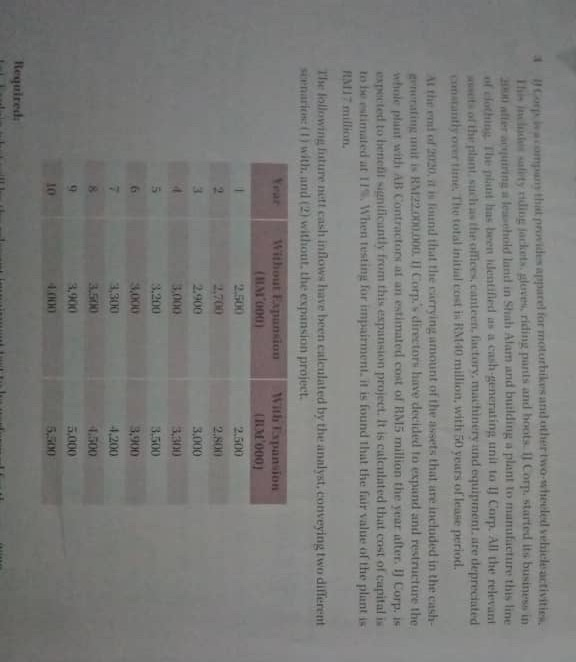

Corp company that provides apparel for motorbikes and other two-heeled vehicles activities This is altydlig jackets gloves, riding pants and boots. Il Corp. started its business in tering afhold land in Shah Alam and building a plant to manufacture this line of clothing. The plant has been identified as a cash generating unit to Il Corp. All the relevant the plant such as the oldes, canteet.factorv, machinery and equipment are depreciated constantly our time. The total initialast RM10 million, with 50 years oflease period. At the emio 2030, it is found that the carrying amount of the assets that are included in the cash- enerating unit is RM22.000.000. IT Corp. directors have decided to expand and restructure the whole plant with AB Contractors at an estimated cost of RM5 million the year after. Il Corp. is expected to bene il significantly from this expansion project. It is calculated that cost of capital is to be estimated at TS. When testing for impairment. it is found that the fair value of the plant is FM7 million l'he following liture nett cash inflows have been calculated by the annlyst. conveying two different senarist with and (2) without the expansion project Without Expansion With Expansion (IM000 (1000) 2.500 2.500 2,700 2.800 3 2.900 3,000 3.000 3,300 3.200 3.500 3.900 7 3.300 -1.200 3.500 1.500 . 3,900 5,000 Required: Corp company that provides apparel for motorbikes and other two-heeled vehicles activities This is altydlig jackets gloves, riding pants and boots. Il Corp. started its business in tering afhold land in Shah Alam and building a plant to manufacture this line of clothing. The plant has been identified as a cash generating unit to Il Corp. All the relevant the plant such as the oldes, canteet.factorv, machinery and equipment are depreciated constantly our time. The total initialast RM10 million, with 50 years oflease period. At the emio 2030, it is found that the carrying amount of the assets that are included in the cash- enerating unit is RM22.000.000. IT Corp. directors have decided to expand and restructure the whole plant with AB Contractors at an estimated cost of RM5 million the year after. Il Corp. is expected to bene il significantly from this expansion project. It is calculated that cost of capital is to be estimated at TS. When testing for impairment. it is found that the fair value of the plant is FM7 million l'he following liture nett cash inflows have been calculated by the annlyst. conveying two different senarist with and (2) without the expansion project Without Expansion With Expansion (IM000 (1000) 2.500 2.500 2,700 2.800 3 2.900 3,000 3.000 3,300 3.200 3.500 3.900 7 3.300 -1.200 3.500 1.500 . 3,900 5,000 Required