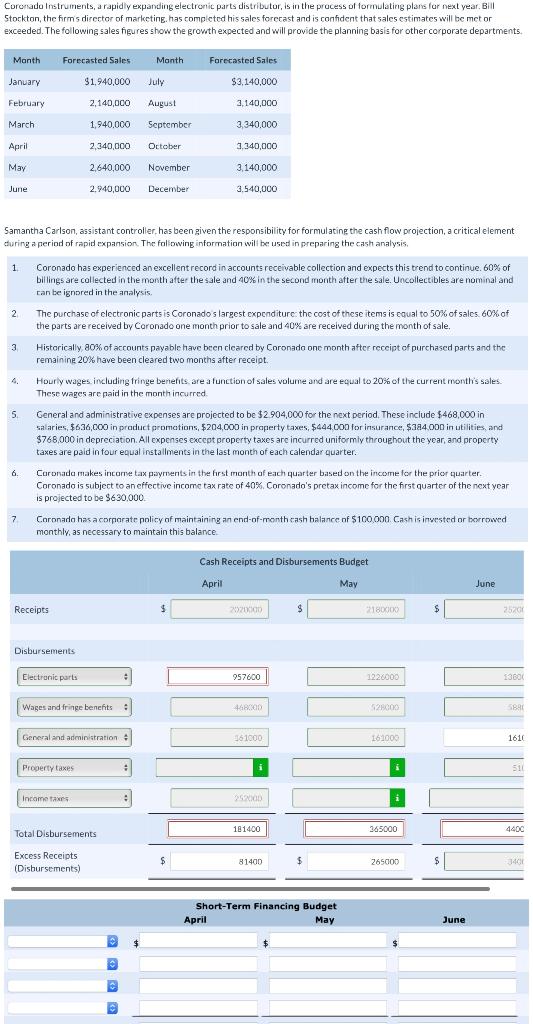

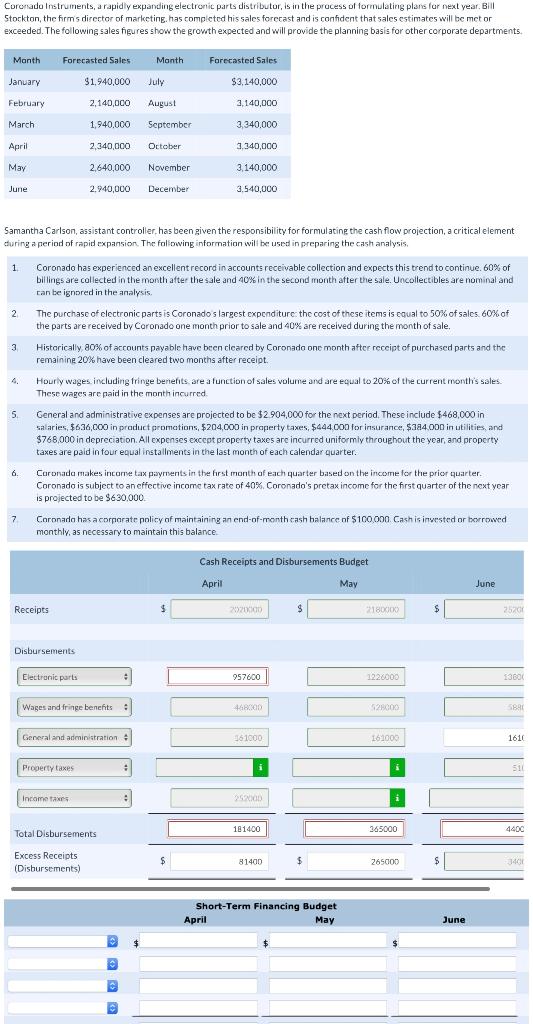

Coronado Instruments, a rapid ly expanding electronic parts distributor, is in the process of formulating plans for next year. Bill Stockton, the firm is director of marketine. has completed his sales forecast and is confident that 5 ales estimates will be met or exceeded. The following sales figures show the growth expected and will provide the planning basis for other corporate departments. Samantha Carlson, assistant controller, has been given the responsibility for formulating the cash flow projection, a critical element during a period of rapid expansion. The following information will be used in preparing the cash analysis. 1. Coronado has experienced an excellent record in accounts receivable collection and expects this trend to continue. 60% of billings are collected in the month after the sale and 40% in the second month after the sale. Uncollectibles are nominal and tan be ignored in the analysis. 2. The purchase of electronic parts is Coronado s largest expenditure the cost of these items is equal to 50% of sales. 60% of the parts are received by Caronado one month prior to sale and 40% are received during the month of sale. 3. Historically, 80% of accounts payable have been cleared by Coronado one month after reccipt of purchased parts and the remaining 20% have been cleared two months after receipt. 4. Hourly wages including fringe benefits are a function of sales volume and are equal to 20% of the cur rent monthis sales. These wages are paid in the month incurred. 5. General and administrative expenses are projected to be $2,904,000 for the next period. These include $468,000 in salaries, $636,000 in product prometions, $204,000 in property taxes, $444,000 for insurance, $384,000 in utilities, and $768,000 in depreciation. All expenses except property taxes are incurred uniformiy throughout the year, and property taxes are paid in four equal installments in the last month of each calendar quarter. 6. Caronada makes incorne tax payruents in the first month of each quarter based on the income for the prior quarter. Coronado is subject to an effective income tax rate of 40x. Coronado's pretax income for the first quarter of the next year is projected to be $630,000. 7. Coronada has a corparate policy of maintaining an end-of-month cash balance of $100 oon. Cash is inwested or becrowed monthly, as necessary to maintain this balance