corporate accouting and reporting

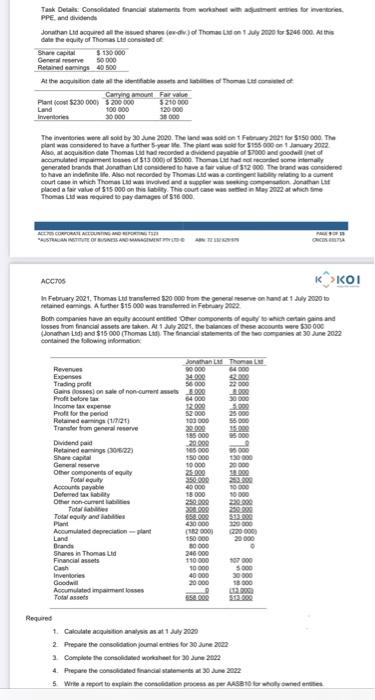

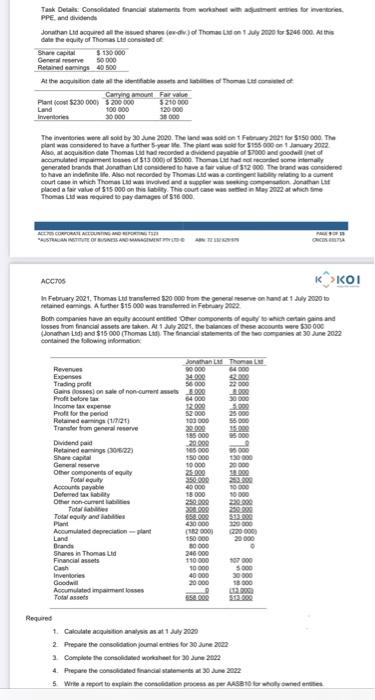

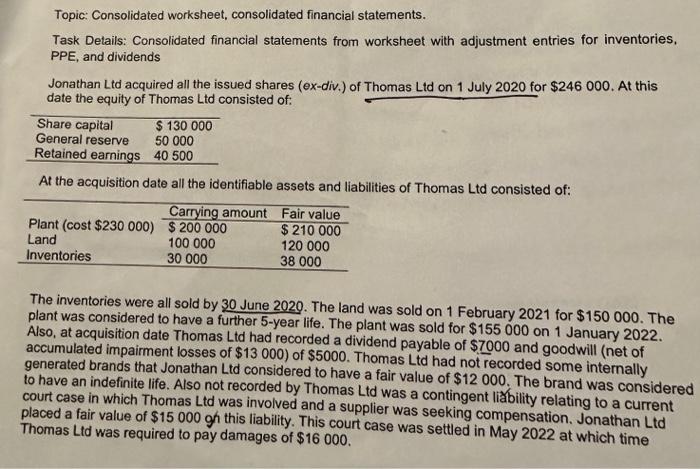

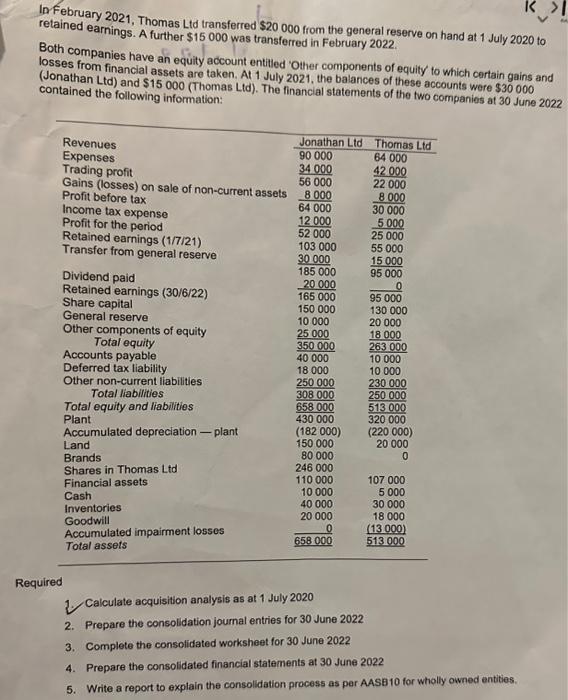

PPE, and dividende Joruchan tid acqued all the iowed share (ex-dw) of Thomas tit on 1 My anzo lor 5246000 . At the dorit he equily of Thomas Lid corsinted of At the acoulition date al the identifable assets and lapabes of fhomun tad caraind of The itvernonet went ali sold by 30 sune 2080. The land was sod ten f futruary 2 tet lor $150600. The Alo, at aoquistos date Themas Lid had faconded a dividend pepable of $7000 and goodedl fret of generabed brands that torathan Lad considered to huve a far value of 5%2. ood. The brand was conibhred placed a tar value of 515000 on this labity. Thit oout case wis setbed in May 2022 at which fine Thomins Lia min mouired to pay damages of 516600. ACctos In Fethuary 2021, Thomas Lid baraleried $20000 trom the geneced nesene on hand at 1 aly 2090 to Boh comparies have an equly doocunt entbed Oher component of eculy be which centain oana and Hosses trom fnancial assets are taken. A 1 duly 202\%. the balances of these acoouts wate f30000 doriained the flolowing information. Requed 1. Calodate acquation analysis as at 1d/y 2000 2. Propare the consolidaton jounal ertres for 30 dune 2022 3. Complete the eorsoldused workahee for 30 hunt 2 tege Topic: Consolidated worksheet, consolidated financial statements. Task Details: Consolidated financial statements from worksheet with adjustment entries for inventories, PPE, and dividends Jonathan Ltd acquired all the issued shares (ex-div.) of Thomas Ltd on 1 July 2020 for $246000. At this date the equity of Thomas Ltd consisted of: At the acquisition date all the identifiable assets and liabilities of Thomas Ltd consisted of: The inventories were all sold by 30 June 2020. The land was sold on 1 February 2021 for $150000. The plant was considered to have a further 5-year life. The plant was sold for $155000 on 1 January 2022. Also, at acquisition date Thomas Ltd had recorded a dividend payable of $7000 and goodwill (net of accumulated impairment losses of $13000 ) of $5000. Thomas Ltd had not recorded some internally generated brands that Jonathan Ltd considered to have a fair value of $12000. The brand was considered to have an indefinite life. Also not recorded by Thomas Ltd was a contingent libility relating to a current court case in which Thomas Ltd was involved and a supplier was seeking compensation. Jonathan Ltd placed a fair value of $15000gh this liability. This court case was settled in May 2022 at which time In February 2021, Thomas Ltd transferred $20000 from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022 Both companies have an equity account entitled 'Other components of equity' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these accounts were $30000 (Jonathan Ltd) and $15000 (Thomas Ltd). The financial statements of the two companies at 30 June 2022 contained the following information: Required 1. Calculate acquisition analysis as at 1 July 2020 2. Prepare the consolidation journal entries for 30 June 2022 3. Complete the consolidated worksheet for 30 June 2022 4. Prepare the consolidated financial statements at 30 June 2022 5. Write a report to explain the consolidation process as per AASB10 for wholly owned entities. PPE, and dividende Joruchan tid acqued all the iowed share (ex-dw) of Thomas tit on 1 My anzo lor 5246000 . At the dorit he equily of Thomas Lid corsinted of At the acoulition date al the identifable assets and lapabes of fhomun tad caraind of The itvernonet went ali sold by 30 sune 2080. The land was sod ten f futruary 2 tet lor $150600. The Alo, at aoquistos date Themas Lid had faconded a dividend pepable of $7000 and goodedl fret of generabed brands that torathan Lad considered to huve a far value of 5%2. ood. The brand was conibhred placed a tar value of 515000 on this labity. Thit oout case wis setbed in May 2022 at which fine Thomins Lia min mouired to pay damages of 516600. ACctos In Fethuary 2021, Thomas Lid baraleried $20000 trom the geneced nesene on hand at 1 aly 2090 to Boh comparies have an equly doocunt entbed Oher component of eculy be which centain oana and Hosses trom fnancial assets are taken. A 1 duly 202\%. the balances of these acoouts wate f30000 doriained the flolowing information. Requed 1. Calodate acquation analysis as at 1d/y 2000 2. Propare the consolidaton jounal ertres for 30 dune 2022 3. Complete the eorsoldused workahee for 30 hunt 2 tege Topic: Consolidated worksheet, consolidated financial statements. Task Details: Consolidated financial statements from worksheet with adjustment entries for inventories, PPE, and dividends Jonathan Ltd acquired all the issued shares (ex-div.) of Thomas Ltd on 1 July 2020 for $246000. At this date the equity of Thomas Ltd consisted of: At the acquisition date all the identifiable assets and liabilities of Thomas Ltd consisted of: The inventories were all sold by 30 June 2020. The land was sold on 1 February 2021 for $150000. The plant was considered to have a further 5-year life. The plant was sold for $155000 on 1 January 2022. Also, at acquisition date Thomas Ltd had recorded a dividend payable of $7000 and goodwill (net of accumulated impairment losses of $13000 ) of $5000. Thomas Ltd had not recorded some internally generated brands that Jonathan Ltd considered to have a fair value of $12000. The brand was considered to have an indefinite life. Also not recorded by Thomas Ltd was a contingent libility relating to a current court case in which Thomas Ltd was involved and a supplier was seeking compensation. Jonathan Ltd placed a fair value of $15000gh this liability. This court case was settled in May 2022 at which time In February 2021, Thomas Ltd transferred $20000 from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022 Both companies have an equity account entitled 'Other components of equity' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these accounts were $30000 (Jonathan Ltd) and $15000 (Thomas Ltd). The financial statements of the two companies at 30 June 2022 contained the following information: Required 1. Calculate acquisition analysis as at 1 July 2020 2. Prepare the consolidation journal entries for 30 June 2022 3. Complete the consolidated worksheet for 30 June 2022 4. Prepare the consolidated financial statements at 30 June 2022 5. Write a report to explain the consolidation process as per AASB10 for wholly owned entities