Answered step by step

Verified Expert Solution

Question

1 Approved Answer

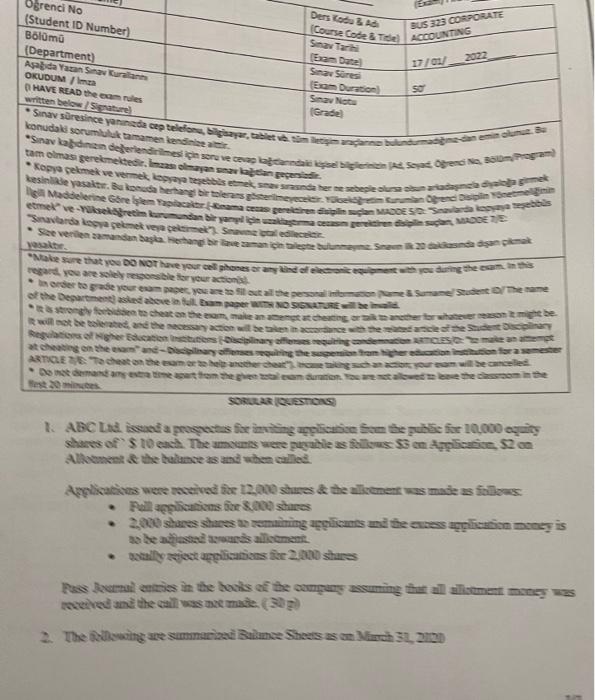

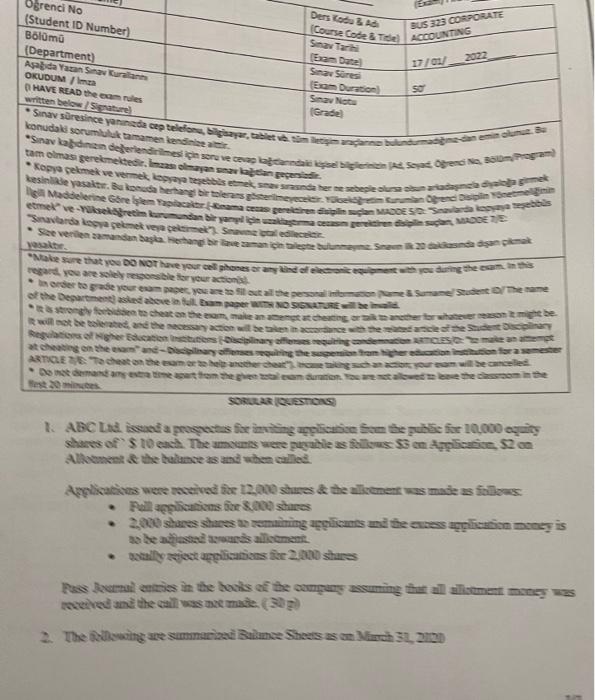

corporate accounting BUS 323 CORPORATE ACCOUNTING 2022 SO Ders Code Ogrenci No Course Code & Toe (Student ID Number) Saw Tarihi Blm Exam Date (Department)

corporate accounting

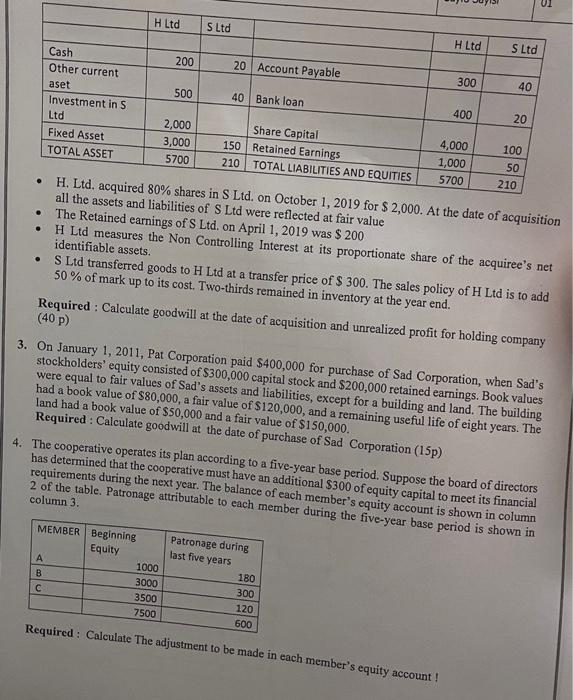

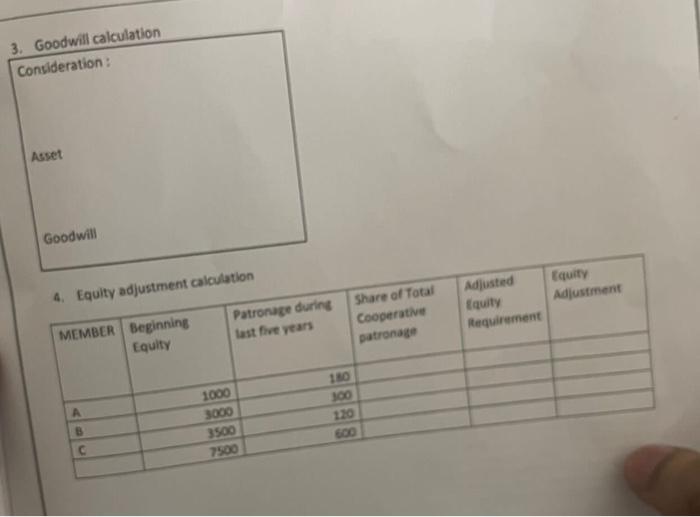

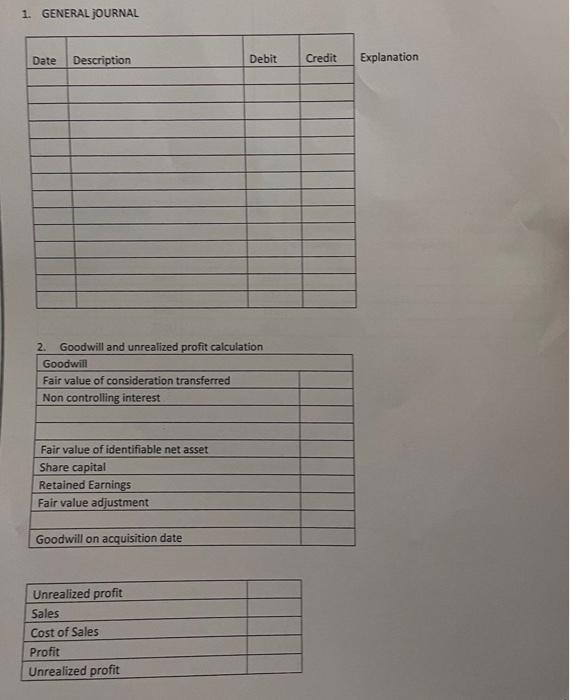

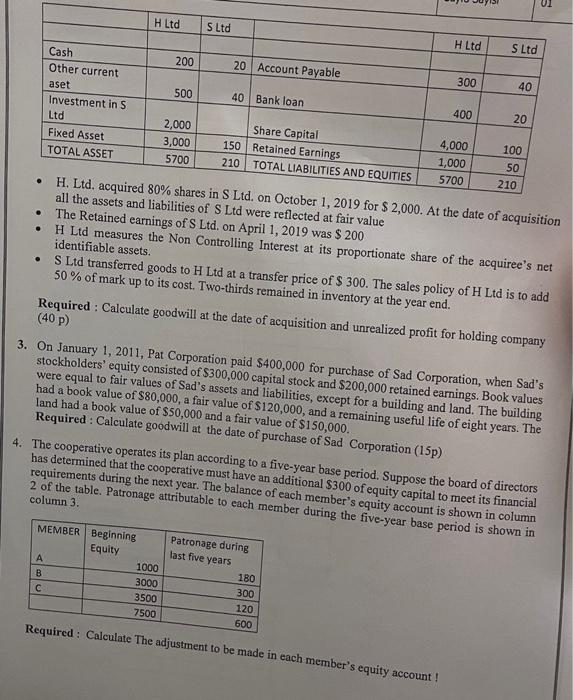

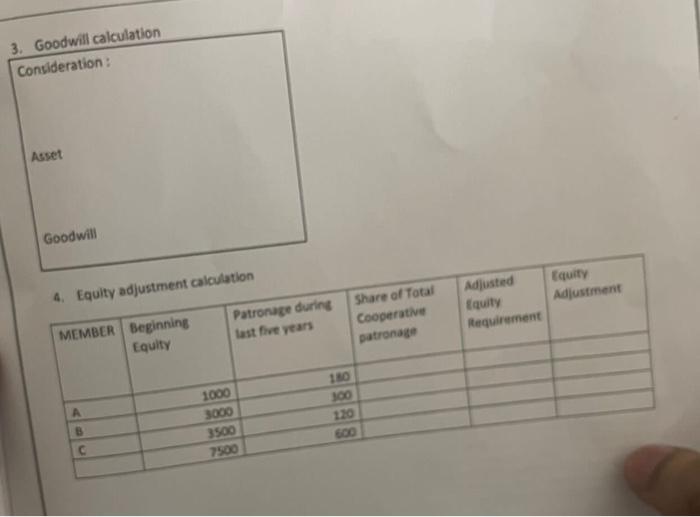

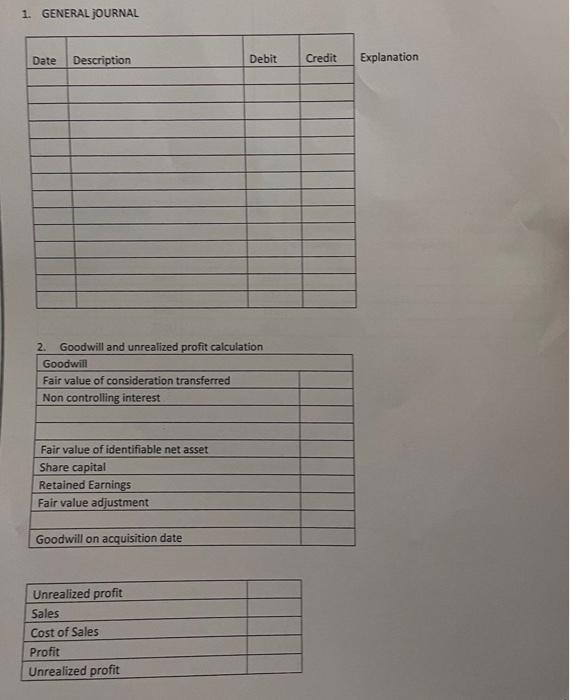

BUS 323 CORPORATE ACCOUNTING 2022 SO Ders Code Ogrenci No Course Code & Toe (Student ID Number) Saw Tarihi Blm Exam Date (Department) Sea Sresi Ada Yazan Sa Kuralla Duration OKUDUM Iman SN HAVE READ theo nules Gradiel written below/Senate Sinay sresince ya cep telefon, Sagisayar, tablet dan bulundurma konudaki sorumluluk tamamen kendine "Selalderlendirilmesi iin son veendale selge Sand 360 gram tam ma gerekmektedir. masaya Kopya ekmek ve vermek lepas Sed Lesinde yasaktanda herhangi tolera Maddelerine Gore byen Tapicarea etmek ve Yunan yang Savrda kesya ekmek veya ekmek Sadece Soeveren dan bagian teman iinde bulunmasndan yasak em aramanandam elence serica MODE SE Sebes alaman sa MADDE "Make sure you DO NOT have your cell phones antes de ca**** regard you are se resensible for your action order to grade your compare your tale personalised the same of the Department over NO SIGNATURE rong forbiddentacheston becom will not be tested and the necessary accion en in Roger Bucation his Tomates cheating on the others guling session to remontoasemete ARTOLETEcheat Donatendangartom hon en SORULARIOUESTIONS 1. ABC od seda presets familias de puble for 10.000 shares of $ 10 each. The amounts were pleasfalou sommaite ce Allotment & the balance as and when called Applications were med 12.000 sures & the ailement was made as follows Pall applications for 3.000 shares 2,000 shares shares to remaining applicants and the messagpiliation memey is beated us alliement lezeject anglications 2.000 shares Pas mal entries in the books of the camery assuming that all slimet mens was received an the call was made (309) 2. The wing see summarized alame Shoes Mc L. 2120 H Ltd S Ltd H Ltd S Ltd 200 20 Account Payable 300 40 500 Cash Other current aset Investment in S Ltd Fixed Asset TOTAL ASSET 40 Bank loan 400 20 2,000 3,000 5700 Share Capital 150 Retained Earnings 210 TOTAL LIABILITIES AND EQUITIES 4,000 1,000 5700 100 50 . 210 . . H. Ltd. acquired 80% shares in S Ltd. on October 1, 2019 for $ 2,000. At the date of acquisition all the assets and liabilities of S Ltd were reflected at fair value The Retained earnings of S Ltd. on April 1, 2019 was $ 200 H Ltd measures the Non Controlling Interest at its proportionate share of the acquiree's net identifiable assets. S Ltd transferred goods to H Ltd at a transfer price of $ 300. The sales policy of H Ltd is to add 50 % of mark up to its cost. Two-thirds remained in inventory at the year end. Required : Calculate goodwill at the date of acquisition and unrealized profit for holding company (40p) 3. On January 1, 2011, Pat Corporation paid $400,000 for purchase of Sad Corporation, when Sad's stockholders' equity consisted of $300,000 capital stock and $200,000 retained earnings. Book values were equal to fair values of Sad's assets and liabilities, except for a building and land. The building had a book value of $80,000, a fair value of $120,000, and a remaining useful life of eight years. The land had a book value of $50,000 and a fair value of $150,000. Required: Calculate goodwill at the date of purchase of Sad Corporation (15p) 4. The cooperative operates its plan according to a five-year base period. Suppose the board of directors has determined that the cooperative must have an additional $300 of equity capital to meet its financial requirements during the next year. The balance of each member's equity account is shown in column 2 of the table. Patronage attributable to each member during the five-year base period is shown in column 3 Patronage during last five years MEMBER Beginning Equity A 1000 B 3000 3500 7500 180 300 120 Required: Calculate The adjustment to be made in each member's equity account ! 600 3. Goodwill calculation Consideration : Asset Goodwill Equity Adjustment 4. Equity adjustment calculation Patronage during Last five years Share of Total Cooperative patronage Adjusted Equity Requirement MEMBER Beginning Equity TRO 300 120 1000 3000 3500 7500 B 1. GENERAL JOURNAL Date Description Debit Credit Explanation 2. Goodwill and unrealized profit calculation Goodwill Fair value of consideration transferred Non controlling interest Fair value of identifiable net asset Share capital Retained Earnings Fair value adjustment Goodwill on acquisition date Unrealized profit Sales Cost of Sales Profit Unrealized profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started