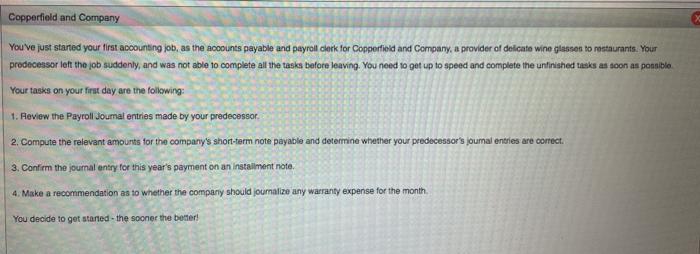

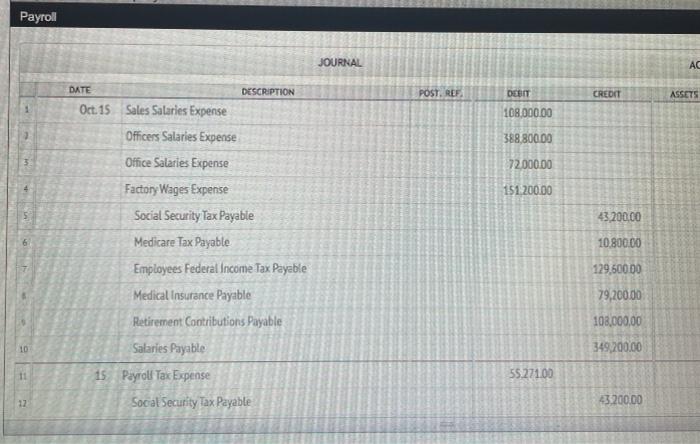

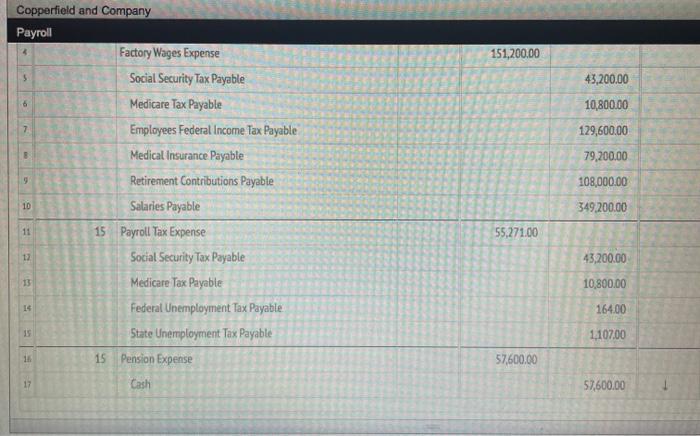

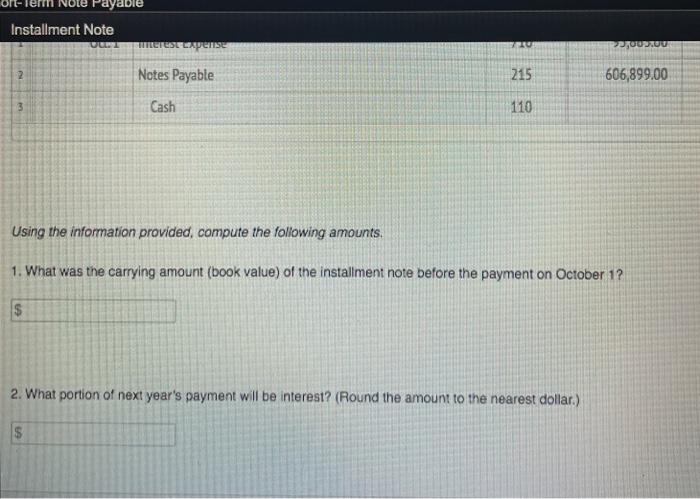

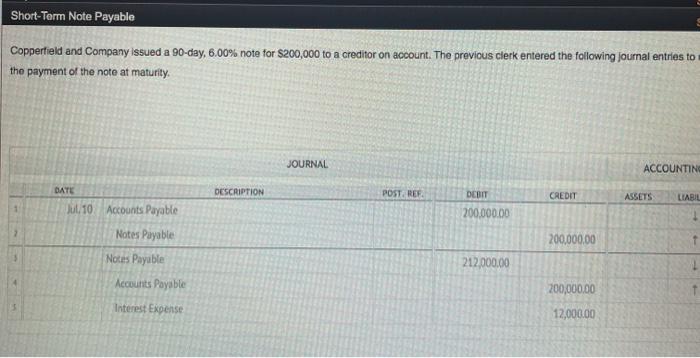

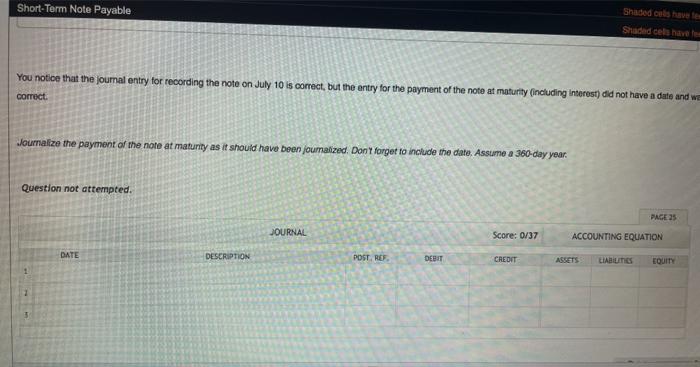

Copperfield and Company Youve just started your first accounting job, as the accounts payable and payroll clerk for Copporfioid and Company, a provider of delicate wine glassen to restaurants. Your predecessor left the job suddenly, and was not able to complete all the tasks before leaving. You need to get up to speed and complete the unfinished tasks as soon as posible Your tasks on your first day are the following: 1. Review the Payroll Journal entries made by your predecessor 2. Compute the relevant amounts for the company's short-term note payable and determine whether your predecessor's journal entries are correct. 3. Confirm the journal entry for this year's payment on an instalment note 4. Make a recommendation as to whether the company should journalize any warranty expense for the month You decide to get started the sooner the better! Payroll JOURNAL AC POST. REF CREDIT ASSETS DEBIT 108.000.00 388,800.00 72.000.00 151 200.00 DATE DESCRIPTION Oct. 15 Sales Salaries Expense Officers Salaries Expense Office Salaries Expense Factory Wages Expense Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable Medical Insurance Payable Retirement Contributions Payable Salaries Payable 43,200.00 10.800.00 129,60000 79,200.00 108,000,00 349,200.00 10 11 55.271.00 15 Payroll Tax Expense Social Security Tax Payable 12 43,200.00 151,200.00 43,200.00 10,800.00 7 129,600.00 3 79,200.00 Copperfield and Company Payroll Factory Wages Expense Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable Medical Insurance Payable Retirement Contributions Payable Salaries Payable 15 Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable 15 Pension Expense 9 108,000.00 10 349,200.00 11 55,271.00 12 43,200.00 13 10,800.00 14 164.00 15 1.107.00 11 57,600,00 17 Cash 57,600.00 e following journal entry was made by your predecessor to record the annual payment on a 5%, 10-year installment note. JOURNAL DATE DESCRIPTION POST. REF DEBIT CREDIT Oct. 1 Interest Expense 710 95,663.00 Notes Payable 215 606,899.00 Cash 110 702,562.00 Note ayable Installment Note UL HETUSE Liperise TO OUROU 2 Notes Payable 215 606,899.00 Cash 110 Using the information provided, compute the following amounts 1. What was the carrying amount (book value) of the installment note before the payment on October 1? 2. What portion of next year's payment will be interest? (Round the amount to the nearest dollar.) $ Short-Term Note Payable Copperfield and Company issued a 90-day, 6.00% note for $200,000 to a creditor on account. The previous clerk entered the following journal entries to the payment of the note at maturity JOURNAL ACCOUNTING DATE DESCRIPTION POST. REF CREDIT ASSETS LIABIL DEBIT 200.000.00 10 Accounts Payable Notes Payable Notes Payable Accounts Payable 200,000.00 212,000.00 200,000.00 Interest Expense 12,000.00 Short-Term Note Payable Shaded cells have You notice that the journal entry for recording the note on July 10 is correct, but the entry for the payment of the note at maturity (including interest) did not have a date and we correct Journalize the payment of the note at maturity as it should have been journalized. Don't forget to include the date. Assume a 360-day year. Question not attempted. PAGE 25 JOURNAL Score: 0/37 ACCOUNTING EQUATION DATE DESCRIPTION POST REF DEBUT CREDIT ASSETS LIABUT EQUITY 1