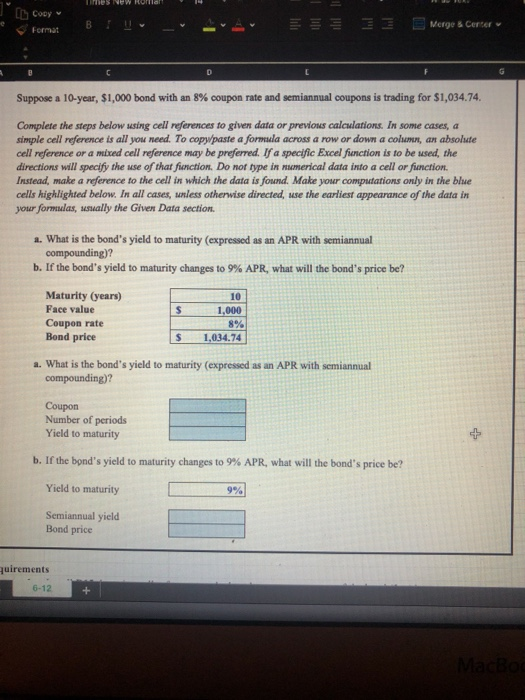

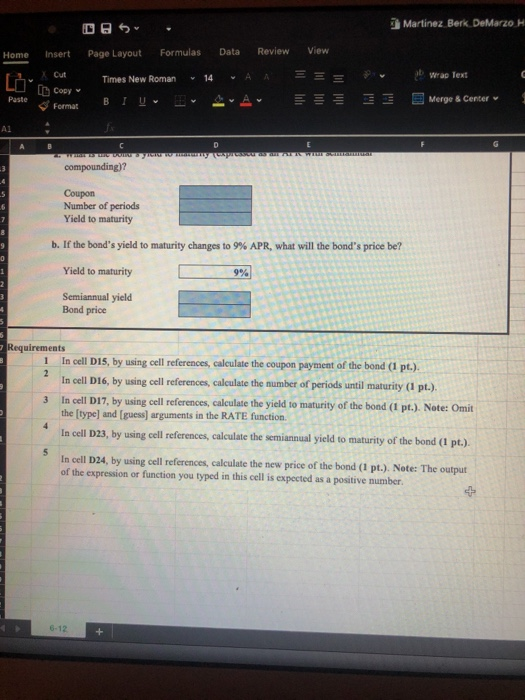

Cooy Format B Merge & Certer Suppose a 10-year, $1,000 bond with an 8% coupon rate and semiannual coupons is trading for $1,034.74. Complete the steps below using cell references to given data or previous calculations. In some cases, simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that fanction. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9% APR, what will the bond's price be? Maturity (years) Face value Coupon rate Bond price 10 1,000 8% S1,034.74 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? Coupon Number of periods Yield to maturity 4 b. If the bond's yield to maturity changes to 9% APR, what will the bond's price be? Yield to maturity 9% Semiannual yield Bond price uirements 6-12 Martinez Berk DeMarzo H Home Insert Page Layout Formulas Data Review View Cut Times New Roman 14 Awao Text PasteFormat Blu- - EE E Merge & Cerner A1 compounding)? Coupon Number of periods Yield to maturity b. If the bond's yield to maturity changes to 9% APR, what will the bond's price be? Yield to maturity [ 9% Semiannual yield Bond price equirements 1 In cell DIS, by using cell references, calculate the coupon payment of the bond (1 pt.). In cell Di6, by using cell references, calculate the number of periods until maturity (1 pt.) In cell D17, by using cell references, calculate the yield to maturity of the bond (1 pt.). Note: Omit the [type] and (guess] arguments in the RATE function In cell D23, by using cell refcrences, calculate the semiannual yield to maturity of the bond (1 pt.) SIn cell D24, by using cell references, calculate the new price of the bond (I pt.). Note: The outpur of the expression or function you typed in this cell is expected as a positive number. 6-12