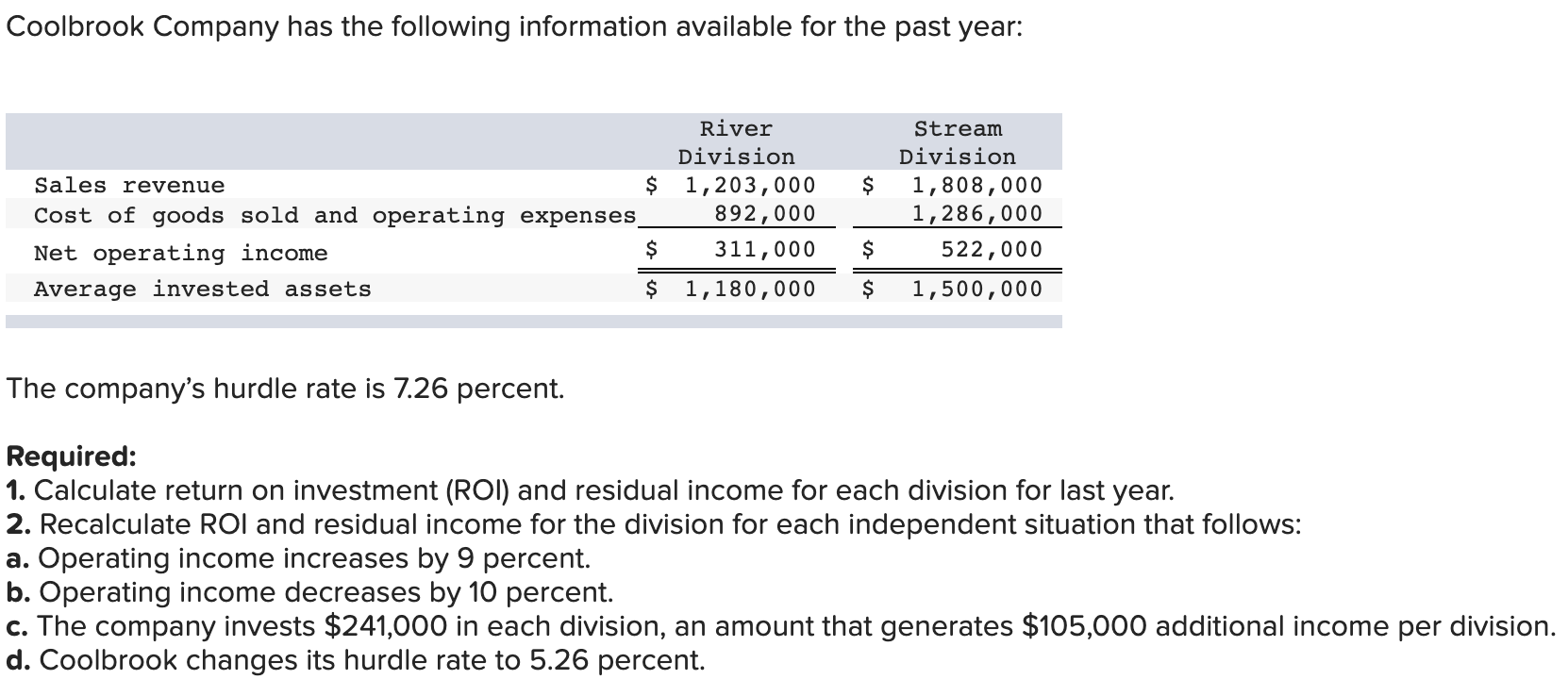

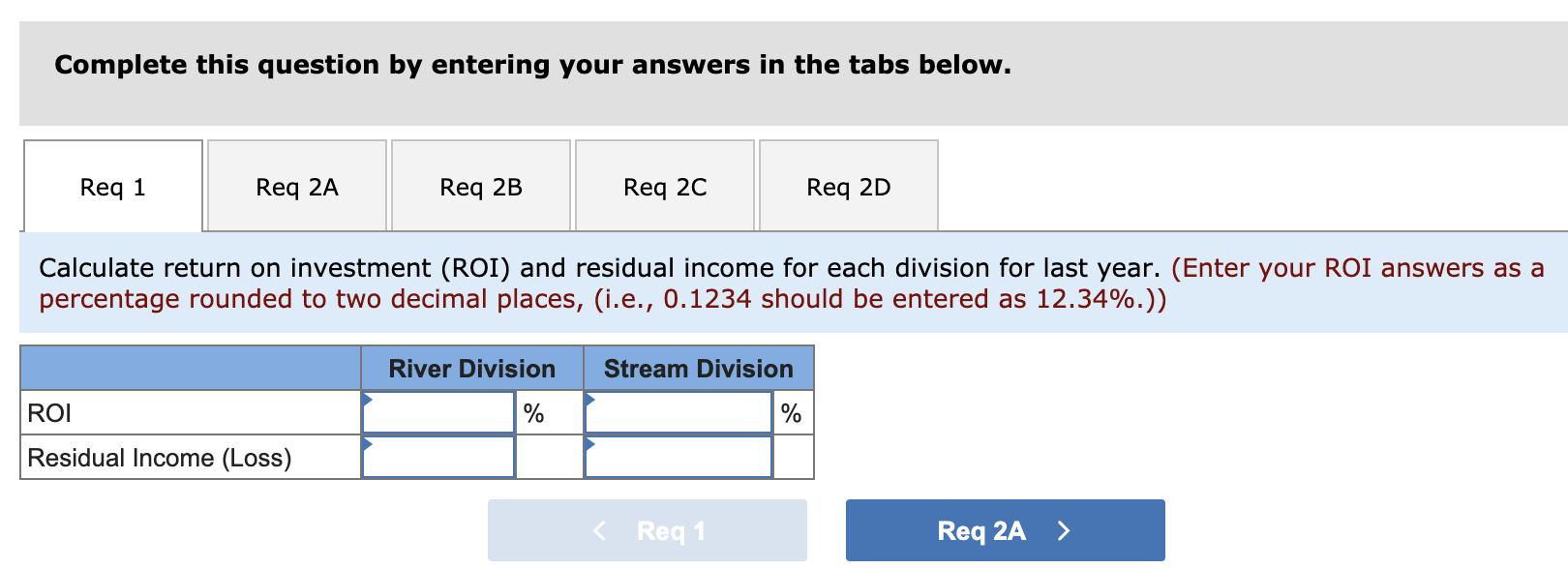

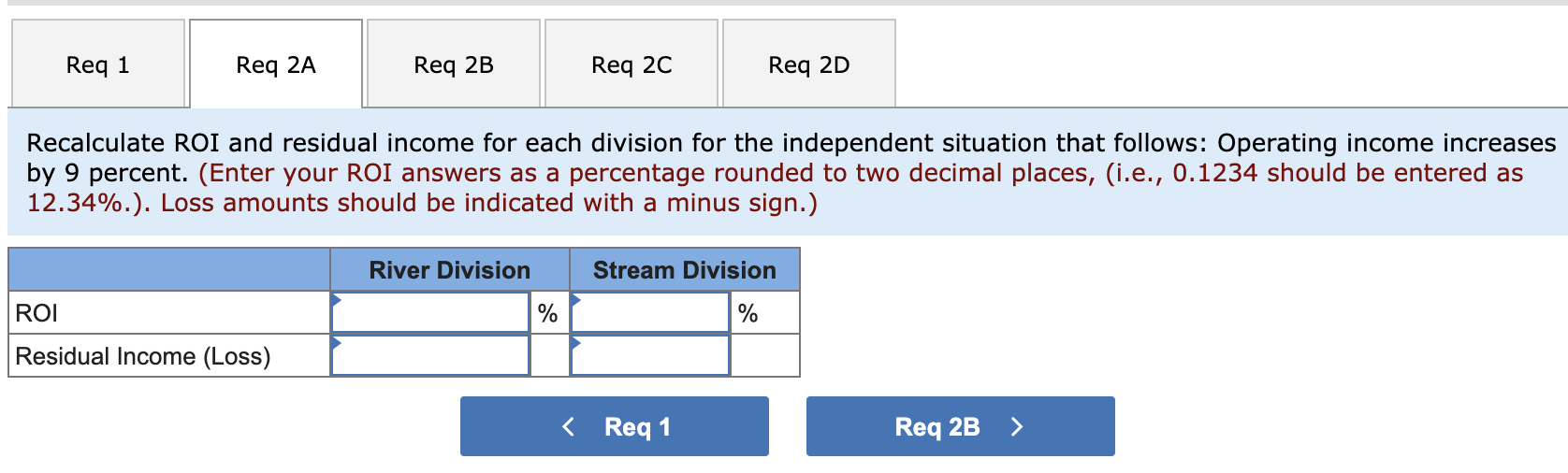

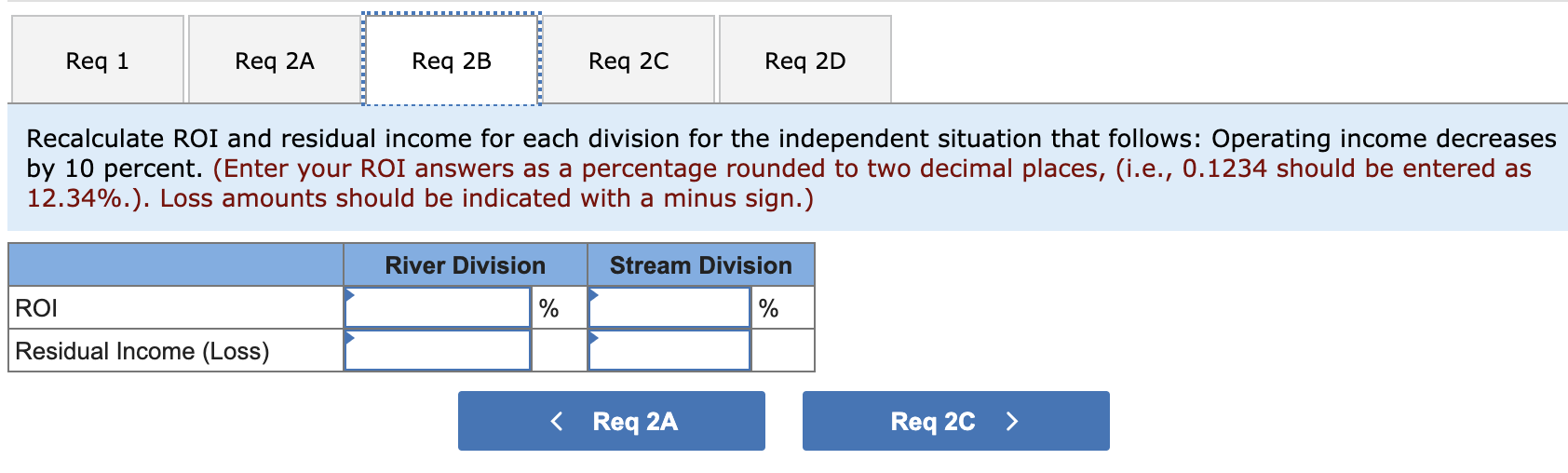

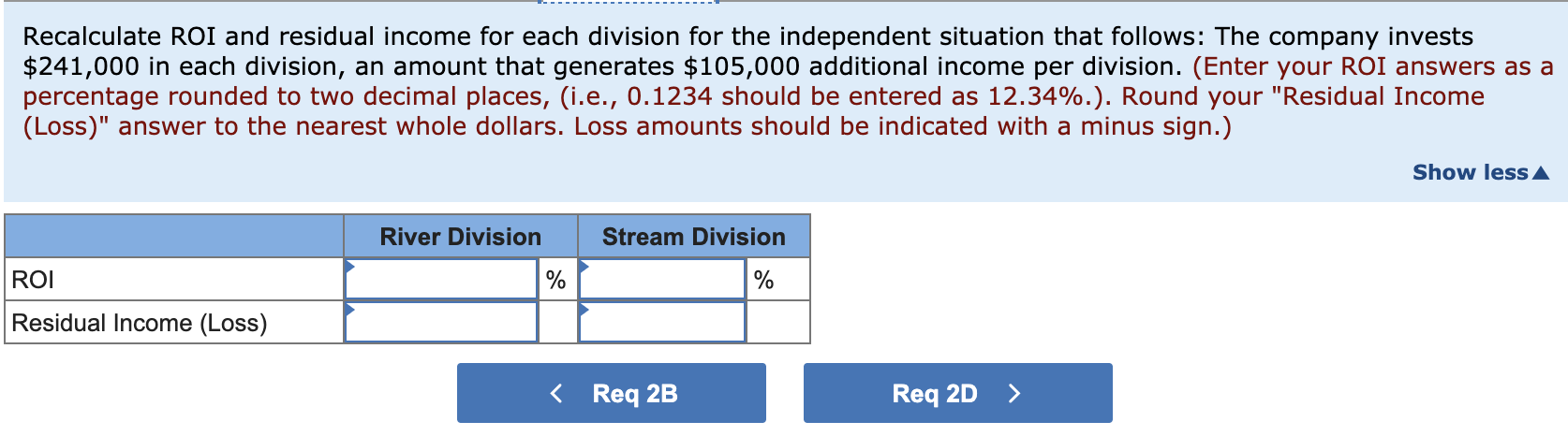

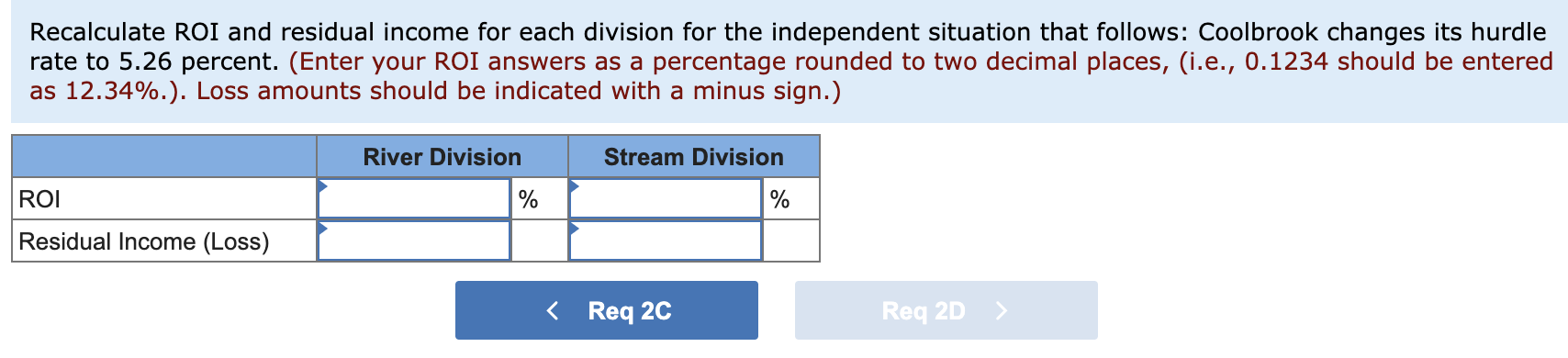

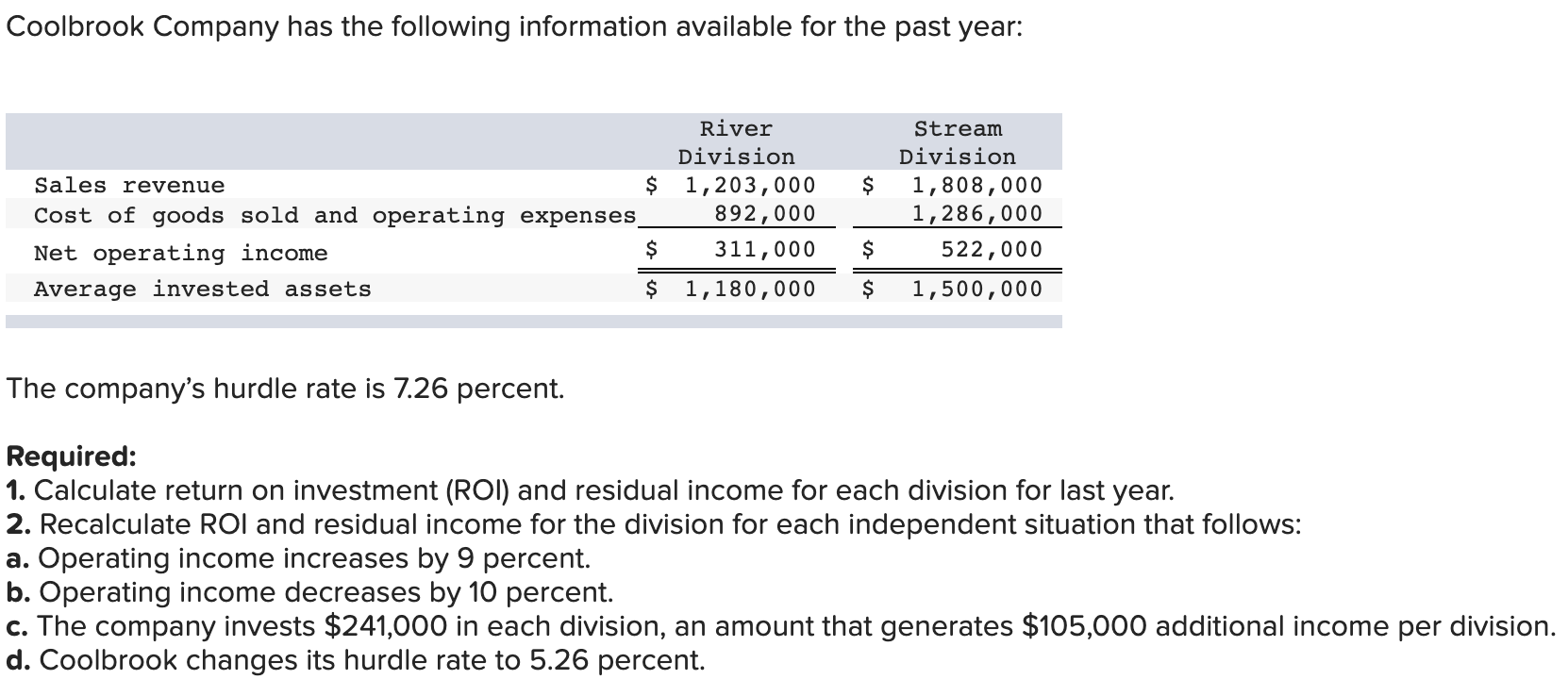

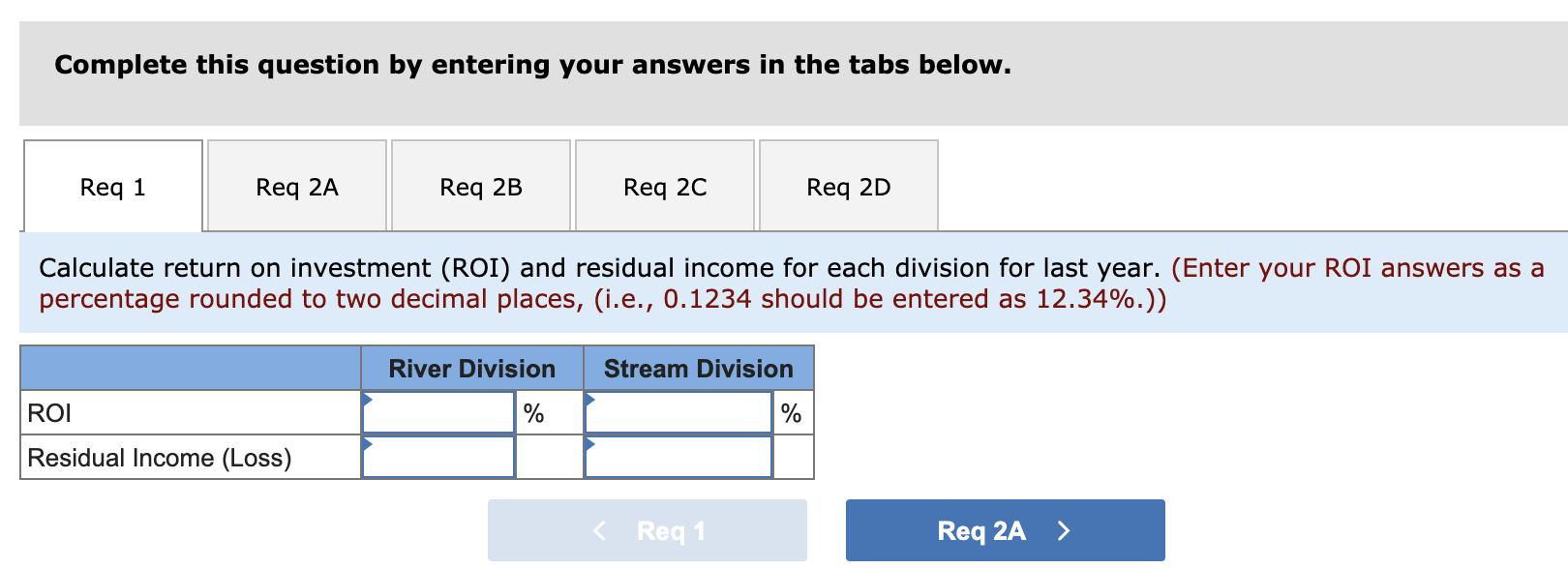

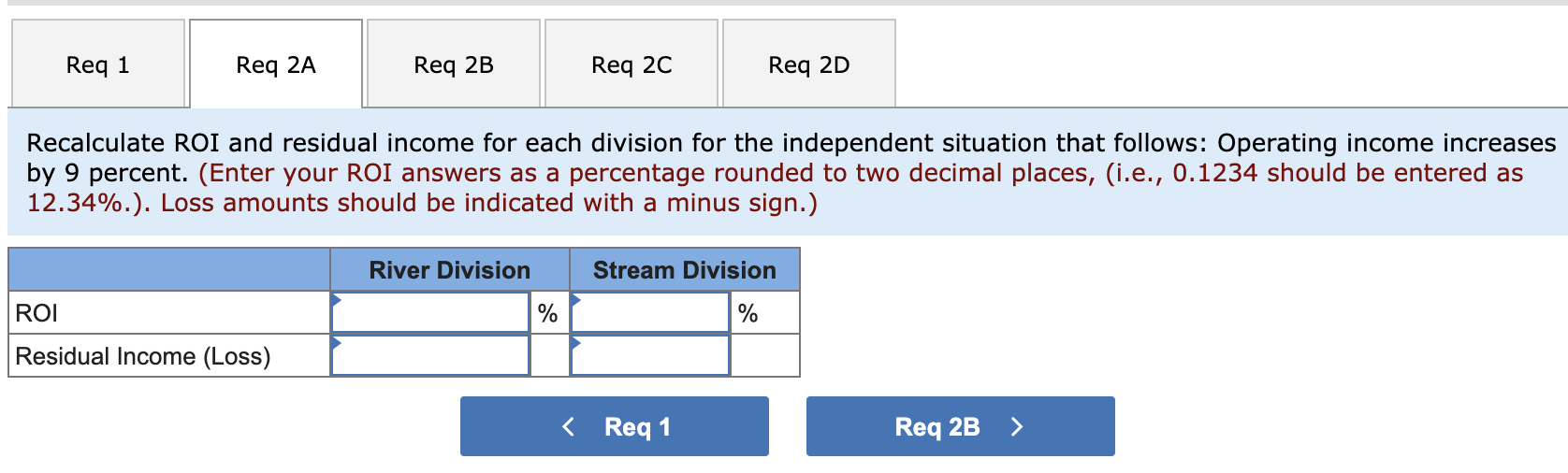

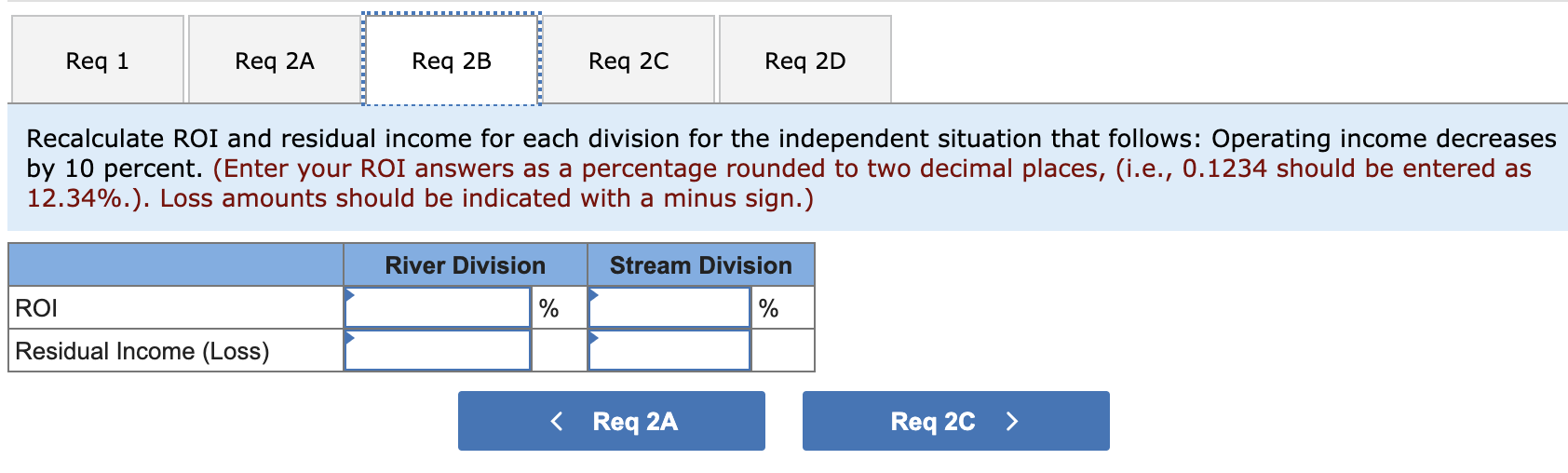

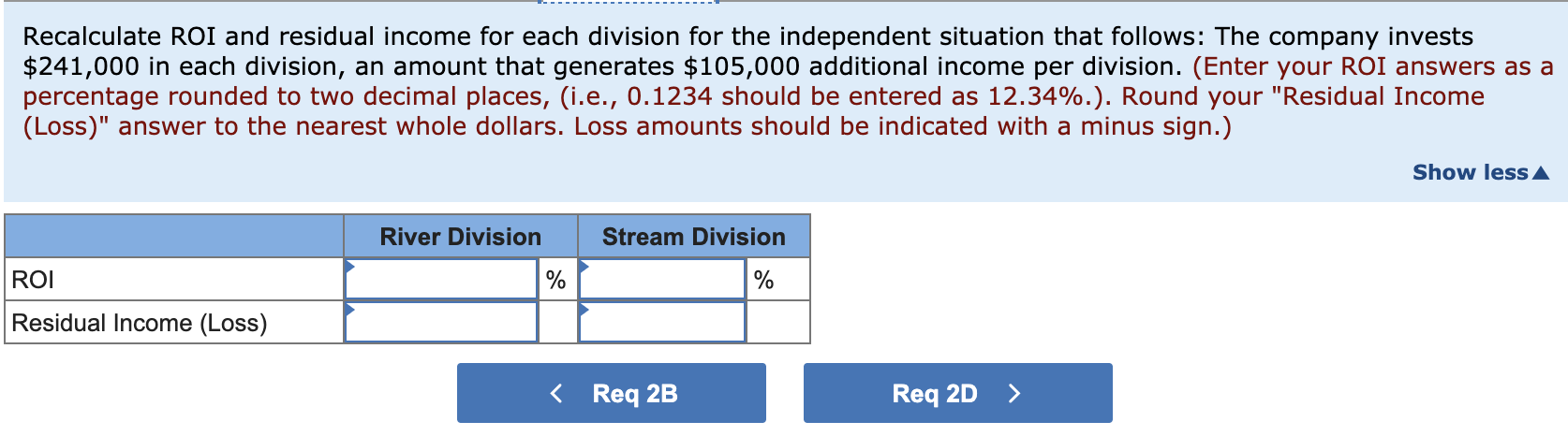

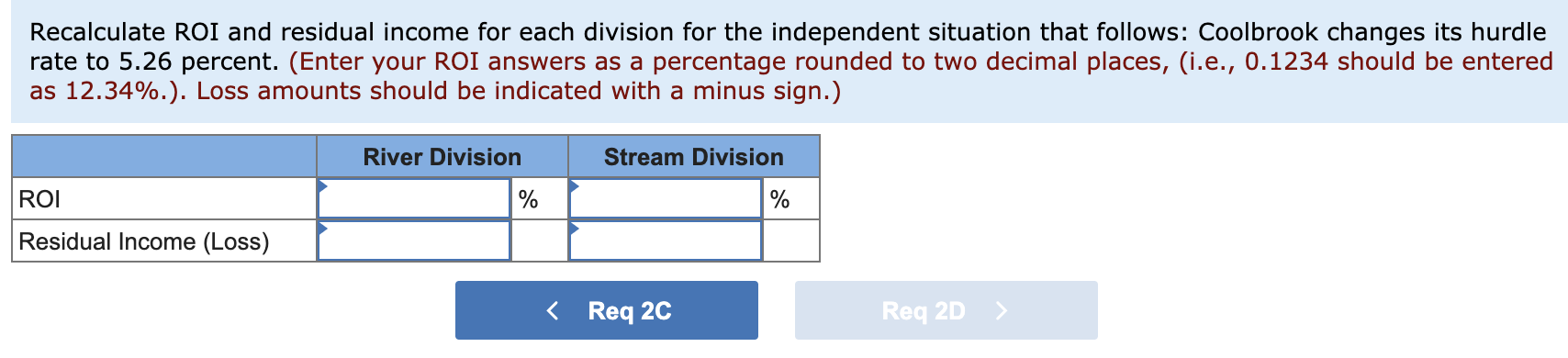

Coolbrook Company has the following information available for the past year: $ River Division Sales revenue $ 1,203,000 Cost of goods sold and operating expenses 892,000 Net operating income $ 311,000 Average invested assets $ 1,180,000 Stream Division 1,808,000 1,286,000 522,000 1,500,000 $ $ The company's hurdle rate is 7.26 percent. Required: 1. Calculate return on investment (ROI) and residual income for each division for last year. 2. Recalculate ROI and residual income for the division for each independent situation that follows: a. Operating income increases by 9 percent. b. Operating income decreases by 10 percent. c. The company invests $241,000 in each division, an amount that generates $105,000 additional income per division. d. Coolbrook changes its hurdle rate to 5.26 percent. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2c Reg 2D Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) River Division Stream Division ROI % % Residual Income (Loss) Req 1 Req 2A > Req 1 Req 2A Req 2B Req 2c Req 2D Recalculate ROI and residual income for each division for the independent situation that follows: Operating income increases by 9 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss amounts should be indicated with a minus sign.) Stream Division River Division % ROI % Residual Income (Loss) Req 1 Req 2A Req 2B Req 2c Req 2D Recalculate ROI and residual income for each division for the independent situation that follows: Operating income decreases by 10 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss amounts should be indicated with a minus sign.) River Division Stream Division ROI % % Residual Income (Loss) Recalculate ROI and residual income for each division for the independent situation that follows: The company invests $241,000 in each division, an amount that generates $105,000 additional income per division. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Round your "Residual Income (Loss)" answer to the nearest whole dollars. Loss amounts should be indicated with a minus sign.) Show less A River Division Stream Division ROI % % Residual Income (Loss) Recalculate ROI and residual income for each division for the independent situation that follows: Coolbrook changes its hurdle rate to 5.26 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss amounts should be indicated with a minus sign.) River Division Stream Division ROI % % Residual Income (Loss)