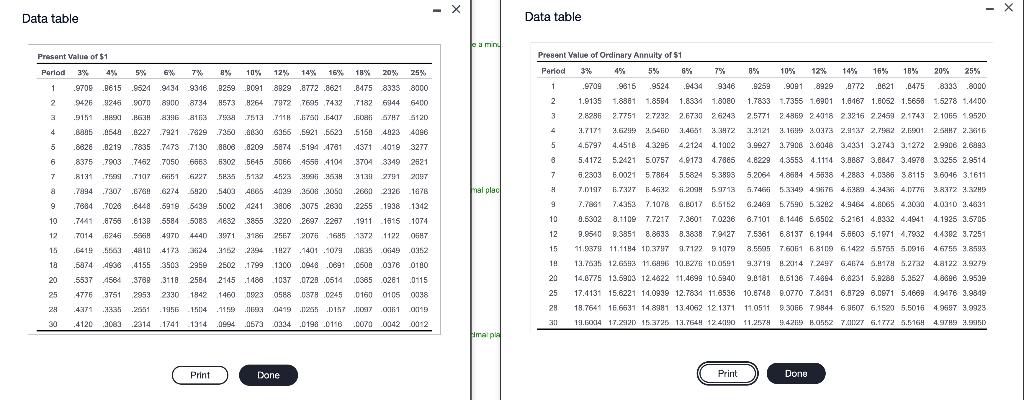

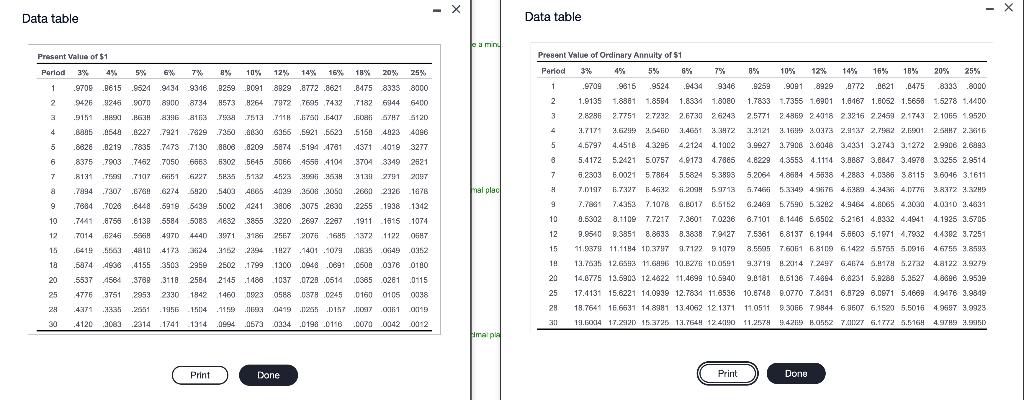

Cooper and Morton, LLP, a law firm, is considering the replacement of its old accounting system with new software that should save $25,000 per year in net cash operating costs. The old system has zero disposal value, but it could be used for the next 12 years. The estimated useful life of the new software is 12 years with zero salvage value, and it will cost $150,000. The required rate of return is 12%.

| 1. | What is the payback period? |

| 2. | Compute the NPV. |

| 3. | Management is unsure about the useful life. What would be the NPV if the useful life were |

| | (a) 5 years instead of 12 or (b) 20 years instead of 12? |

| 4. | Suppose the life will be 12 years, but the savings will be $22,000 per year instead of $25,000. What would be the NPV? |

| 5. | Suppose the annual savings will be $24,000 for 8 years. What would be the NPV? |

-> Data table Data table amn Present Value of $1 Period 3% 4% 5% 6% 7% 8% 10%. 12% 14% 16% 18% 20%, 25% 1 9708.3615 9524 9434 9346 3299 3091 3929 8772.8621 .8475 8338 8000 2 9442E 9246 5070) 8900 8900 8734 8734 573 8264 7172 7695 7432 7182 6144 F40 6400 3 .9151 .H891 BEH .8396 .8113 KM 7513.11.175.154.17 .BAI YH7 5120 4 .BODE 0543 .6227 .7921 7829 .7350 $630 6365 .8030 6356 5921 .5623 .51594023 4956 5 .8828 .6219.7835 7478 7130 .88088209 9209 5874 5874.5194 4781 .43714019 3277 6 .8375 .7903 .7462 7050 6563 5302 5645 5066 4558 4104 3704 3349 2521 7 .8131 .75251 .71017 E1 .6227 53 5132 4123 06 963 3139 279120197 .7894 7307 .67696224 5920 .5403 4865 4029 2008 .3050 2050 2020 .2860 2326 1676 9 .7684 7028 .8448 .59795439 .5002 4241 3808.3075 .2830 .2255 1938 1392 10 .7441 .6753613B .61335584 -5083 652 46S2 .3855 .3865 3220 .2697 2297 . 1911 1915 1071 12 7014 6246 50R 49170) 4440 3971 3186 2567 2076 1685 1372 1129 0687 15 .641! .5503 .48111 4123 32124 3102 2294 1927 1401 10711 1835 0149 0352 18 .5374 .4938 .4155 3503 2959 2502 2502 1799 1300 .0948 .0891 .05000376 0100 20 .5537 4564 97893110 2584 2145 .2145 1488 1488 1037 1037 .0728 .0514 0728 05140385 02810115 25 4776 3751 29532330 1842 1460 0923 0588 057 245 0160 91050338 28 4371 .3335 .2551 . 1956 15114 . 1155 .:10593 01419 ( 1125 1187.18097 OH 0149 30.4120 3083 .2014 1741 1314 .0994 .0573 0334 .0198 .0116 .0070 0342 0312 nal plac Present Value of Ordinary Annuity of S1 Period 3% 454 5% 65% 7% 8% 105 12% % 145 16% 18% 20% 25% 1 .6709 .9816 9524 .2434 9346 .9259 .9991 8929 .9772 .8621 0475 .8333.8000 2 1.8135 1.8881 1.8584 1.8834 1.8080 1.7833 1.7355 1.6901 1.8467 1.6062 1.5658 1.5278 1.4400 3 2828 27751 27292 2.6739 26243 2.5771 24369 24048 2.32 16 2.2459 2.743 21065 9520 4 3.717 2.6129199 2.5460 3.4651 3.3972 33.2121 2.169 20373 2.91937 2,7962 2.1901 2.547 2.36116 5 4.6797 4.4516 4.3296 4.2124 4.1002 3.6427 3.7908 3.6948 3.4331 3.2743 3.1272 2.9906 2.8893 8 5.41725.2421 5.0757 4.9173 4.7865 4.6229 4.3553 4.11143.0067 3.6047 3.4978 2.3255 2.9514 7 5.2303 6.0021 57864 5.5824 53898 5.2054 4.8584 45538 4.2883 4.0985 3.8115 9.6046 3.1611 7.19117 6.7327 15.482 1.2008 551713 5.745.3349 4.76 4.11289 4.243 4.1977 3.8372 32.329 9 7.7881 7.4353 7.1078 6.8017 B.5152 6.2469 5.7590 5.3262 4.9464 4.6065 4.2000 4.0310 2.4621 10 0.5302 8.1109 7.7217 7.3601 7.0236 8.7101 8.1446 5.8502 5.2161 4.6332 4.4941 4.1925 3.5705 12 8.8540 8.3851 8.8533 8.3838 7.927 7.5961 6.8137 6.1944 5.5603 5.1971 4.7962 1.4382 3.7251 15 11.9579 11.1194 103797 3.7122 3 10179 8.5505 76051 6.3109 6.1422 55755 5.0916 4.6755 3.8593 19 13.7535 12.6593 11.6496 11.6276 1.0591 9.2719 1.2.114 72497 6.474 6.178 5.2732 4.8122 2.9279 20 14.6775 12.5903 12.4822 11.4699 10.5940 9.6181 2.5136 7.4894 6.8231 5.9289 5.3527 4.8896 2.9529 25 17.4131 15.6221 14.0939 12.7834 11.8536 10.6748 8.0770 7.8431 6.8729 8.1871 5.4689 4.9476 3.9349 28 18.764 166531 14.8981 13.4052 12.1371 110511 9.3066 79844 6.9507 6.1520 5.5015 4.9597 3.9923 311 19.150014 17.2120 15.372! 13.7649 12418:0 11.25799.4219 .05.27.CZT 6.1772 6.51644.979 1.950 ) Hapa 0 Print Done Print Done