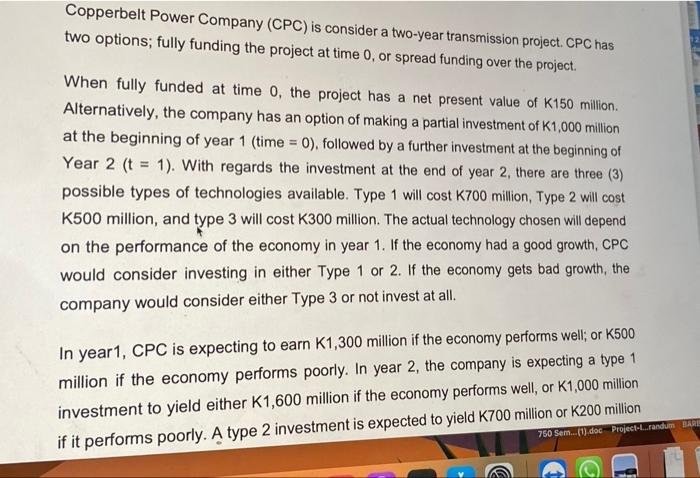

Copperbelt Power Company (CPC) is consider a two-year transmission project. CPC has two options; fully funding the project at time 0 , or spread funding over the project. When fully funded at time 0 , the project has a net present value of K150 million. Alternatively, the company has an option of making a partial investment of K1,000 million at the beginning of year 1 (time =0 ), followed by a further investment at the beginning of Year 2(t=1). With regards the investment at the end of year 2, there are three (3) possible types of technologies available. Type 1 will cost K700 million, Type 2 will cost K500 million, and type 3 will cost K300 million. The actual technology chosen will depend on the performance of the economy in year 1 . If the economy had a good growth, CPC would consider investing in either Type 1 or 2 . If the economy gets bad growth, the company would consider either Type 3 or not invest at all. In year 1, CPC is expecting to earn K1,300 million if the economy performs well; or K500 million if the economy performs poorly. In year 2, the company is expecting a type 1 investment to yield either K1,600 million if the economy performs well, or K1,000 million Copperbelt Pawer Compary (CPC) is consider a two-year transmission project. CPC has two options, fully funtling the project at time Q, or spread funding over the project. Whea fully funded at tine 0 , the proiect has a net present yalue of k.150 miltson. Alteinatively, the compary has an option of making a partial investinert of 1,900 million at the beginning of year 1 (time 0)1 followed by a further investment at the beginning of Year 2(t=1). With tegards the imestment at tine end of year 2 . there are three (2) postable types of tochnsiogies avalable. Type 1 will cost K.700 milison, Type 2 will cost K.600 million, and type 3 will cost K300 milion. The actual technelegy ehosen will depend on the performance of the tconemy it year 1 if the econcemy had a good grawth, CPC would consider irvesting in either Type 1 or 2. If the ecanomy pets bad growth, the company would consider either Type 9 er not invest at all. In yeart, CPC is especting to earn K1,300 millisn if the economy performs wes, or K500 nilition it the econcety performs pooty. in year 2 , the compary is expecting a type 1 investrient to vield either K1,600 millice if the econorzy berfoems wall, or K1,000mili on it it performs poorhy. 4 type 2 ifvestment is exptcted to yisid k700 million or k20.0 mittion for a good of poor econsm, respectivety. A type 3 investment is expected to yield KB00 millien or K600 milion for a geed or poor ecanamy, resoectively, Nuthirvg is expected under the 'ne- furtherw imentment' seenarid if the economy performs poorly. Hovever, this scenarie is expeeted to yield keoo million should the econamic nerfocmance the good: All the eamings represent actual cashfiows. There is an equal likelitood of a good or bad ecorveny in year t; and a A0\%, likethoed of good tconomy in the year 2. Assume that the overal rate of retum on the LUSE is 9K4, the risk-tree rate is 4%, and CPC has a beta of 1.2. Required: a. Prepute a Deciaien Tree of this groject and determine a wich ievertewent should be made at the beginning of Year ? b. Theternine the expocted veluitity in the cumings of each of the four sienurwos in yoar 2 . c. Derensine the nel pecsent value of the partial Luidieg praia al your 0 d. Whit is the value of the purtial fuvding eption? e. Beiefly explein the Imitatieas of this ajproacs to muestricn analysis Copperbelt Power Company (CPC) is consider a two-year transmission project. CPC has two options; fully funding the project at time 0 , or spread funding over the project. When fully funded at time 0 , the project has a net present value of K150 million. Alternatively, the company has an option of making a partial investment of K1,000 million at the beginning of year 1 (time =0 ), followed by a further investment at the beginning of Year 2(t=1). With regards the investment at the end of year 2, there are three (3) possible types of technologies available. Type 1 will cost K700 million, Type 2 will cost K500 million, and type 3 will cost K300 million. The actual technology chosen will depend on the performance of the economy in year 1 . If the economy had a good growth, CPC would consider investing in either Type 1 or 2 . If the economy gets bad growth, the company would consider either Type 3 or not invest at all. In year 1, CPC is expecting to earn K1,300 million if the economy performs well; or K500 million if the economy performs poorly. In year 2, the company is expecting a type 1 investment to yield either K1,600 million if the economy performs well, or K1,000 million Copperbelt Pawer Compary (CPC) is consider a two-year transmission project. CPC has two options, fully funtling the project at time Q, or spread funding over the project. Whea fully funded at tine 0 , the proiect has a net present yalue of k.150 miltson. Alteinatively, the compary has an option of making a partial investinert of 1,900 million at the beginning of year 1 (time 0)1 followed by a further investment at the beginning of Year 2(t=1). With tegards the imestment at tine end of year 2 . there are three (2) postable types of tochnsiogies avalable. Type 1 will cost K.700 milison, Type 2 will cost K.600 million, and type 3 will cost K300 milion. The actual technelegy ehosen will depend on the performance of the tconemy it year 1 if the econcemy had a good grawth, CPC would consider irvesting in either Type 1 or 2. If the ecanomy pets bad growth, the company would consider either Type 9 er not invest at all. In yeart, CPC is especting to earn K1,300 millisn if the economy performs wes, or K500 nilition it the econcety performs pooty. in year 2 , the compary is expecting a type 1 investrient to vield either K1,600 millice if the econorzy berfoems wall, or K1,000mili on it it performs poorhy. 4 type 2 ifvestment is exptcted to yisid k700 million or k20.0 mittion for a good of poor econsm, respectivety. A type 3 investment is expected to yield KB00 millien or K600 milion for a geed or poor ecanamy, resoectively, Nuthirvg is expected under the 'ne- furtherw imentment' seenarid if the economy performs poorly. Hovever, this scenarie is expeeted to yield keoo million should the econamic nerfocmance the good: All the eamings represent actual cashfiows. There is an equal likelitood of a good or bad ecorveny in year t; and a A0\%, likethoed of good tconomy in the year 2. Assume that the overal rate of retum on the LUSE is 9K4, the risk-tree rate is 4%, and CPC has a beta of 1.2. Required: a. Prepute a Deciaien Tree of this groject and determine a wich ievertewent should be made at the beginning of Year ? b. Theternine the expocted veluitity in the cumings of each of the four sienurwos in yoar 2 . c. Derensine the nel pecsent value of the partial Luidieg praia al your 0 d. Whit is the value of the purtial fuvding eption? e. Beiefly explein the Imitatieas of this ajproacs to muestricn analysis