Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coppo is a copper mining firm. The output one year later is expected to be 1,000,000 lb. Coppo has just purchased a new equipment

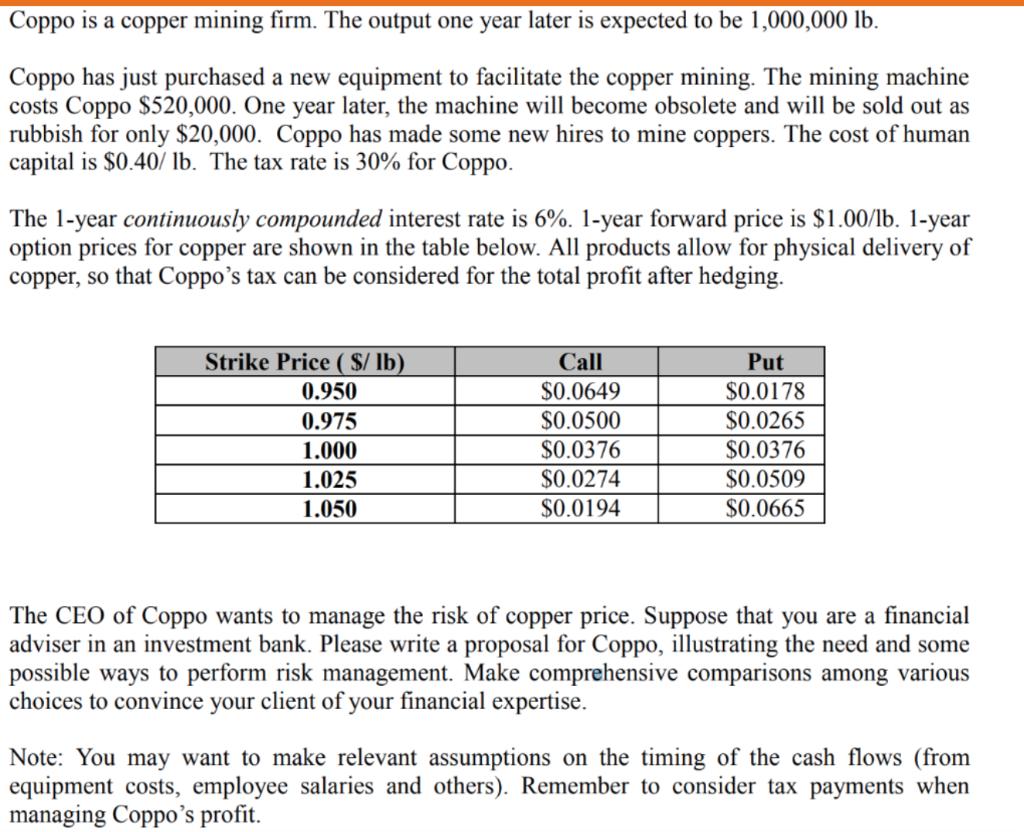

Coppo is a copper mining firm. The output one year later is expected to be 1,000,000 lb. Coppo has just purchased a new equipment to facilitate the copper mining. The mining machine costs Coppo $520,000. One year later, the machine will become obsolete and will be sold out as rubbish for only $20,000. Coppo has made some new hires to mine coppers. The cost of human capital is $0.40/ lb. The tax rate is 30% for Coppo. The 1-year continuously compounded interest rate is 6%. 1-year forward price is $1.00/lb. 1-year option prices for copper are shown in the table below. All products allow for physical delivery of copper, so that Coppo's tax can be considered for the total profit after hedging. Strike Price (S/ lb) 0.950 0.975 1.000 1.025 1.050 Call $0.0649 $0.0500 $0.0376 $0.0274 $0.0194 Put $0.0178 $0.0265 $0.0376 $0.0509 $0.0665 The CEO of Coppo wants to manage the risk of copper price. Suppose that you are a financial adviser in an investment bank. Please write a proposal for Coppo, illustrating the need and some possible ways to perform risk management. Make comprehensive comparisons among various choices to convince your client of your financial expertise. Note: You may want to make relevant assumptions on the timing of the cash flows (from equipment costs, employee salaries and others). Remember to consider tax payments when managing Coppo's profit.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

8 RISK MANAGEMENT STRATEGY 1 SELL IN FORWARD 1 per pound e006 1061836547 A Revenue in year1 1000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started