Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cooper Insurance Ltd. issues bonds with a face value of $100 million that mature in 12 years. The bonds carry a 7.4% interest rate and

Cooper Insurance Ltd. issues bonds with a face value of $100 million that mature in 12 years. The bonds carry a 7.4% interest rate and are sold at 116.53 to yield 5.5%. They pay interest semi-annually.

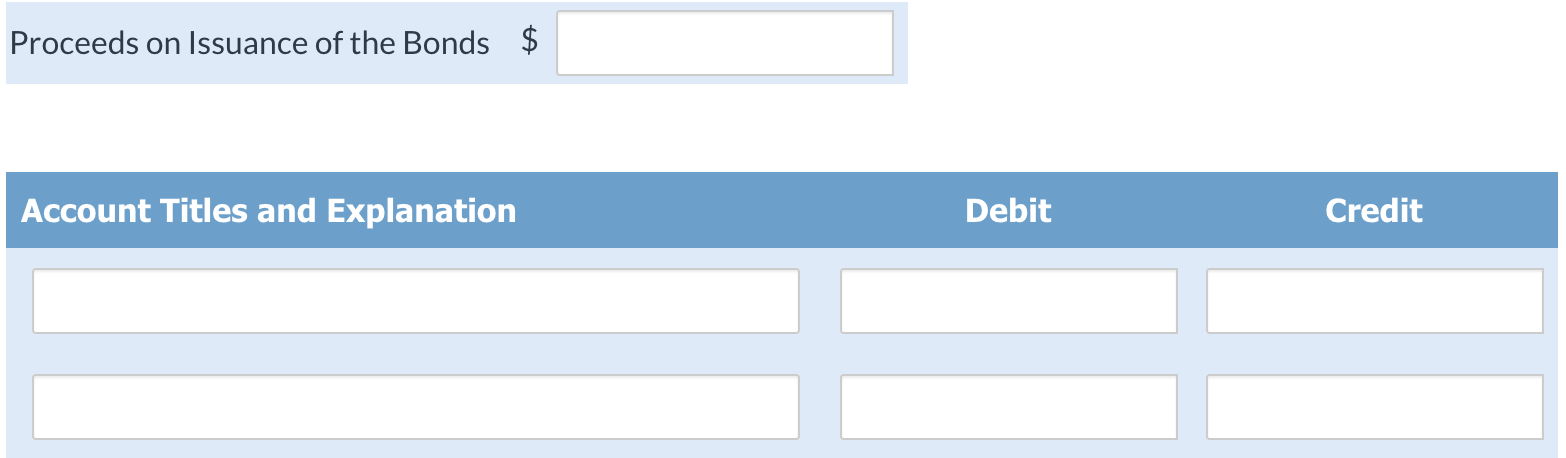

a) Calculate the proceeds on issuance of the bonds, and show the journal entry to record the issuance.

b) Will the carrying value of the liability for these bonds increase over time, or decrease?

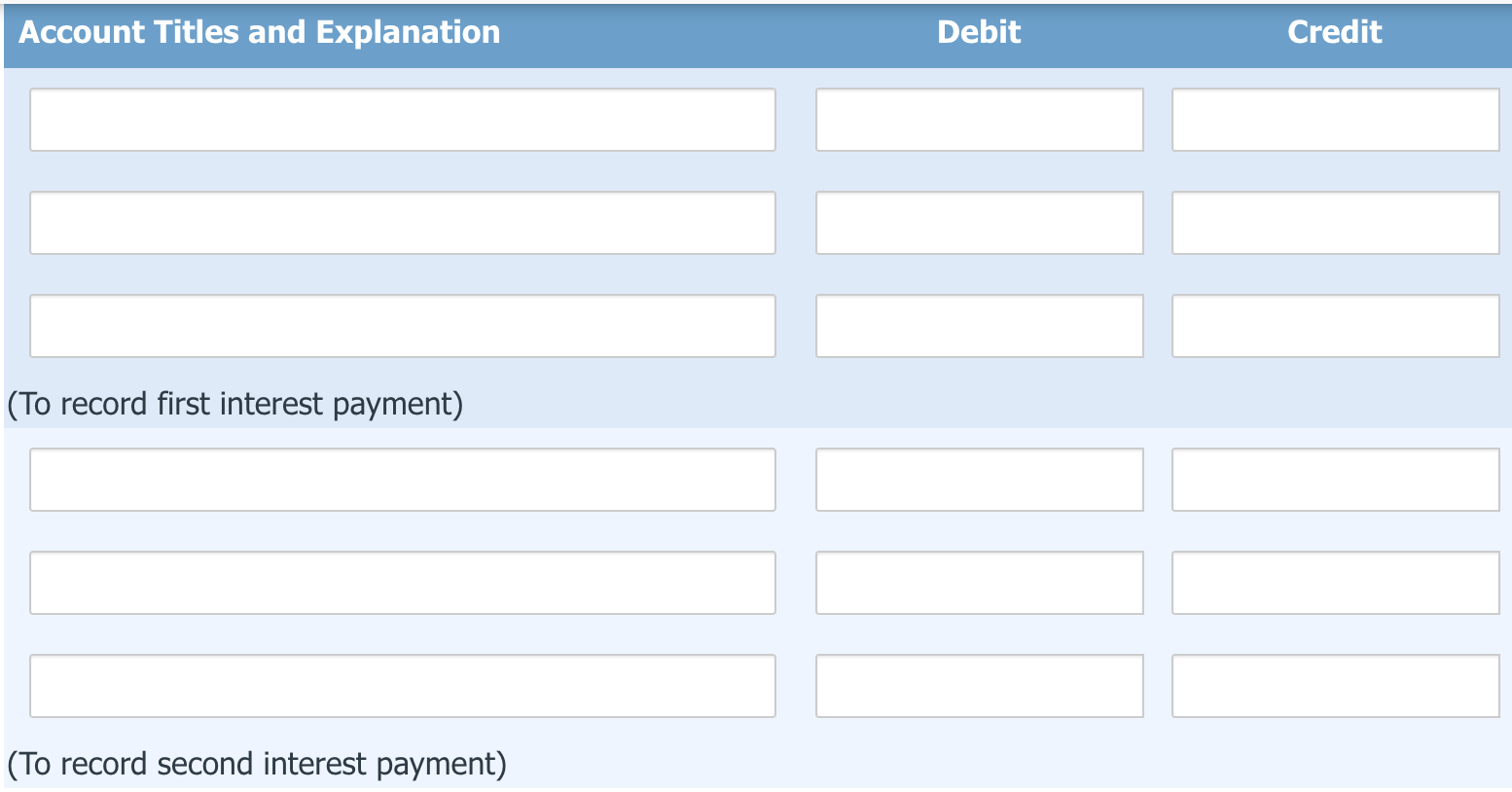

c) Show the journal entries to record the first two interest payments on these bonds. Ignore year-end accruals of interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started