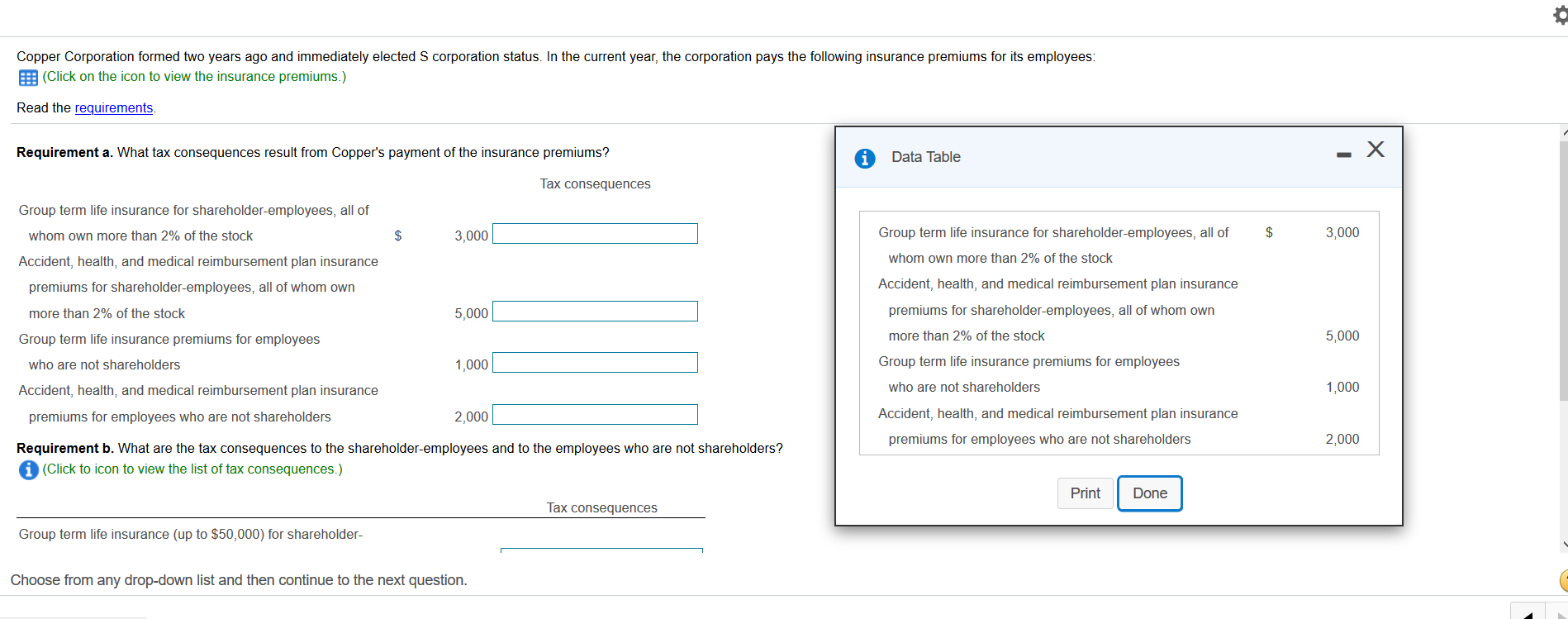

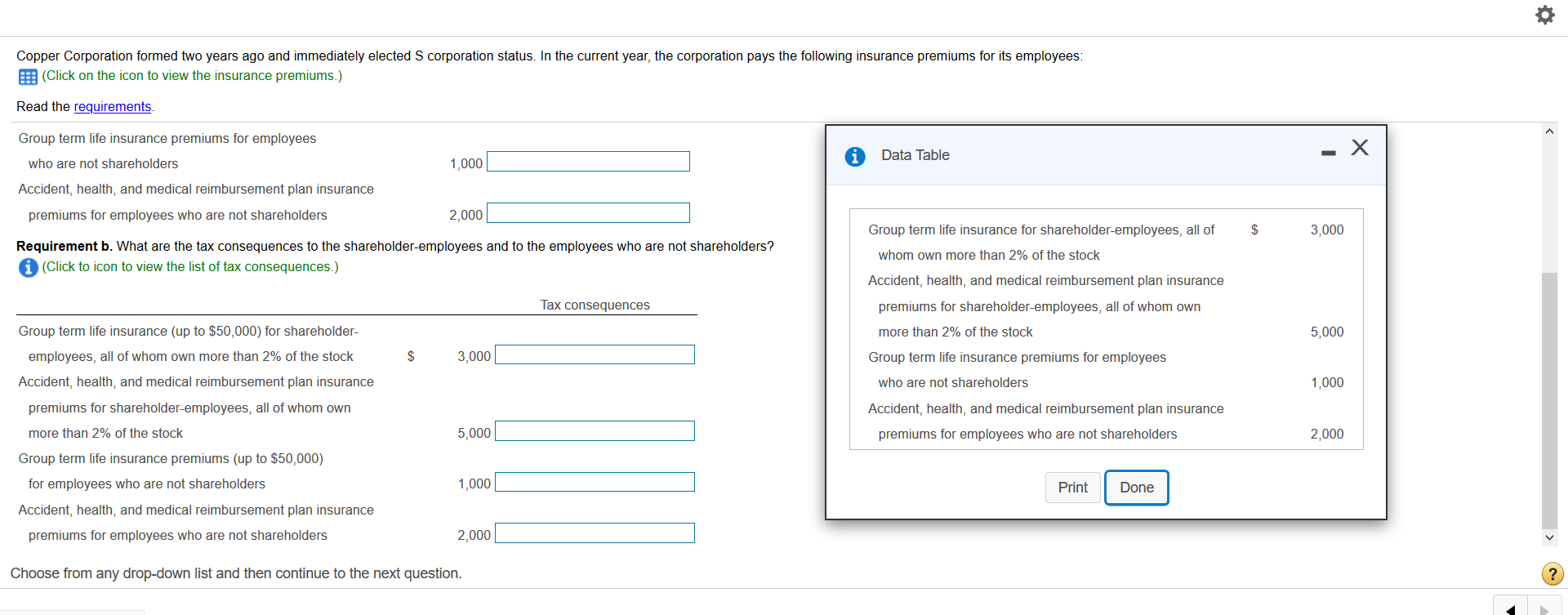

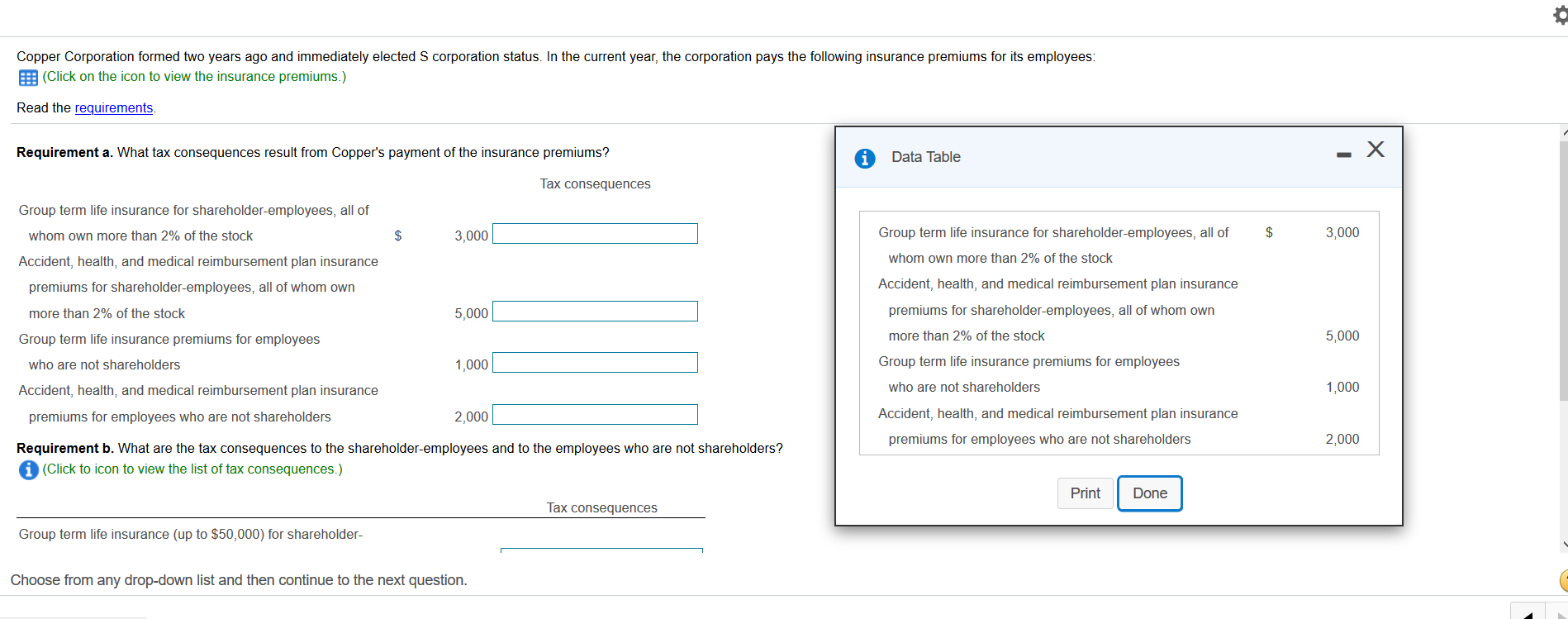

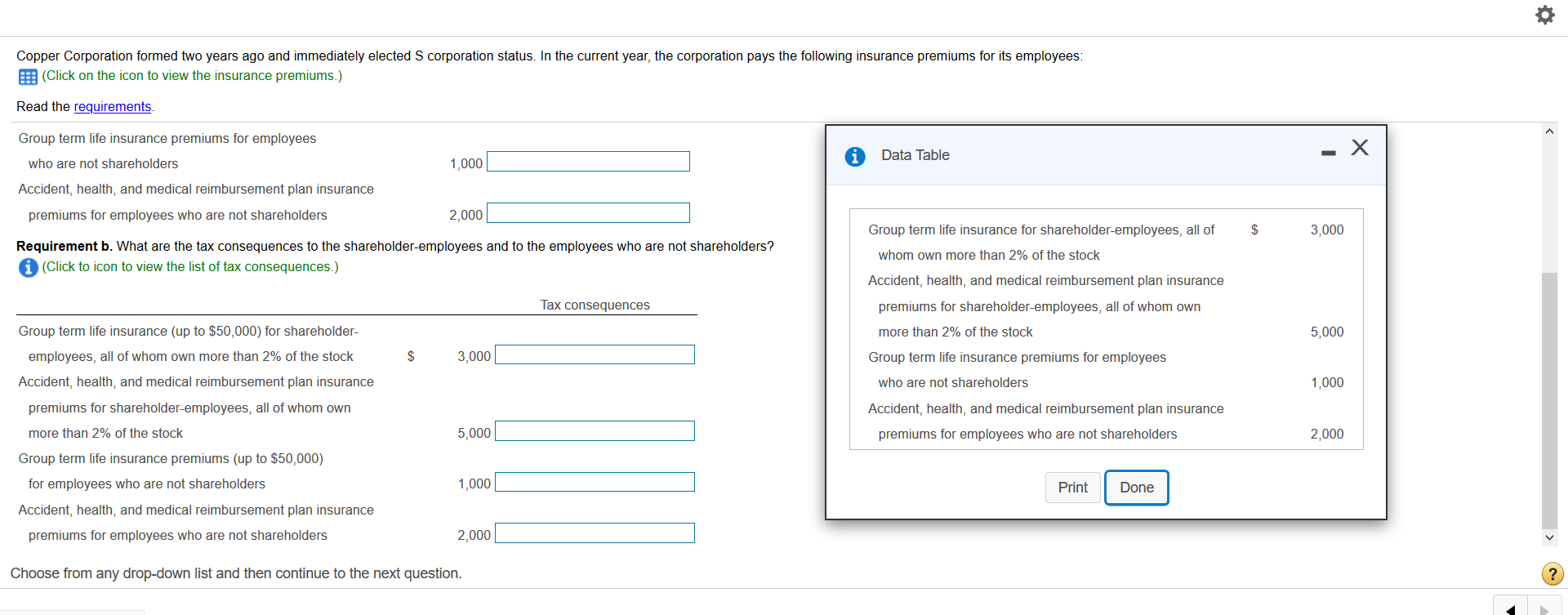

Copper Corporation formed two years ago and immediately elected S corporation status. In the current year, the corporation pays the following insurance premiums for its employees: (Click on the icon to view the insurance premiums.) Read the requirements Requirement a. What tax consequences result from Copper's payment of the insurance premiums? A Data Table - X Tax consequences $ 3,000 $ 3,000 Group term life insurance for shareholder-employees, all of whom own more than 2% of the stock Accident, health, and medical reimbursement plan insurance Group term life insurance for shareholder-employees, all of whom own more than 2% of the stock Accident, health, and medical reimbursement plan insurance premiums for shareholder-employees, all of whom own more than 2% of the stock Group term life insurance premiums for employees who are not shareholders Accident, health, and medical reimbursement plan insurance 5,000 premiums for shareholder-employees, all of whom own more than 2% of the stock 5,000 1,000 Group term life insurance premiums for employees who are not shareholders 1,000 premiums for employees who are not shareholders 2,000 Accident, health, and medical reimbursement plan insurance premiums for employees who are not shareholders 2,000 Requirement b. What are the tax consequences to the shareholder-employees and to the employees who are not shareholders? (Click to icon to view the list of tax consequences.) Print Done Tax consequences Group term life insurance (up to $50,000) for shareholder- Choose from any drop-down list and then continue to the next question. Copper Corporation formed two years ago and immediately elected S corporation status. In the current year, the corporation pays the following insurance premiums for its employees: (Click on the icon to view the insurance premiums.) Read the requirements A - Data Table 1,000 X Group term life insurance premiums for employees who are not shareholders Accident, health, and medical reimbursement plan insurance premiums for employees who are not shareholders 2,000 $ 3,000 Requirement b. What are the tax consequences to the shareholder-employees and to the employees who are not shareholders? (Click to icon to view the list of tax consequences.) Group term life insurance for shareholder-employees, all of whom own more than 2% of the stock Accident, health, and medical reimbursement plan insurance Tax consequences premiums for shareholder-employees, all of whom own more than 2% of the stock 5,000 $ 3,000 Group term life insurance premiums for employees who are not shareholders 1,000 Group term life insurance (up to $50,000) for shareholder- employees, all of whom own more than 2% of the stock Accident, health, and medical reimbursement plan insurance premiums for shareholder-employees, all of whom own more than 2% of the stock Group term life insurance premiums (up to $50,000) for employees who are not shareholders Accident, health, and medical reimbursement plan insurance premiums for employees who are not shareholders Accident, health, and medical reimbursement plan insurance premiums for employees who are not shareholders 5,000 2,000 1,000 Print Done 2,000L Choose from any drop-down list and then continue to the next