Question

Corporate Actions Monica owns a 9% stake in the Monte Azul Corporation, a domestic corporation. The shares were part of her grandmother's inheritance and Monica

Corporate Actions

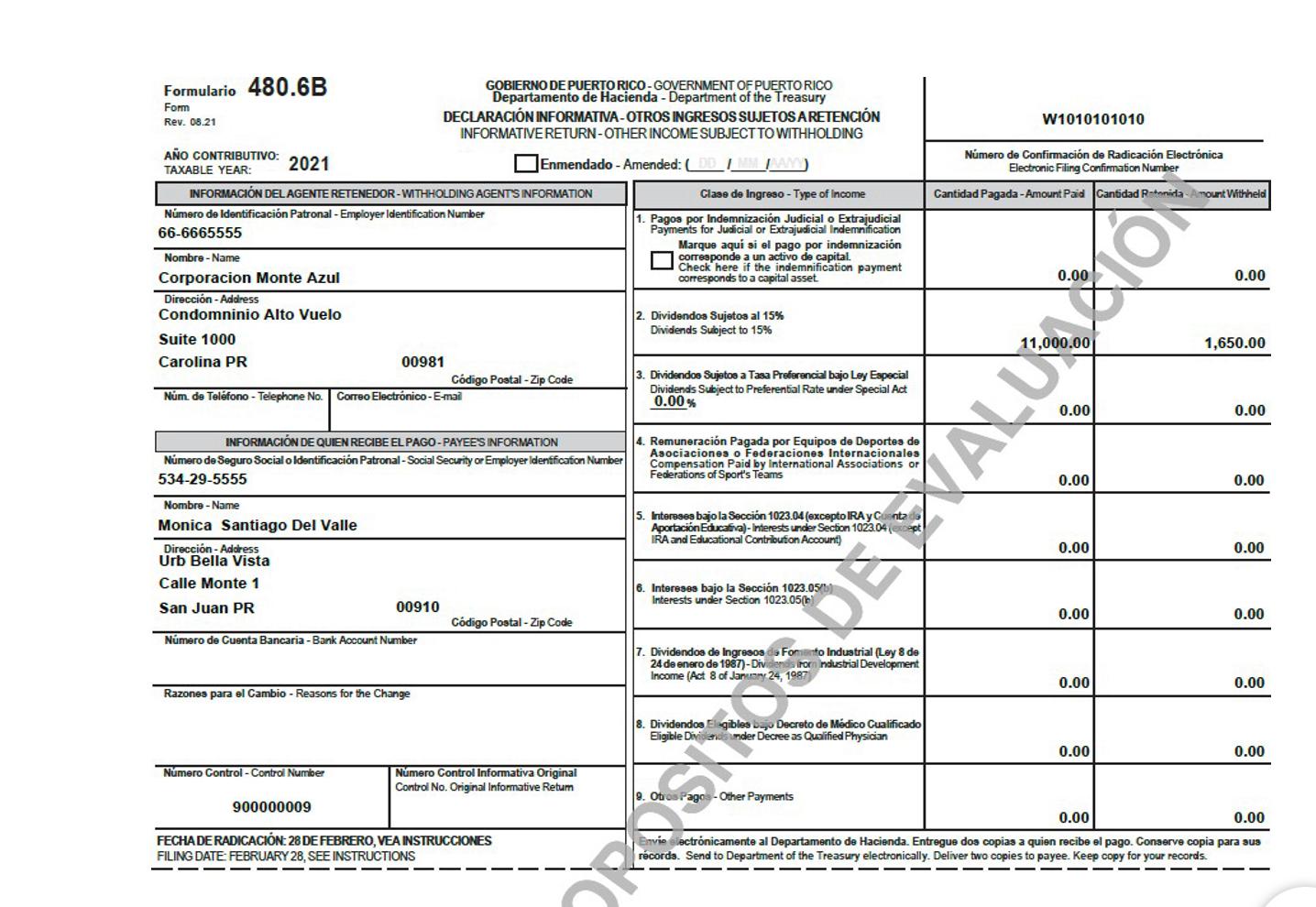

Monica owns a 9% stake in the Monte Azul Corporation, a domestic corporation. The shares were part of her grandmother's inheritance and Monica received them before marrying Pedro. During 2021, the Corporation paid Monica the amount of $11,000 in dividends, as shown in the following Information Statement.

1. Requirements: Calculate

a. the net income (loss) of Medical Equipment & Supply.

b. Sugar Bakery's net income (loss).

c. the deduction for depreciation for the property used in the rental activity.

d. the net income (loss) from the rental activity.

and. adjusted gross income for marriage in 2021.

F. the net income subject to tax for the marriage in 2021.

g. the normal tax, the preferential rate tax and the total income tax.

h. the income tax payable or the refund to be received.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started