Answered step by step

Verified Expert Solution

Question

1 Approved Answer

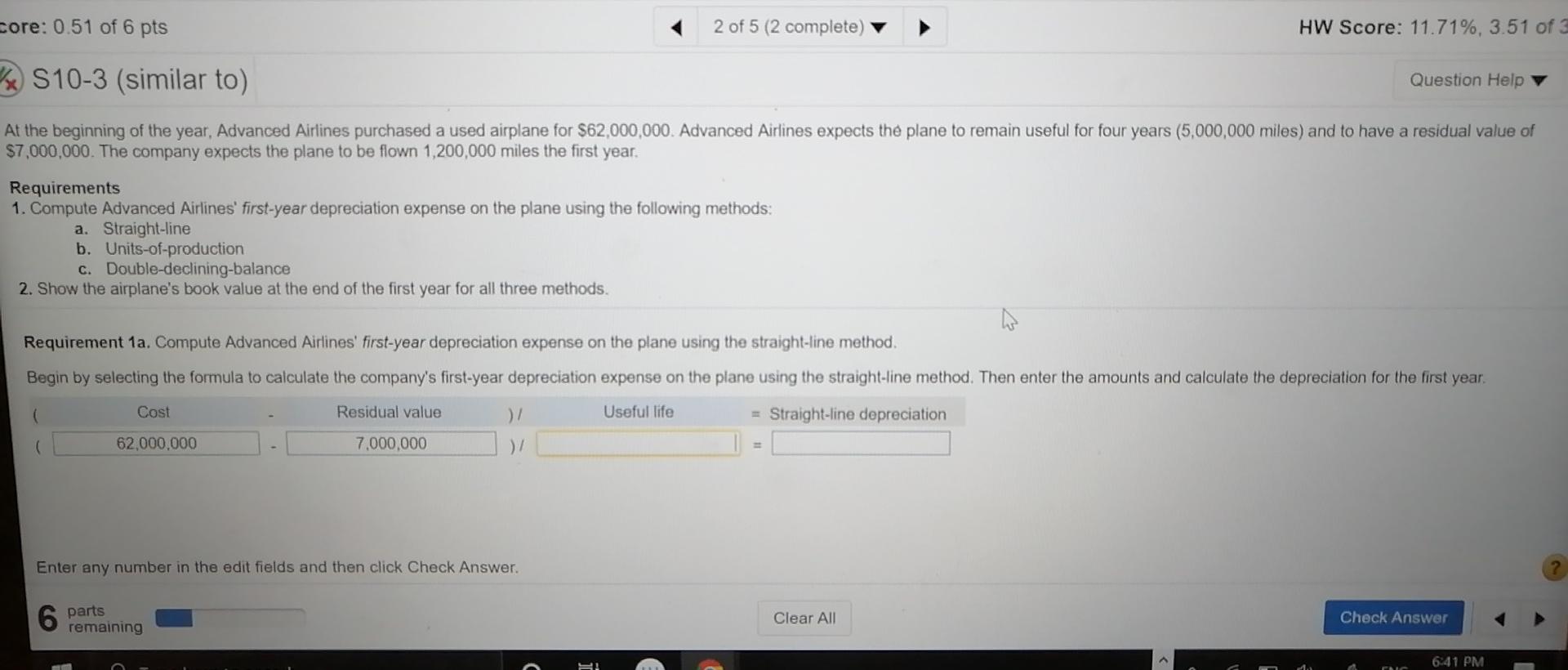

core: 0.51 of 6 pts 2 of 5 (2 complete) HW Score: 11.71%, 3.51 of 3 S10-3 (similar to) Question Help At the beginning of

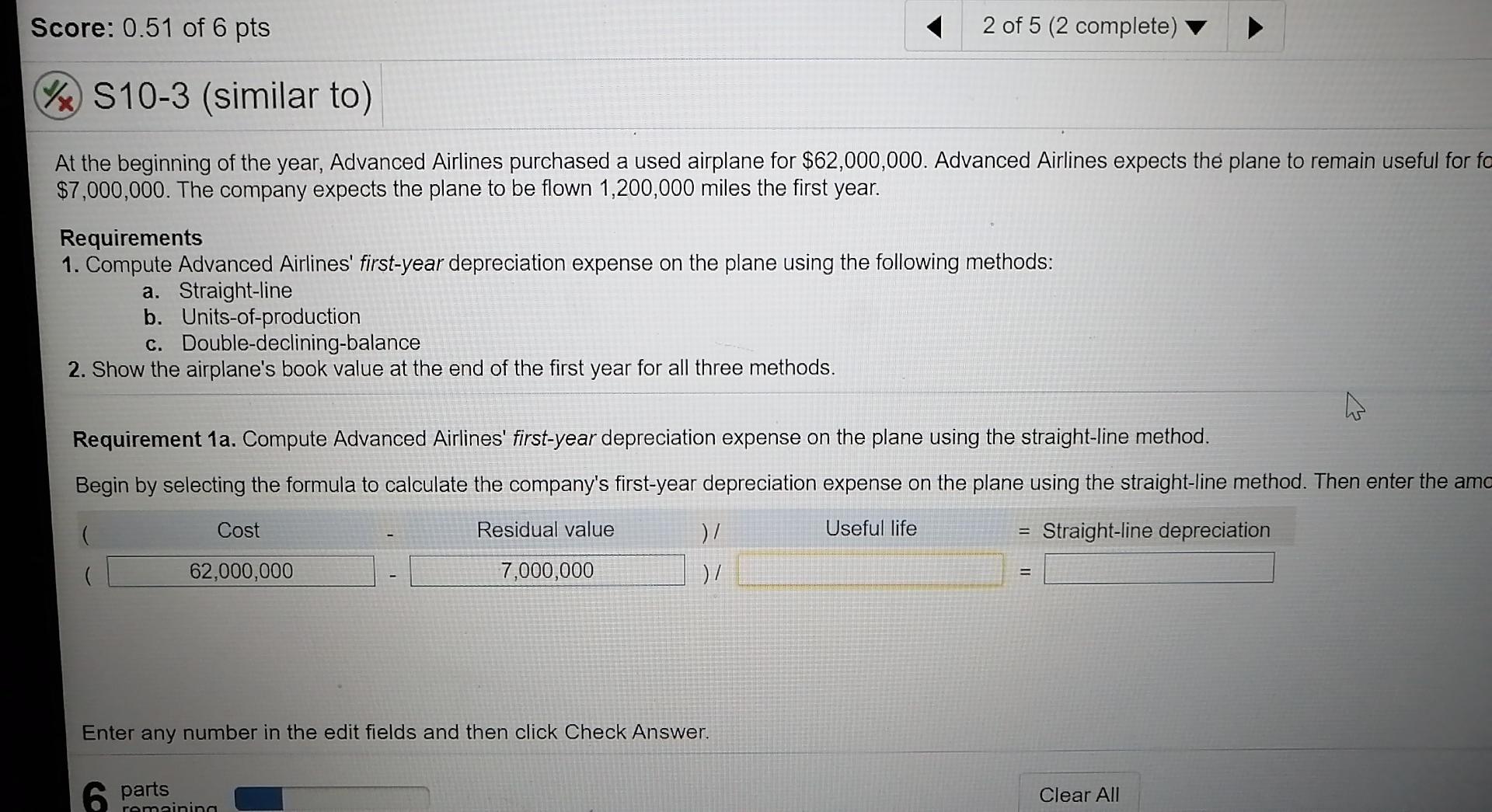

core: 0.51 of 6 pts 2 of 5 (2 complete) HW Score: 11.71%, 3.51 of 3 S10-3 (similar to) Question Help At the beginning of the year, Advanced Airlines purchased a used airplane for $62,000,000. Advanced Airlines expects the plane to remain useful for four years (5,000,000 miles) and to have a residual value of $7,000,000. The company expects the plane to be flown 1,200,000 miles the first year. Requirements 1. Compute Advanced Airlines' first-year depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods. Requirement 1a. Compute Advanced Airlines' first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's reciation expense on the using the str ine method. Then enter the amounts and calculate the depreciation for the first year. Cost Residual value ) Useful life = Straight-line depreciation 62.000.000 7,000,000 Enter any number in the edit fields and then click Check Answer. 6 parts Clear All Check Answer remaining 6:41 PM C ! Score: 0.51 of 6 pts 2 of 5 (2 complete) yx S10-3 (similar to) At the beginning of the year, Advanced Airlines purchased a used airplane for $62,000,000. Advanced Airlines expects the plane to remain useful for fo $7,000,000. The company expects the plane to be flown 1,200,000 miles the first year. Requirements 1. Compute Advanced Airlines' first-year depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods. Requirement 1a. Compute Advanced Airlines' first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amo Cost Residual value 17 Useful life Straight-line depreciation 62,000,000 7,000,000 )/ Enter any number in the edit fields and then click Check Answer. 6 parts Clear All remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started