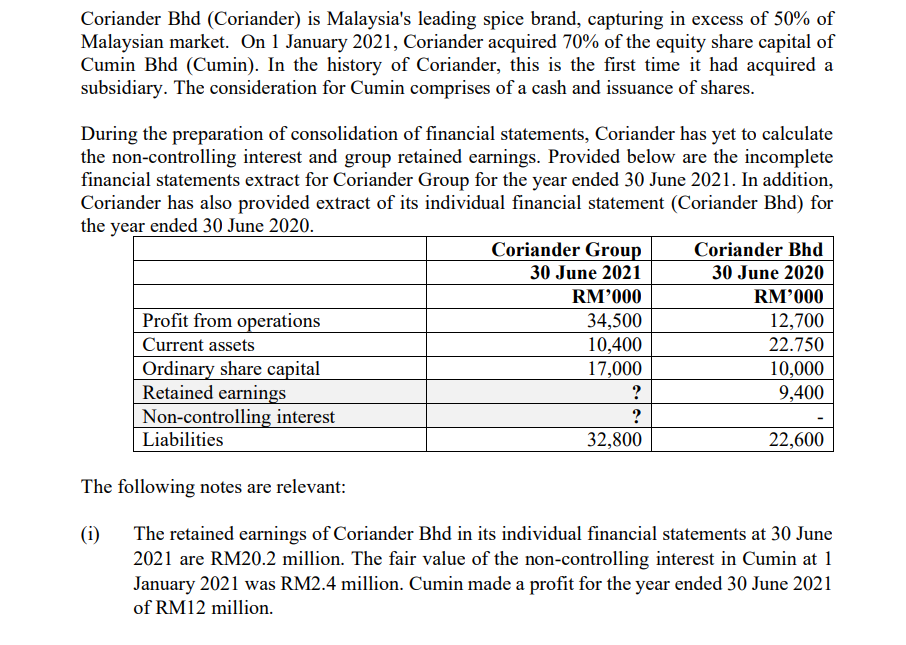

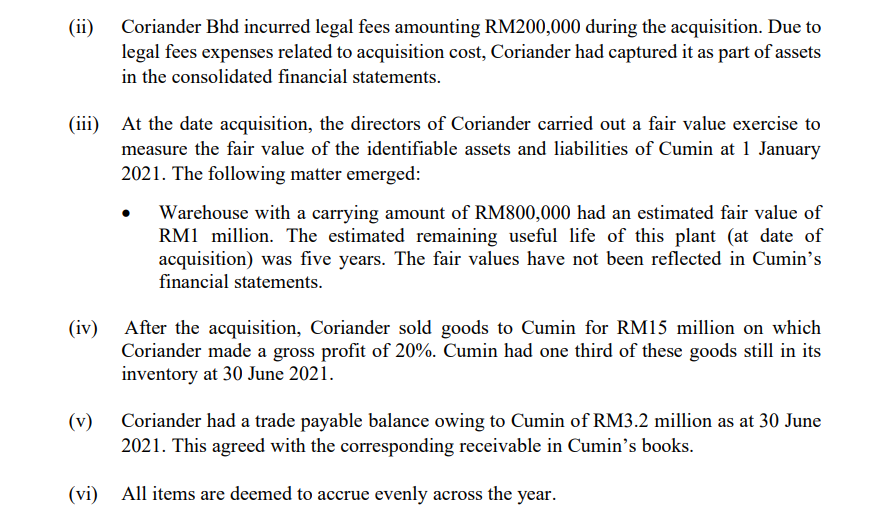

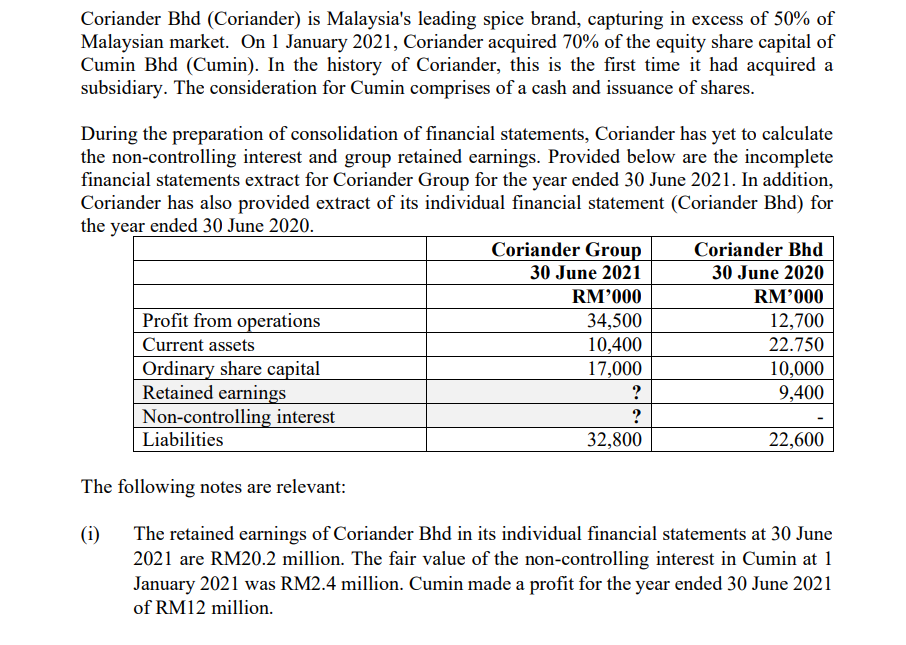

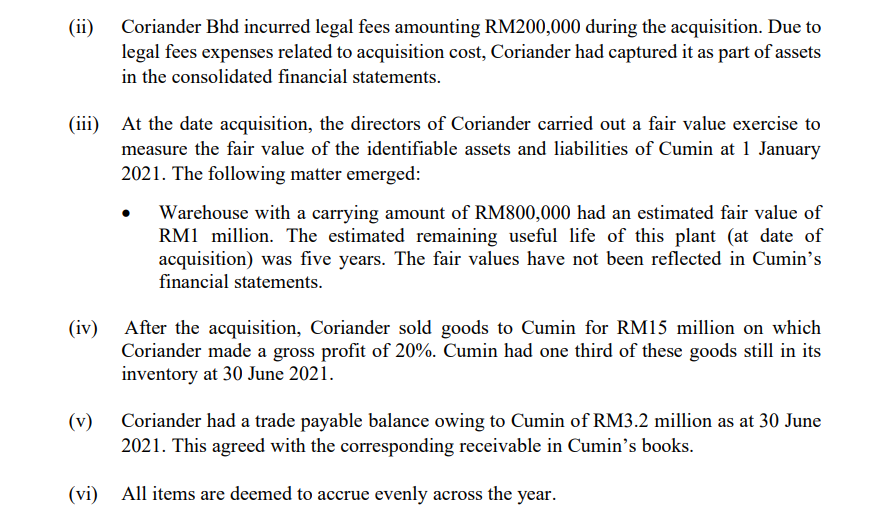

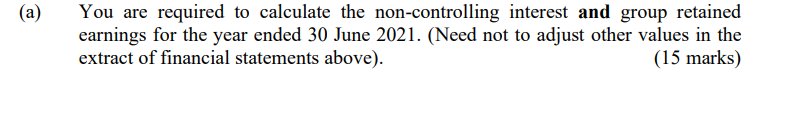

Coriander Bhd (Coriander) is Malaysia's leading spice brand, capturing in excess of 50% of Malaysian market. On 1 January 2021, Coriander acquired 70% of the equity share capital of Cumin Bhd (Cumin). In the history of Coriander, this is the first time it had acquired a subsidiary. The consideration for Cumin comprises of a cash and issuance of shares. During the preparation of consolidation of financial statements, Coriander has yet to calculate the non-controlling interest and group retained earnings. Provided below are the incomplete financial statements extract for Coriander Group for the year ended 30 June 2021. In addition, Coriander has also provided extract of its individual financial statement (Coriander Bhd) for the year ended 30 June 2020. Coriander Group Coriander Bhd 30 June 2021 30 June 2020 RM'000 RM'000 Profit from operations 34,500 12,700 Current assets 10,400 22.750 Ordinary share capital 17,000 10,000 Retained earnings ? 9,400 Non-controlling interest ? Liabilities 32,800 22,600 The following notes are relevant: (1) The retained earnings of Coriander Bhd in its individual financial statements at 30 June 2021 are RM20.2 million. The fair value of the non-controlling interest in Cumin at 1 January 2021 was RM2.4 million. Cumin made a profit for the year ended 30 June 2021 of RM12 million. Coriander Bhd incurred legal fees amounting RM200,000 during the acquisition. Due to legal fees expenses related to acquisition cost, Coriander had captured it as part of assets in the consolidated financial statements. (iii) At the date acquisition, the directors of Coriander carried out a fair value exercise to measure the fair value of the identifiable assets and liabilities of Cumin at 1 January 2021. The following matter emerged: Warehouse with a carrying amount of RM800,000 had an estimated fair value of RM1 million. The estimated remaining useful life of this plant (at date of acquisition) was five years. The fair values have not been reflected in Cumin's financial statements. (iv) After the acquisition, Coriander sold goods to Cumin for RM15 million on which Coriander made a gross profit of 20%. Cumin had one third of these goods still in its inventory at 30 June 2021. (v) Coriander had a trade payable balance owing to Cumin of RM3.2 million as at 30 June 2021. This agreed with the corresponding receivable in Cumin's books. (vi) All items are deemed to accrue evenly across the year. (a) You are required to calculate the non-controlling interest and group retained earnings for the year ended 30 June 2021. (Need not to adjust other values in the extract of financial statements above). (15 marks) Coriander Bhd (Coriander) is Malaysia's leading spice brand, capturing in excess of 50% of Malaysian market. On 1 January 2021, Coriander acquired 70% of the equity share capital of Cumin Bhd (Cumin). In the history of Coriander, this is the first time it had acquired a subsidiary. The consideration for Cumin comprises of a cash and issuance of shares. During the preparation of consolidation of financial statements, Coriander has yet to calculate the non-controlling interest and group retained earnings. Provided below are the incomplete financial statements extract for Coriander Group for the year ended 30 June 2021. In addition, Coriander has also provided extract of its individual financial statement (Coriander Bhd) for the year ended 30 June 2020. Coriander Group Coriander Bhd 30 June 2021 30 June 2020 RM'000 RM'000 Profit from operations 34,500 12,700 Current assets 10,400 22.750 Ordinary share capital 17,000 10,000 Retained earnings ? 9,400 Non-controlling interest ? Liabilities 32,800 22,600 The following notes are relevant: (1) The retained earnings of Coriander Bhd in its individual financial statements at 30 June 2021 are RM20.2 million. The fair value of the non-controlling interest in Cumin at 1 January 2021 was RM2.4 million. Cumin made a profit for the year ended 30 June 2021 of RM12 million. Coriander Bhd incurred legal fees amounting RM200,000 during the acquisition. Due to legal fees expenses related to acquisition cost, Coriander had captured it as part of assets in the consolidated financial statements. (iii) At the date acquisition, the directors of Coriander carried out a fair value exercise to measure the fair value of the identifiable assets and liabilities of Cumin at 1 January 2021. The following matter emerged: Warehouse with a carrying amount of RM800,000 had an estimated fair value of RM1 million. The estimated remaining useful life of this plant (at date of acquisition) was five years. The fair values have not been reflected in Cumin's financial statements. (iv) After the acquisition, Coriander sold goods to Cumin for RM15 million on which Coriander made a gross profit of 20%. Cumin had one third of these goods still in its inventory at 30 June 2021. (v) Coriander had a trade payable balance owing to Cumin of RM3.2 million as at 30 June 2021. This agreed with the corresponding receivable in Cumin's books. (vi) All items are deemed to accrue evenly across the year. (a) You are required to calculate the non-controlling interest and group retained earnings for the year ended 30 June 2021. (Need not to adjust other values in the extract of financial statements above). (15 marks)