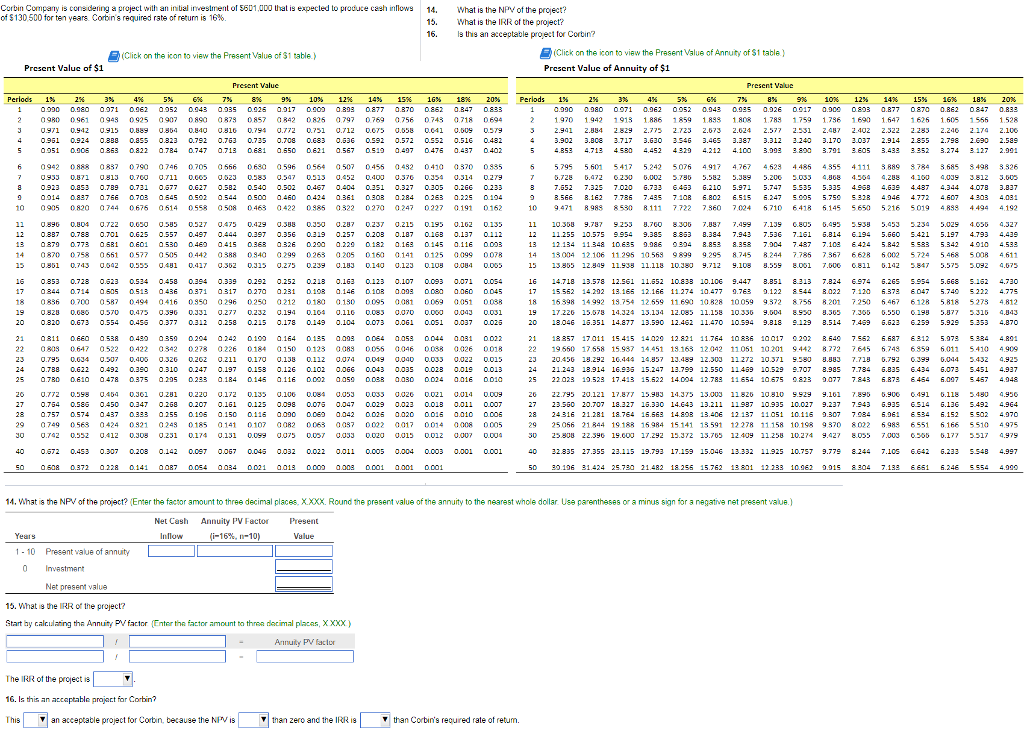

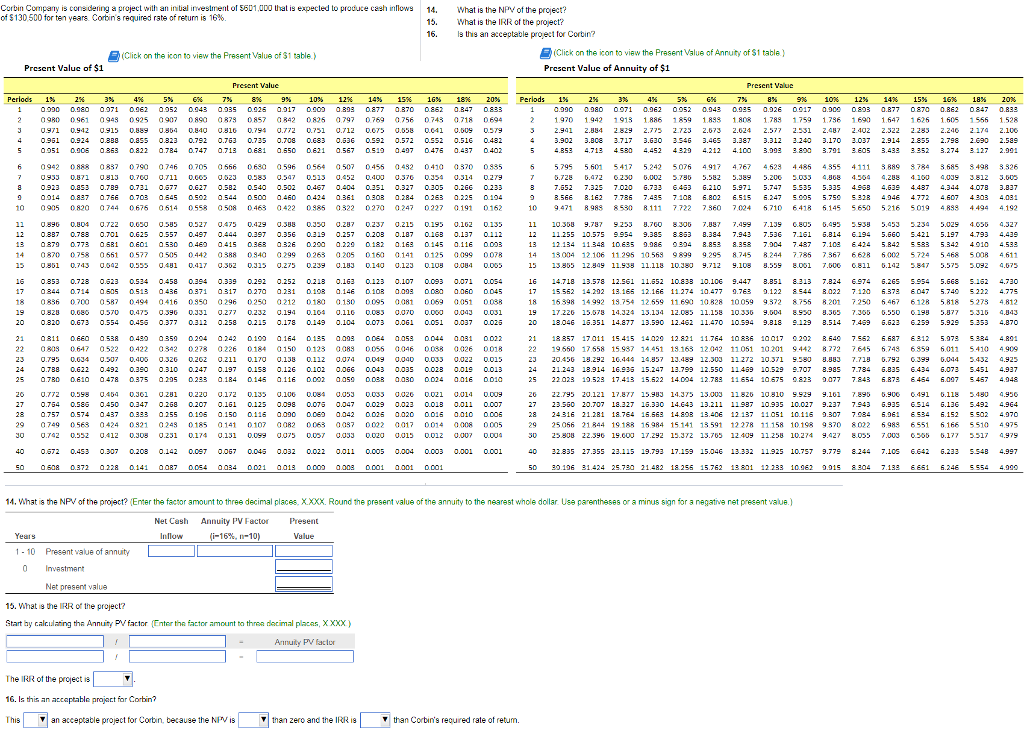

, Corbin Company is consdeling a pra ect wilh an nual r vesinent of s ? u00 that s eApected to produce cash rllo of $ 130 500 for ten years Corns required rate of return is 16% What is the NPV of the pro ect? 14. 15 hat is the IRR of the project? 16. s this an acceptable pro ect for Corbin? Click on the icon to view the Present leoAy of $1 table ) Present Value of Annuity of $1 (Click on the icon to vis the Present Valus of 31 table.) Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7%?9%10% 12% 14% 15% 16% 18% 20% Periods 1% 2% 3% 4% 5% 6% 7%8%9% 10% 12% 14% 15% 16% 18% 20% 0.990 0.980 0971 0.962 0952 0.943 0.935 0.926 017 0.0 0803 0.877 0870 .B62 0847 0.83 2 0980 0961 0948 0925 907 0890 878 0857 842 0825 0797 0769 756 0743 0718 O694 3 971 0.942 0915 0.8 504 0840 10 0.794 0.772 0.71 .12 00TS 0.5 0C41 O.DUS DSTS 0951 0.924 03B8 0.855 0323 0.792 0.763 0.735 0.708 0.E83 0.3 0.592 0.52 0552 0.516 0432 1970 1942 1913 1886 1859 1.8 1.808 1.78 1759 1786 16901.647 1626 1.605 155 1528 2.941 2.?84 2829 2.775 2.723 2.673 2.624 ?,577 2.531 Z.487 2.402 ?.322 2.285 Z.246 2174 2.100 4 3.90 3.BC8 3.717 3.630 S4G 3.465 33 3.312 240 3.170 2.037 2.914 2855 2.798 26E9 2.5a9 6 0888 0837 0790 0746 0705 0566 0630 0.596 0564 0.507 0455 0482 0410 370 0942 0933 0.871 0813 0700 11 0.005 .23 0583 .57 0.13 2 0400 0.7 0.354 0.314 D27 0835 5 5.795 5.601 5417 5.242 506 4.917 4.6 4.2 4485 4355 4111 3,889 8784 .685 8498 8.826 7.728 .472 230 6.00 .736 5.52 5.39 5.200 033 .36 30 4.288 4100 4.039 3812 3.003 ? 7.552 7.325 7.020 G.733 6453 6.210 5.971 5.747 S-S35 5.335 4.95B 4.639 4.437 4.344 4.078 3.837 8 0.923 0.853 0.789 0.731 0.577 0.627 0.582 0.540 0.502 0.467 0.404 0.3si 0.327 0.?05 0.266 0.233 0014 0.837 0766 0.703 O.545 ?.SO2 O.544 0S00 ?.460 0.424 0.361 030B ?,284 0263 ?.225 0104 10 0905 0 820 0744 0676 0 514 0558 0508 0463 0422 0885 0322 0270 247 0227 0191 0162 B.568 B.12 7.736 7.435 710B 6.802 6.515 .247 5.005 5.75 532 4.048 4772 4.607 4303 4.03 10 9471 8.983 8530 8111 7 722 7860 7024 5.710 6418 6.145 5650 5.216 5019 4883 4494 4.192 11 0.896 0.?04 0.722 0.650 g.585 0.527 g.475 0.429 0.388 0.350 0.287 0.237 o.215 0.195 0.162 0.135 12 37 0783 0.701 0.625 0.557 0497 0444 0.39 0.356 0319 0.257 0203 0.187 016 0.137 0112 13 a379 0.773 a 581 0E01 a 530 0.460 a415 0.363 0.326 0.20 0.220 0.182 ?.163 0.145 o.116 0003 14 0870 0.758 0551 0.577 0505 0442 0388 0344 299 0263 0205 0160 0141 0125 0099 0078 11 10.350 9.787 9253 ?.760 8.300 7.?87 7,499 7.1J9 0.805 5.495 5.938 5.453 5.234 5.029 4.055 4.327 12 11255 10.575 9954 9.38 8353 8.384 7.943 7.536 7161 .314 194 5.660 5.421 5.197 4.793 4.439 14 13004 12.106 11.295 10.569 9899 9.295 8.745 8.244 7785 7.367 6628 6.002 5724 5.468 5008 4.611 15 13805 12.9 11.9 11.118 10.30 9.712 9.103 .559 8.001 7.000 0811 6.142 3.847 5.573 3.092 4.073 LE 14.718 13.578 12.S6l?.552 10.S38 10.106 9.447 3.351 8.313 7.824 6.974 6.265 S.954 5.668 S452 4.730 16 353 0728 0623 0.534 0458 0.3 0.339 0.292 0.252 0213 0.163 0123 0.107 0.093 0.71 0.054 17 0344 0.714 a 505 0.513 a 436 0.371 a317 0.270 0.231 010B ?.146 0, 10B 0098 0ce 0.060 0045 18 0836 0700 0587 0494 0.416 0850 0296 0250 0212 0180 0.180 0095 008 00 0051 0038 18 16398 14992 18.754 12.559 11.690 10828 10059 9372 8755 8.20 7250 6.467 6128 5.818 5273 4.812 20 0.820 0.673 0.554 04SS 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.025 20 13.046 1.351 14.877 13.590 12.462 11.470 10594 9.18 9 129 B.514 7.459 6.622 259 5.929 5353 4.870 21 18857 17 1115 415 14.?29 12.821 11.764 10 36 10a17 202 B640 7S52 6.687 6312 5.978 S334 4.801 22 19 650 17.558 15.937 14.451 19.163 12042 11051 10.201 944 8. 7645 6.74 6359 6.011 5410 4.909 22 808 0647 0522 0422 0342 0.278 0226 0184 .150 0123 0.08 0055 0.046 003 026 0018 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.01S 0.013 25 0780 .610 478 0.375 0295 0.233 0.184 0146 a116 .002 a.059 .088 a.030 0024 a16 0010 24 21243 13.914 16.935 15.247 11.799 12.550 11459 10.529 9 707 B.985 7.734 6.B3 6.434 6.0 5451 4.937 20 0.772 0.598 0404 0301 21 0.220 0.172 0.135 .100 04 0.03 0.S3 z0 0021 014 DD09 27 0.754 0.585 0450 0347 0.268 0207 0.161 0125 0.098 0.075 0.047 0.029 0.023 0.018 0.0ii 0.007 28 0.757 0.574 0 437 0.333 O.255 0.105 0.150 0.116 o.??000e) a.042 0.02??? a020 0.015 0.010 0006 29 0749 0563 0424 0821 248 0185 141 0107 082 0 063 087 0002 017 0014 008 0005 0 0.742 0.552 g.412 0.JQ8 g.231 0.174 g.131 0.099 g.975 0.057 g.JJJ 0.020 g.(J15 0.012 0.007 O. 20 22.795 20.121 17.877 15.U3 14.375 13.003 11826 10.810 9.92 .101 7.895 0.900 041 6.118 240 4.950 27 23560 20.707 18.327 1.330 14.643 13.211 11937 10935 10.027 9.237 7943 6.935 514 6.136 5.492 4.964 28 24316 21.281 18764 15.563 14.808 13.4D 12 137 11051 10.116 .307 7.84 6.061 534 6.152 S502 4.970 29 25056 21844 19188 15984 15.141 13.591 12278 11158 10198 9370 8022 6989 6551 6.166 5510 4975 25.8OW 22.396 19.??? 17.292 15.372 13.765 12.409 11.258 10.274 g.427 8.055 7.003 0.50b 5.177 5.517 4.979 40 .572 0.453 .307 0.208 0.142 .08 0067 0.045 0.032 0.022 0.i1 0.005 0.004 0.003 0.0o1 0.001 40 32 335 27.355 23.115 19.793 17.159 15.046 13332 11925 10.757 9.779 8244 7.10 642 6.23 554B 4.997 50 30 19631 42425 73021482 18255 15762 13801 12 233 10.06.2 001s 04 7.138 6651 6.246 SS54 4.990 14. What is the NPV of the project? (Eter the factor amount to three decimal places, XXXX. Round the present value of the annuity to the nearest whole dollar Use parentheses or a minus sign for a negative net precent value.) Net Cash Annuity PV Factor 1-16%, m-10) Present Years Value 1-10 Present value of annuity 0 Investmant Net present value 15. What s the IRR of the project? tart by calclating tha Annuity P factor (Entor the factor amount to thrsa dlocimal placas, X XXX) Arnuty Pfactur The IRR ot the project is 16. Is this an atcaptable projact fiar Corbin? his | ?I an acceptable project tor Cortin because the NMis ? | 1nan zero and the IRR 18 T than Corbin's reoured rate of retum