Answered step by step

Verified Expert Solution

Question

1 Approved Answer

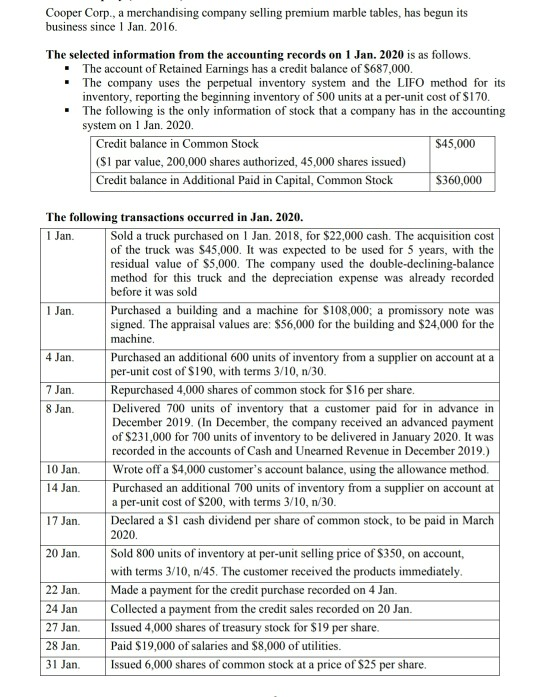

Cooper Corp., a merchandising company selling premium marble tables, has begun its business since 1 Jan. 2016. The selected information from the accounting records on

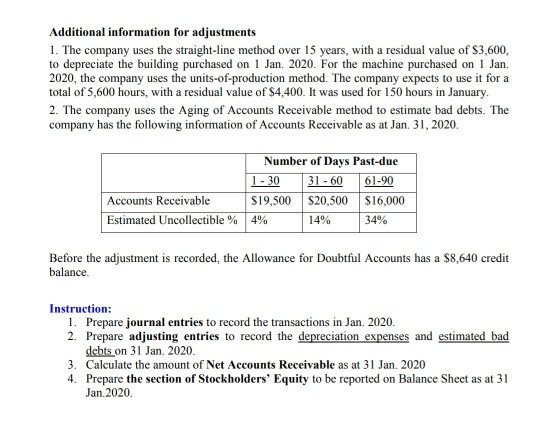

Cooper Corp., a merchandising company selling premium marble tables, has begun its business since 1 Jan. 2016. The selected information from the accounting records on 1 Jan. 2020 is as follows. The account of Retained Earnings has a credit balance of $687,000. The company uses the perpetual inventory system and the LIFO method for its inventory, reporting the beginning inventory of 500 units at a per-unit cost of $170. The following is the only information of stock that a company has in the accounting system on 1 Jan, 2020 Credit balance in Common Stock $45,000 ($1 par value, 200,000 shares authorized, 45,000 shares issued) Credit balance in Additional Paid in Capital, Common Stock $360,000 The following transactions occurred in Jan. 2020. 1 Jan. Sold a truck purchased on 1 Jan. 2018, for $22,000 cash. The acquisition cost of the truck was $45,000. It was expected to be used for 5 years, with the residual value of $5,000. The company used the double-declining-balance method for this truck and the depreciation expense was already recorded before it was sold 1 Jan. Purchased a building and a machine for $108,000; a promissory note was signed. The appraisal values are: $56,000 for the building and $24,000 for the machine. 4 Jan. Purchased an additional 600 units of inventory from a supplier on account at a per-unit cost of $190, with terms 3/10, n/30. 7 Jan. Repurchased 4,000 shares of common stock for $16 per share. 8 Jan. Delivered 700 units of inventory that a customer paid for in advance in December 2019. (In December, the company received an advanced payment of $231,000 for 700 units of inventory to be delivered in January 2020. It was recorded in the accounts of Cash and Unearned Revenue in December 2019.) 10 Jan. Wrote off a $4,000 customer's account balance, using the allowance method. 14 Jan. Purchased an additional 700 units of inventory from a supplier on account at a per-unit cost of $200, with terms 3/10,n/30. 17 Jan. Declared a $1 cash dividend per share of common stock, to be paid in March 2020. 20 Jan Sold 800 units of inventory at per-unit selling price of $350, on account, with terms 3/10, 1/45. The customer received the products immediately. 22 Jan. Made a payment for the credit purchase recorded on 4 Jan. 24 Jan Collected a payment from the credit sales recorded on 20 Jan. 27 Jan Issued 4,000 shares of treasury stock for $19 per share. 28 Jan. Paid $19,000 of salaries and $8,000 of utilities. 31 Jan Issued 6,000 shares of common stock at a price of $25 per share. Additional information for adjustments 1. The company uses the straight-line method over 15 years, with a residual value of $3,600, to depreciate the building purchased on 1 Jan. 2020. For the machine purchased on 1 Jan. 2020, the company uses the units-of-production method. The company expects to use it for a total of 5,600 hours, with a residual value of $4,400. It was used for 150 hours in January. 2. The company uses the Aging of Accounts Receivable method to estimate bad debts. The company has the following information of Accounts Receivable as at Jan 31, 2020. Number of Days Past-due 1 - 30 31-60 61-90 $19,500 $20,500 $16,000 4% 14% 34% Accounts Receivable Estimated Uncollectible % Before the adjustment is recorded, the Allowance for Doubtful Accounts has a $8,640 credit balance. Instruction: 1. Prepare journal entries to record the transactions in Jan. 2020. 2. Prepare adjusting entries to record the depreciation expenses and estimated bad debts on 31 Jan 2020 3. Calculate the amount of Net Accounts Receivable as at 31 Jan. 2020 4. Prepare the section of Stockholders' Equity to be reported on Balance Sheet as at 31 Jan.2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started