CORAL BAY HOSPITAL, 6th ed: Traditional Project Analysis.

Please answer the case, and include the following:

Question: Coral bay has hired you as a financial consultant. Present a project analysis for ambulatory surgery center and then present your findings and recommendations to the board of directors.

Findings: Answer the case, what is the NPV, IRR, MIRR, and payback of the proposed ambulatory surgery center? Do the measures indicate acceptance or rejection of the proposed ambulatory surgery center? Please explain and show how you generally calculated this.

Provide 2 recommendations based off your findings for the board of directors. How does it connect back with your findings.

***please note the given information is in the case.

All you have to do is solve the calculation/finding part in excel with and provide 2 recommendation

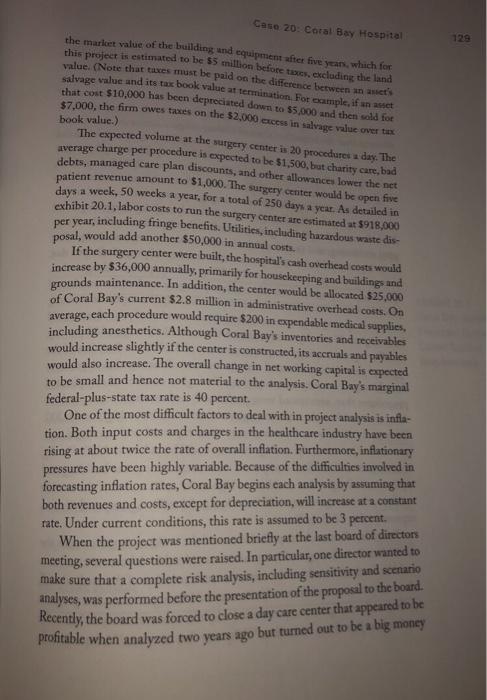

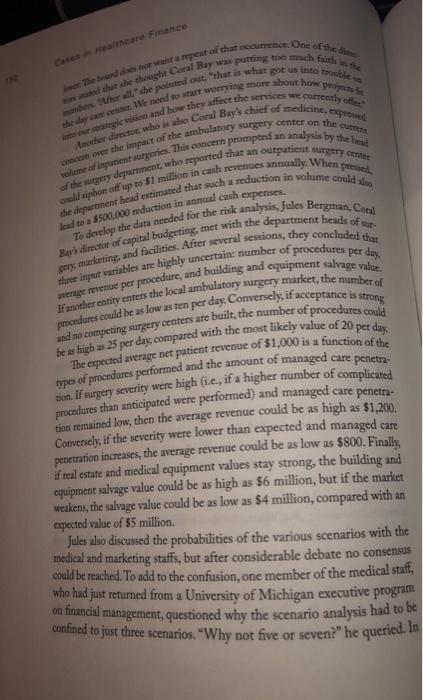

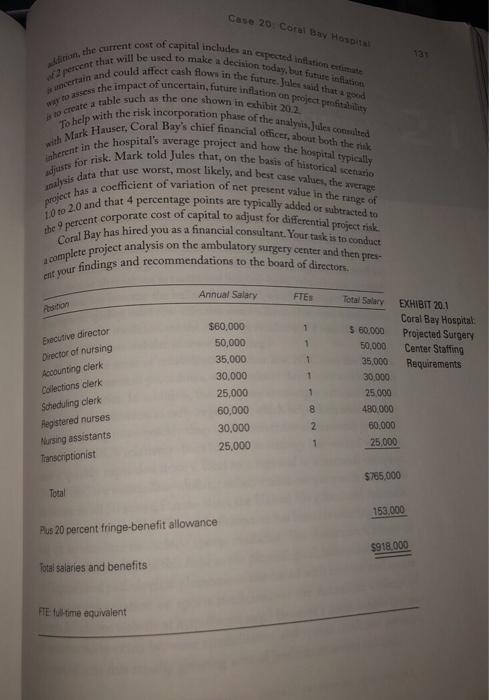

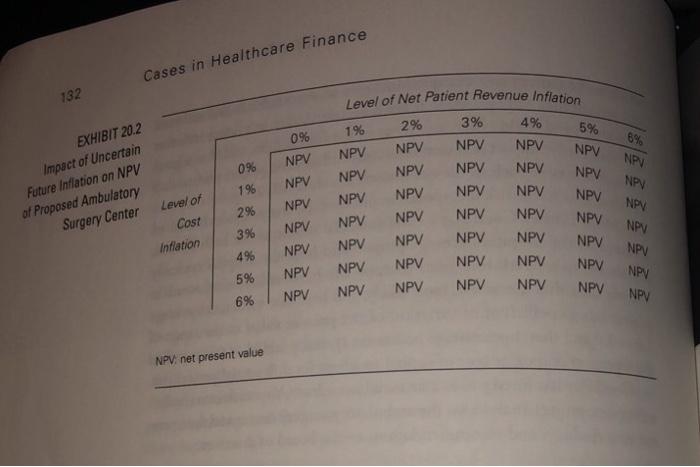

CASE CORAL BAY HOSPITAL TRADITIONAL PROJECT ANALYSIS 20 CORAL BAY HOSPITAL is a 250-bed, investor-owned hospital located in Coral Bay, Florida, which is known as the "The Sport Fishing Capital of the World." The hospital was founded in 1946 by Dr. Rob Winslow, a prominent Florida physician, on his return from service in World War II. He relinquished control of Coral Bay in 1967 while it was still small and in a relatively quiet setting. However, in recent years, south Florida has expe- rienced a population explosion, which has fostered high economic growth and the need for more healthcare services. Today, under a succession of excellent CEOs, Coral Bay is recognized as one of the leading healthcare providers in the area. Coral Bay's management is currently evaluating a proposed ambulatory (outpatient) surgery center. (For more information on ambulatory surgery, see the Ambulatory Surgery Center Association website at www.ascassocia- tion.org.) More than 80 percent of all outpatient surgery is performed by specialists in gastroenterology, gynecology, ophthalmology, otolaryngology, orthopedics, plastic surgery, and urology. Ambulatory surgery requires an average of about one-and-a-half hours to complete: Minor procedures take about one hour or less, and major procedures typically take two or more hours. About 60 percent of the procedures are performed under general anesthesia, 30 percent under local anesthesia, and 10 percent under regional or spinal anesthesia. In general, operating rooms are built in pairs so that a patient can be prepped in one room while the surgeon is completing a procedure in the other room. The outpatient surgery market has experienced significant growth since the first ambulatory surgery center opened in 1970. By 1990, about 2.5 million 127 Foundation of ACHE, 2018. Reproduction without permission is prohibited procedures were being performed at stand-alone outpatient centers, and by 2017, the number had grown to more than 20 million. This growth has been have enabled many procedures that were historically performed in impatient fueled primarily by three factors. First, rapid advancements in technology surgical suites to be offered at outpatient settings. This shift was caused mainly by advances in laser, laparoscopic, endoscopic, and arthroscopic technologies surgery services has grown substantially. Third, patients prefer outpatient minimally invasive surgery techniques, so the number of Medicare patients using outpatient Because of these factors, the number of inpatient surgeries has remained whereas the number of outpatient Cases in Healthcare Finance Second, Medicare has been aggressive in approving new surgeries because they are more convenient, and third-party payers prefer them because they are less costly. more or less flat over the past 20 years procedures has continuously grown more than 10 percent annually. Rapid growth in the number of outpatient surgeries has been accompanied by a corresponding growth in the number of outpatient facilities nationwide The number currently stands at about 5,300, so competition in many areas has become intense. Somewhat surprisingly, no outpatient surgery Center exists in Coral Bay's immediate service area, although rumors are that local surgeons are exploring the feasibility of a physician-owned facility Coral Bay currently owns a parcel of land adjacent to its facility that is a perfect location for the surgery center. The hospital bought the land five years ago for $150,000 and spent and expensed for tax purposes) $25,000 to clear the land and put in sewer and utility lines last year. If sold in today's market, the land would bring in $200,000, net of all fees, commissions, and taxes. Land prices have been extremely volatile, so Coral Bay's standard procedure is to assume a salvage value equal to the current value of the land. Of course, land is not depreciated for either book or tax purposes. The surgery center building, which would house four operating suites, would cost $5 million, and the equipment would cost an additional $5 million, for a total of $10 million. Assume that both the building and the equipment fall into the MACRS (modified accelerated cost recovery system) five-year class for tax-depreciation purposes. (In reality, the building would have to be depreciated over a much longer period than the equipment.) The project will probably have a long life, but Coral Bay typically assumes a five-year life in its capital budgeting analyses and then approximates the value of the cash flows beyond Year 5 by including a terminal, or salvage, value in the analysis. To estimate the salvage value, Coral Bay typically uses 129 Case 20: Coral Bay Hospital the marloet value of the building and equipment after five years, which for this project is estimated to be $5 million before taxes, excluding the land value. (Note that taxes must be paid on the difference between an auct's salvage value and its tax book value at termination. For example, if an asset that cost $10,000 has been depreciated down to $5,000 and then sold for $7,000, the firm owes taxes on the $2,000 excess in salvage value over tex. book value.) The expected volume at the surgery center is 20 procedures a day. The average charge per procedure is expected to be $1,500, bat charity care, bad debts, managed care plan discounts, and other allowances lower the net patient revenue amount to $1,000. The surgery ceniter would be open five days a week, 50 weeks a year, for a total of 250 days a year. As detailed in exhibit 20.1, labor costs to run the surgery center are estimated at $918,000 per year, including fringe benefits. Utilities, including hazardous waste dis- posal, would add another $50,000 in annual costs. If the surgery center were built, the hospital's cash overhead costs would increase by $36,000 annually, primarily for housekeeping and buildings and grounds maintenance. In addition, the center would be allocated $25,000 of Coral Bay's current $2.8 million in administrative overhead costs. On average, each procedure would require $200 in expendable medical supplies, including anesthetics. Although Coral Bay's inventories and receivables would increase slightly if the center is constructed, its accruals and payables would also increase. The overall change in net working capital is expected to be small and hence not material to the analysis. Coral Bay's marginal One of the most difficult factors to deal with in project analysis is infla- federal-plus-state tax rate is 40 percent. tion. Both input costs and charges in the healthcare industry have been rising at about twice the rate of overall inflation. Furthermore, inflationary pressures have been highly variable. Because of the difficulties involved in forecasting inflation rates, Coral Bay begins each analysis by assuming that both revenues and costs, except for depreciation, will increase at a constant rate. Under current conditions, this rate is assumed to be 3 percent. When the project was mentioned briefly at the last board of directors meeting, several questions were raised. In particular, one director wanted to make sure that a complete risk analysis, including sensitivity and scenario analyses, was performed before the presentation of the proposal to the board. Recently, the board was forced to close a day care center that appeared to be profitable when analyzed two years ago but turned out to be a big money he hot wat ampert of that occurrence. One of the di that she thought Coral Bay was putting too much faith in the ther allshe pointed out that is what got us into trouble the day out. We need to start worrying more about how peojoc fit interior and how they affect the semices we currently her director who is acho Coral Bays chief of medicine, more the impact of the ambulatory surgery center on the out of the surgery department, who reported that an outpatient surgery Cente iphon off up to $1 million in cash revenues annually. When po the department head estimated that such a reduction in volume could lead to a $500,000 reduction in annual cash expenses. Burl director of capital budgeting, met with the department heads of sur To develop the data needed for the risk analysis, Jules Bergman, Coral ser mariting and facilities. After several sessions, they concluded that were revenue per procedure, and building and equipment salvage valut. If another entity enters the local ambulatory surgery market, the number of procedures could be as low as ten per day. Conversely, if acceptance is strong and no competing surgery centers are built, the number of procedures could be as high as 25 per day, compared with the most likely value of 20 per day. The appected average net patient revenue of $1,000 is a function of the prompted an analysis by the head volume of inpatient surgeries. This concem types of procedures performed and the amount of managed care penetra procedures than anticipated were performed) and managed care penetra- tion. If surgery severity were high (ie, if a higher number of complicated tion remained low, then the average revenue could be as high as $1,200. Conversely, if the severity were lower than expected and managed care penetration increases, the average revenue could be as low as $800. Finally, if real estate and medical equipment values stay strong, the building and equipment salvage value could be as high as $6 million, but if the market weakens, the salvage value could be as low as $4 million, compared with an expected value of $5 million Jules also discussed the probabilities of the various scenarios with the medical and marketing staffs, but after considerable debate no consensus could be reached. To add to the confusion, one member of the medical staff, who had just returned from a University of Michigan executive program on financial management, questioned why the scenario analysis had to be confined to just three scenarios. "Why not five or seven?" he queried. In Werent that will be used to make a decision today, but future of Aman, the current cost of capital includes an expected to me certain and could affect cash flows in the future Jales said that good to assess the impact of uncertain, future inflation on poject profitab crare a table such as the one shown chibit with Mark Hauser, Coral Bay's chief financial officer, about both the nuk To help with the risk incorporation phase of the analyses cond adjusts for risk. Mark told Jules that, on the basis of historical scenario inherent in the hospital's average project and how the hospital typically alisis data that use worst, most likely, and best case values, the average punct has a cocfficient of variation of net present value in the range of the percent corporate cost of capital to adjust for differential project tisk 1.0 to 2.0 and that 4 percentage points are typically added or subtracted to Coral Bay has hired you as a financial consultant. Your task is to conduct complete project analysis on the ambulatory surgery center and then per ent your findings and recommendations to the board of directors Case 20. Coral Bay Hospital 131 Annual Salary FTES Executive director Director of nursing Accounting clerk Collections clerk Scheduling clerk Registered nurses Nursing assistants $60,000 50,000 35,000 30.000 25,000 60,000 30,000 25,000 Total Salary EXHIBIT 20.1 Coral Bay Hospital $ 60,000 Projected Surgery 50,000 Center Staffing 35.000 Requirements 30.000 25.000 480.000 60.000 25,000 2 1 Transcriptionist $765,000 Total 153.000 Pus 20 percent fringe-benefit allowance $918,000 Total salaries and benefits FIE full-time equivalent Cases in Healthcare Finance 132 Level of Net Patient Revenue Inflation 3% NPV NPV NPV NPV NPV 2% NPV NPV NPV NPV NPV NPV NPV NPV 2% NPV 5% NPV NPV 0% EXHIBIT 20.2 Impact of Uncertain Future Inflation on NPV of Proposed Ambulatory Surgery Center Level of 4% NPV NPV NPV NPV 0% 1 % NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV 8% NPV NPV NPV NPV NPV NPV 196 Cost Inflation 3% 49 NPV NPV NPV NPV NPV NPV NPV NPV NPV 5% 6% NPV. net present value CASE CORAL BAY HOSPITAL TRADITIONAL PROJECT ANALYSIS 20 CORAL BAY HOSPITAL is a 250-bed, investor-owned hospital located in Coral Bay, Florida, which is known as the "The Sport Fishing Capital of the World." The hospital was founded in 1946 by Dr. Rob Winslow, a prominent Florida physician, on his return from service in World War II. He relinquished control of Coral Bay in 1967 while it was still small and in a relatively quiet setting. However, in recent years, south Florida has expe- rienced a population explosion, which has fostered high economic growth and the need for more healthcare services. Today, under a succession of excellent CEOs, Coral Bay is recognized as one of the leading healthcare providers in the area. Coral Bay's management is currently evaluating a proposed ambulatory (outpatient) surgery center. (For more information on ambulatory surgery, see the Ambulatory Surgery Center Association website at www.ascassocia- tion.org.) More than 80 percent of all outpatient surgery is performed by specialists in gastroenterology, gynecology, ophthalmology, otolaryngology, orthopedics, plastic surgery, and urology. Ambulatory surgery requires an average of about one-and-a-half hours to complete: Minor procedures take about one hour or less, and major procedures typically take two or more hours. About 60 percent of the procedures are performed under general anesthesia, 30 percent under local anesthesia, and 10 percent under regional or spinal anesthesia. In general, operating rooms are built in pairs so that a patient can be prepped in one room while the surgeon is completing a procedure in the other room. The outpatient surgery market has experienced significant growth since the first ambulatory surgery center opened in 1970. By 1990, about 2.5 million 127 Foundation of ACHE, 2018. Reproduction without permission is prohibited procedures were being performed at stand-alone outpatient centers, and by 2017, the number had grown to more than 20 million. This growth has been have enabled many procedures that were historically performed in impatient fueled primarily by three factors. First, rapid advancements in technology surgical suites to be offered at outpatient settings. This shift was caused mainly by advances in laser, laparoscopic, endoscopic, and arthroscopic technologies surgery services has grown substantially. Third, patients prefer outpatient minimally invasive surgery techniques, so the number of Medicare patients using outpatient Because of these factors, the number of inpatient surgeries has remained whereas the number of outpatient Cases in Healthcare Finance Second, Medicare has been aggressive in approving new surgeries because they are more convenient, and third-party payers prefer them because they are less costly. more or less flat over the past 20 years procedures has continuously grown more than 10 percent annually. Rapid growth in the number of outpatient surgeries has been accompanied by a corresponding growth in the number of outpatient facilities nationwide The number currently stands at about 5,300, so competition in many areas has become intense. Somewhat surprisingly, no outpatient surgery Center exists in Coral Bay's immediate service area, although rumors are that local surgeons are exploring the feasibility of a physician-owned facility Coral Bay currently owns a parcel of land adjacent to its facility that is a perfect location for the surgery center. The hospital bought the land five years ago for $150,000 and spent and expensed for tax purposes) $25,000 to clear the land and put in sewer and utility lines last year. If sold in today's market, the land would bring in $200,000, net of all fees, commissions, and taxes. Land prices have been extremely volatile, so Coral Bay's standard procedure is to assume a salvage value equal to the current value of the land. Of course, land is not depreciated for either book or tax purposes. The surgery center building, which would house four operating suites, would cost $5 million, and the equipment would cost an additional $5 million, for a total of $10 million. Assume that both the building and the equipment fall into the MACRS (modified accelerated cost recovery system) five-year class for tax-depreciation purposes. (In reality, the building would have to be depreciated over a much longer period than the equipment.) The project will probably have a long life, but Coral Bay typically assumes a five-year life in its capital budgeting analyses and then approximates the value of the cash flows beyond Year 5 by including a terminal, or salvage, value in the analysis. To estimate the salvage value, Coral Bay typically uses 129 Case 20: Coral Bay Hospital the marloet value of the building and equipment after five years, which for this project is estimated to be $5 million before taxes, excluding the land value. (Note that taxes must be paid on the difference between an auct's salvage value and its tax book value at termination. For example, if an asset that cost $10,000 has been depreciated down to $5,000 and then sold for $7,000, the firm owes taxes on the $2,000 excess in salvage value over tex. book value.) The expected volume at the surgery center is 20 procedures a day. The average charge per procedure is expected to be $1,500, bat charity care, bad debts, managed care plan discounts, and other allowances lower the net patient revenue amount to $1,000. The surgery ceniter would be open five days a week, 50 weeks a year, for a total of 250 days a year. As detailed in exhibit 20.1, labor costs to run the surgery center are estimated at $918,000 per year, including fringe benefits. Utilities, including hazardous waste dis- posal, would add another $50,000 in annual costs. If the surgery center were built, the hospital's cash overhead costs would increase by $36,000 annually, primarily for housekeeping and buildings and grounds maintenance. In addition, the center would be allocated $25,000 of Coral Bay's current $2.8 million in administrative overhead costs. On average, each procedure would require $200 in expendable medical supplies, including anesthetics. Although Coral Bay's inventories and receivables would increase slightly if the center is constructed, its accruals and payables would also increase. The overall change in net working capital is expected to be small and hence not material to the analysis. Coral Bay's marginal One of the most difficult factors to deal with in project analysis is infla- federal-plus-state tax rate is 40 percent. tion. Both input costs and charges in the healthcare industry have been rising at about twice the rate of overall inflation. Furthermore, inflationary pressures have been highly variable. Because of the difficulties involved in forecasting inflation rates, Coral Bay begins each analysis by assuming that both revenues and costs, except for depreciation, will increase at a constant rate. Under current conditions, this rate is assumed to be 3 percent. When the project was mentioned briefly at the last board of directors meeting, several questions were raised. In particular, one director wanted to make sure that a complete risk analysis, including sensitivity and scenario analyses, was performed before the presentation of the proposal to the board. Recently, the board was forced to close a day care center that appeared to be profitable when analyzed two years ago but turned out to be a big money he hot wat ampert of that occurrence. One of the di that she thought Coral Bay was putting too much faith in the ther allshe pointed out that is what got us into trouble the day out. We need to start worrying more about how peojoc fit interior and how they affect the semices we currently her director who is acho Coral Bays chief of medicine, more the impact of the ambulatory surgery center on the out of the surgery department, who reported that an outpatient surgery Cente iphon off up to $1 million in cash revenues annually. When po the department head estimated that such a reduction in volume could lead to a $500,000 reduction in annual cash expenses. Burl director of capital budgeting, met with the department heads of sur To develop the data needed for the risk analysis, Jules Bergman, Coral ser mariting and facilities. After several sessions, they concluded that were revenue per procedure, and building and equipment salvage valut. If another entity enters the local ambulatory surgery market, the number of procedures could be as low as ten per day. Conversely, if acceptance is strong and no competing surgery centers are built, the number of procedures could be as high as 25 per day, compared with the most likely value of 20 per day. The appected average net patient revenue of $1,000 is a function of the prompted an analysis by the head volume of inpatient surgeries. This concem types of procedures performed and the amount of managed care penetra procedures than anticipated were performed) and managed care penetra- tion. If surgery severity were high (ie, if a higher number of complicated tion remained low, then the average revenue could be as high as $1,200. Conversely, if the severity were lower than expected and managed care penetration increases, the average revenue could be as low as $800. Finally, if real estate and medical equipment values stay strong, the building and equipment salvage value could be as high as $6 million, but if the market weakens, the salvage value could be as low as $4 million, compared with an expected value of $5 million Jules also discussed the probabilities of the various scenarios with the medical and marketing staffs, but after considerable debate no consensus could be reached. To add to the confusion, one member of the medical staff, who had just returned from a University of Michigan executive program on financial management, questioned why the scenario analysis had to be confined to just three scenarios. "Why not five or seven?" he queried. In Werent that will be used to make a decision today, but future of Aman, the current cost of capital includes an expected to me certain and could affect cash flows in the future Jales said that good to assess the impact of uncertain, future inflation on poject profitab crare a table such as the one shown chibit with Mark Hauser, Coral Bay's chief financial officer, about both the nuk To help with the risk incorporation phase of the analyses cond adjusts for risk. Mark told Jules that, on the basis of historical scenario inherent in the hospital's average project and how the hospital typically alisis data that use worst, most likely, and best case values, the average punct has a cocfficient of variation of net present value in the range of the percent corporate cost of capital to adjust for differential project tisk 1.0 to 2.0 and that 4 percentage points are typically added or subtracted to Coral Bay has hired you as a financial consultant. Your task is to conduct complete project analysis on the ambulatory surgery center and then per ent your findings and recommendations to the board of directors Case 20. Coral Bay Hospital 131 Annual Salary FTES Executive director Director of nursing Accounting clerk Collections clerk Scheduling clerk Registered nurses Nursing assistants $60,000 50,000 35,000 30.000 25,000 60,000 30,000 25,000 Total Salary EXHIBIT 20.1 Coral Bay Hospital $ 60,000 Projected Surgery 50,000 Center Staffing 35.000 Requirements 30.000 25.000 480.000 60.000 25,000 2 1 Transcriptionist $765,000 Total 153.000 Pus 20 percent fringe-benefit allowance $918,000 Total salaries and benefits FIE full-time equivalent Cases in Healthcare Finance 132 Level of Net Patient Revenue Inflation 3% NPV NPV NPV NPV NPV 2% NPV NPV NPV NPV NPV NPV NPV NPV 2% NPV 5% NPV NPV 0% EXHIBIT 20.2 Impact of Uncertain Future Inflation on NPV of Proposed Ambulatory Surgery Center Level of 4% NPV NPV NPV NPV 0% 1 % NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV NPV 8% NPV NPV NPV NPV NPV NPV 196 Cost Inflation 3% 49 NPV NPV NPV NPV NPV NPV NPV NPV NPV 5% 6% NPV. net present value