Answered step by step

Verified Expert Solution

Question

1 Approved Answer

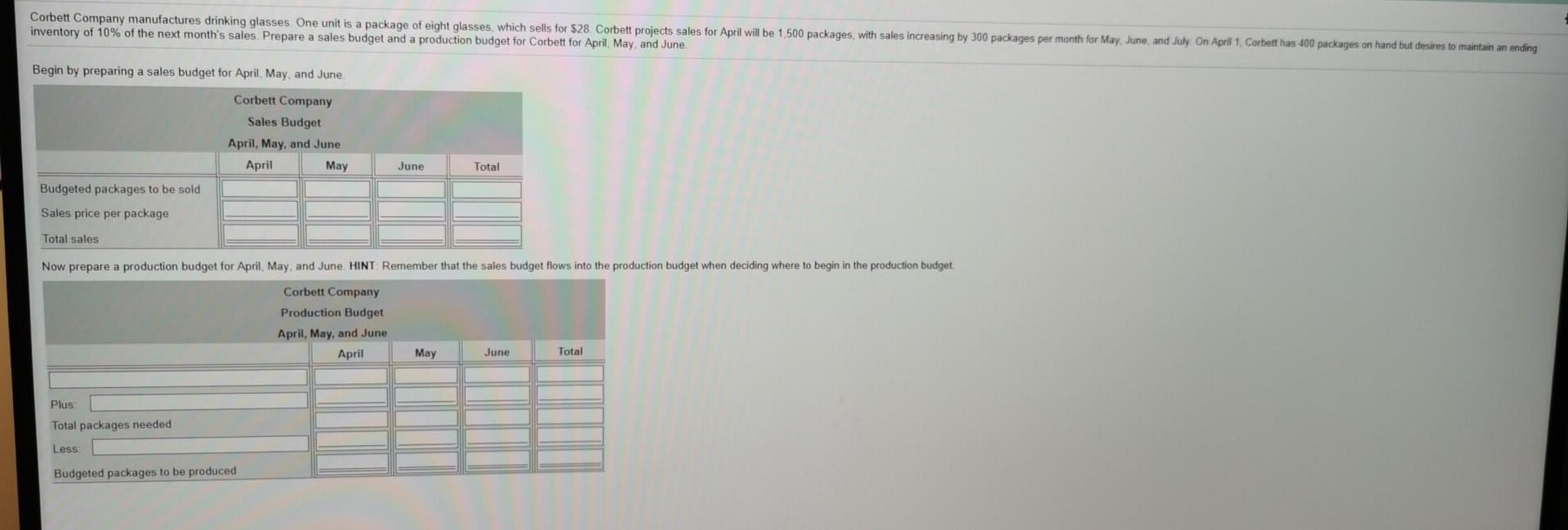

Corbett Company manufactures drinking glasses One unit is a package of eight glasses, which sells for $28 Corbett projects sales for April will be 1.500

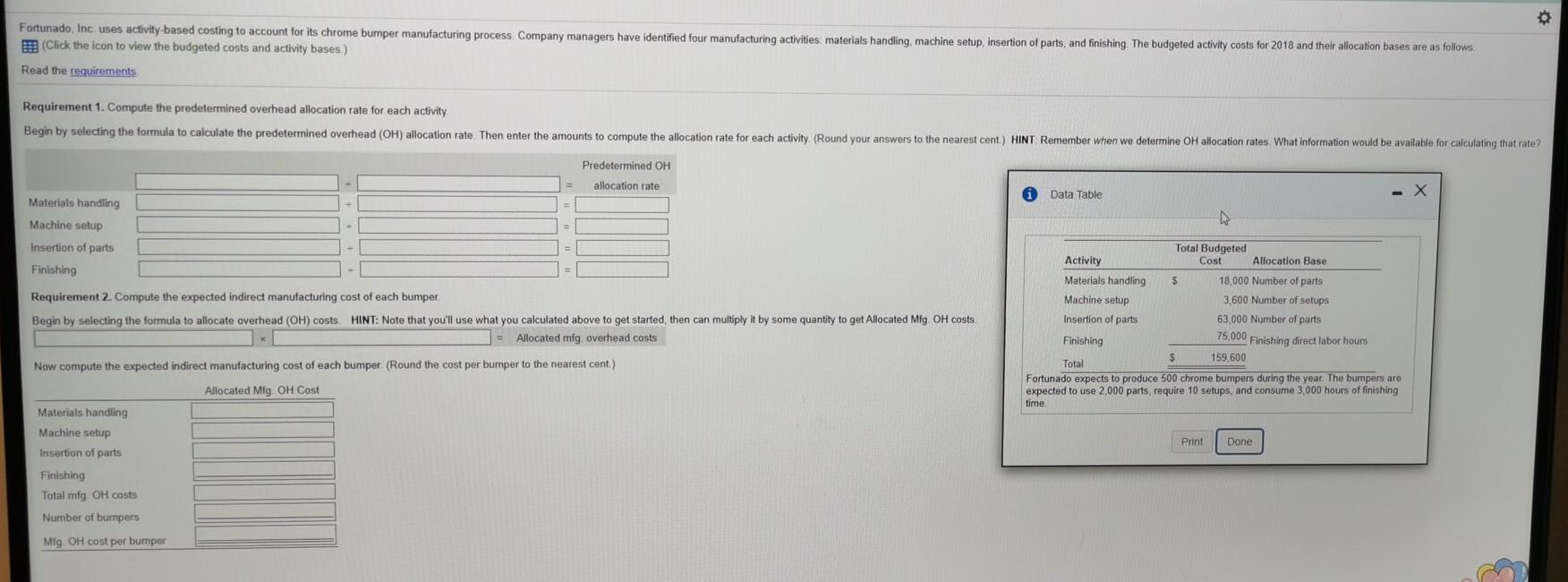

Corbett Company manufactures drinking glasses One unit is a package of eight glasses, which sells for $28 Corbett projects sales for April will be 1.500 packages, with sales increasing by 300 packages per month for May June, and July On April 1. Corbett has 400 packages on hand but desires to maintain an ending inventory of 10% of the next month's sales. Prepare a sales budget and a production budget for Corbett for April, May and June Begin by preparing a sales budget for April, May, and June Corbett Company Sales Budget April, May, and June April May June Total Budgeted packages to be sold Sales price per package Total sales Now prepare a production budget for April, May and June HINT Remember that the sales budget flows into the production budget when deciding where to begin in the production budget Corbett Company Production Budget April, May, and June April June Total May Plus Total packages needed Less Budgeted packages to be produced 0 Fortunado, Inc uses activity-based costing to account for its chrome bumper manufacturing process. Company managers have identified four manufacturing activities: materials handling, machine setup, insertion of parts, and finishing. The budgeted activity costs for 2018 and their allocation bases are as follows EB (Click the icon to view the budgeted costs and activity bases.) Read the requirements Requirement 1. Compute the predetermined overhead allocation rate for each activity Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Round your answers to the nearest cent) HINT Remember when we determine OH allocation rates What information would be available for calculating that rate? Predetermined OH allocation rate + Data Table - X Materials handling - Machine setup Insertion of parts Finishing Requirement 2. Compute the expected indirect manufacturing cost of each bumper. Begin by selecting the formula to allocate overhead (OH) costs HINT: Note that you'll use what you calculated above to get started, then can multiply it by some quantity to get Allocated Mfg. OH costs Allocated mfg, overhead costs Total Budgeted Activity Cost Allocation Base Materials handling $ 18,000 Number of parts Machine setup 3,600 Number of setups Insertion of parts 63,000 Number of parts Finishing 75,000 Finishing direct labor hours $ 159,600 Total Fortunado expects to produce 500 chrome bumpers during the year. The bumpers are expected to use 2,000 parts, require 10 setups, and consume 3,000 hours of finishing time Now compute the expected indirect manufacturing cost of each bumper (Round the cost per bumper to the nearest cent.) Allocated Mfg. OH Cost Materials handling Machine setup Insertion of parts Print Done Finishing Total mfg OH costs Number of bumpers Mag. OH cost per bumper

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started