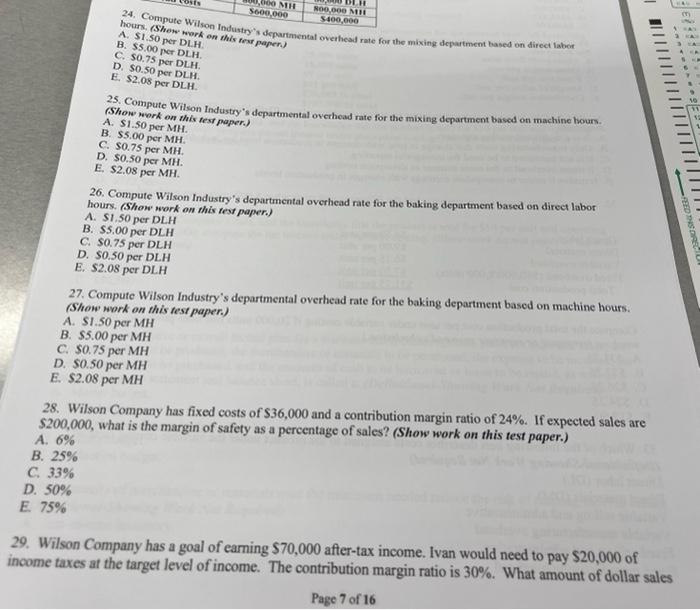

COROM NOO,000 MH 5600,000 $400,000 24. Compute Wilson Industry's departmental overhead rate for the mixing department based on direct labor hours. (Show work on this test paper) A. S1.50 per DLH. B. $5.00 per DLH C. S0.75 per DLH D. $0.50 per DLH E. $2.08 per DLH ishcompute Wilson Industry's departmental overhead rate for the mixing department based on machine hour. (Show work on A. $1.50 per MH. B. $5.00 per MH C. S0.75 per MH. D. $0.50 per MH. E $2.08 per MH. - SORUL 26. Compute Wilson Industry's departmental overhead rate for the baking department based on direct labor hours. (Show work on this test paper.) A. S1.50 per DLH B. $5.00 per DLH C. 0.75 per DLH D. $0.50 per DLH E. $2.08 per DLH 27. Compute Wilson Industry's departmental overhead rate for the baking department based on machine hours. (Show work on this test paper.) A $1.50 per MH B. $5.00 per MH C. $0.75 per MH D. 80,50 per MH E $2.08 per MH 28. Wilson Company has fixed costs of S36,000 and a contribution margin ratio of 24%. If expected sales are $200,000, what is the margin of safety as a percentage of sales? (Show work on this test paper.) A. 6% B. 25% C.33% D. 50% E 75% 29. Wilson Company has a goal of earning S70,000 after-tax income. Ivan would need to pay $20,000 of income taxes at the target level of income. The contribution margin ratio is 30%. What amount of dollar sales Page 7 of 16 COROM NOO,000 MH 5600,000 $400,000 24. Compute Wilson Industry's departmental overhead rate for the mixing department based on direct labor hours. (Show work on this test paper) A. S1.50 per DLH. B. $5.00 per DLH C. S0.75 per DLH D. $0.50 per DLH E. $2.08 per DLH ishcompute Wilson Industry's departmental overhead rate for the mixing department based on machine hour. (Show work on A. $1.50 per MH. B. $5.00 per MH C. S0.75 per MH. D. $0.50 per MH. E $2.08 per MH. - SORUL 26. Compute Wilson Industry's departmental overhead rate for the baking department based on direct labor hours. (Show work on this test paper.) A. S1.50 per DLH B. $5.00 per DLH C. 0.75 per DLH D. $0.50 per DLH E. $2.08 per DLH 27. Compute Wilson Industry's departmental overhead rate for the baking department based on machine hours. (Show work on this test paper.) A $1.50 per MH B. $5.00 per MH C. $0.75 per MH D. 80,50 per MH E $2.08 per MH 28. Wilson Company has fixed costs of S36,000 and a contribution margin ratio of 24%. If expected sales are $200,000, what is the margin of safety as a percentage of sales? (Show work on this test paper.) A. 6% B. 25% C.33% D. 50% E 75% 29. Wilson Company has a goal of earning S70,000 after-tax income. Ivan would need to pay $20,000 of income taxes at the target level of income. The contribution margin ratio is 30%. What amount of dollar sales Page 7 of 16